February 4, 2025 · 16 min read

From Traditional Banking to Fintech: How AI-Driven Collaboration Is Powering the Shift

Shaimaa Badawi

Traditional banking is no longer the powerhouse it once was. Fintech is changing the financial world, and AI-driven collaboration is at the center of this transformation. From automating risk management to enhancing customer experiences, AI is enabling banks and fintech firms to work smarter, faster, and more securely.

This article explores the key drivers behind the shift, the challenges banks face, and how AI is revolutionizing decision-making and financial operations. By the end, you’ll see why AI-powered collaboration is not just an option; it’s the future of finance.

What factors are driving the shift from traditional banking to fintech?

The shift from traditional banking to fintech is driven by several key factors that are reshaping the financial industry. Here’s a closer look at the main forces behind this transformation:

1. Technological advancements

Innovations like AI, blockchain, cloud computing, and big data analytics have enabled fintech firms to provide faster, more efficient, and more secure financial solutions. These technologies allow for personalized banking experiences, automation of services, and enhanced risk management.

One notable example is the rise of AI-driven chatbots and robo-advisors, which provide 24/7 customer support and financial guidance without the need for human intervention. Similarly, blockchain is transforming transactions by offering secure, transparent, and decentralized financial operations.

2. Changing consumer behavior

Consumers today expect seamless, digital-first experiences in every aspect of their lives, including banking. The demand for mobile and online banking solutions has surged, with younger generations preferring digital platforms over brick-and-mortar branches. Traditional banks, which often rely on outdated legacy systems, struggle to keep up with the real-time, personalized services offered by fintech startups.

For instance, digital banks such as Revolut and N26 have gained popularity by offering user-friendly apps with features like instant payments, multi-currency accounts, and fee-free international transactions, capabilities that traditional banks have been slow to adopt.

3. Cost efficiency and automation

Fintech companies operate with leaner business models, leveraging automation to reduce overhead costs associated with maintaining physical branches. AI-powered automation streamlines processes such as loan approvals, credit assessments, and fraud detection, allowing fintech firms to provide services at a lower cost compared to traditional banks.

For example, automated lending platforms like Upstart use AI to assess borrower creditworthiness more accurately and quickly than traditional banks. AI-driven analytics are revolutionizing financial transactions, making streamlining mergers and acquisitions with AI a game-changer for banks and fintech firms aiming for efficiency and precision.

4. Regulatory changes and open banking

Governments and regulatory bodies are increasingly promoting digital financial services to enhance financial inclusion, security, and competition. Regulations like the European Union’s Revised Payment Services Directive (PSD2) and Open Banking initiatives have forced traditional banks to share customer data with third-party fintech providers.

Effective financial communication is crucial for businesses seeking to strengthen stakeholder confidence, and managing investor relations meetings plays a key role in ensuring transparency and trust.

5. Increased competition from fintech startups

The agility of fintech startups allows them to introduce new financial products faster than traditional banks. With venture capital funding pouring into the fintech sector, these companies are disrupting traditional banking services by offering more attractive rates, better user experiences, and innovative financial solutions.

For example, peer-to-peer (P2P) lending platforms like LendingClub and Wise (formerly TransferWise) have challenged traditional banking models by providing alternative lending and international money transfer options that are cheaper and more efficient.

6. Cybersecurity and fraud prevention

As cyber threats increase, fintech firms are leveraging AI and advanced encryption technologies to offer more secure financial services. AI-driven fraud detection systems analyze transaction patterns in real time to identify suspicious activities and mitigate risks faster than traditional banking systems.

For instance, Mastercard and Visa have integrated AI-based fraud detection tools that proactively block suspicious transactions, reducing the risk of financial crime.

7. The rise of embedded finance

Embedded finance is becoming a major driver of fintech adoption, allowing non-financial companies to integrate financial services directly into their platforms. Businesses across various industries, such as e-commerce, healthcare, and ride-hailing services, are now offering payments, lending, and insurance solutions without requiring users to engage with a traditional bank.

A good example is Buy Now, Pay Later (BNPL) services like Klarna and Afterpay, which integrate seamlessly into e-commerce platforms, allowing consumers to access credit at the point of purchase.

How has AI transformed financial services and customer interactions?

AI has significantly transformed financial services and customer interactions, introducing innovations that enhance efficiency, personalization, and security. Here's how:

1. Enhanced customer service through AI-powered tools

Financial institutions are increasingly adopting AI-driven solutions to improve customer service. AI-powered chatbots and virtual assistants handle routine inquiries, provide financial advice, and manage transactions, offering 24/7 support and reducing operational costs.

For instance, Commonwealth Bank's AI capabilities support customer messaging and live chat services. They handle approximately 50,000 inquiries daily with tailored responses, thereby reducing the need for additional call center staff.

2. Personalization of financial products and services

AI enables financial institutions to analyze vast amounts of customer data to offer personalized financial products and services. By understanding individual customer behaviors and preferences, banks can tailor offerings to meet specific needs.

Companies like Personetics Technologies specialize in AI-based engagement platforms that provide data-driven personalization, helping banks deliver relevant financial management information to their customers.

3. Improved risk management and fraud detection

AI enhances risk management and fraud detection by analyzing transaction patterns to identify anomalies and potential threats in real-time. Machine learning algorithms can detect unusual activities, enabling proactive measures against fraud.

For example, Commonwealth Bank utilizes AI to process millions of transactions, effectively preventing fraud and enhancing security for its customers.

4. Automation of routine tasks

AI automates routine and time-consuming tasks, such as data entry and report generation, allowing financial professionals to focus on more strategic activities. This automation leads to increased efficiency and reduced operational costs.

Wells Fargo, for instance, is integrating AI into various operations, including automating information entry processes in call centers, which streamlines tasks for bankers and tellers.

5. Development of advanced financial advisory services

AI-driven tools provide advanced financial advisory services by analyzing market trends and customer portfolios to offer investment recommendations. These tools democratize access to sophisticated financial advice, making it available to a broader audience.

Tiger Brokers, for example, has integrated DeepSeek's AI model into its AI-powered chatbot, TigerGPT, enhancing market analysis and trading capabilities for its customers.

6. Proactive customer engagement

AI enables proactive customer engagement by anticipating customer needs and offering timely solutions. Predictive analytics allow banks to identify when customers might require specific services, such as loan offers or investment opportunities, and reach out proactively.

McKinsey highlights that businesses are rapidly adopting AI technologies to transform every point of the customer service experience, leading to more proactive and personalized engagement.

7. Integration of AI in investment strategies

AI is transforming investment strategies by analyzing large datasets to identify market patterns and inform trading decisions. Financial institutions leverage AI to enhance their investment offerings and provide clients with data-driven insights.

Vanguard, for instance, is investing heavily in technology and AI to enhance user experience and customer service. They aim to disrupt the financial industry further by expanding into investment advice and actively managed funds.

With the ability to process vast amounts of financial data in real-time, AI-driven investment decision-making is reshaping portfolio management, enabling smarter and more strategic asset allocation.

Why are traditional banks collaborating with fintech companies?

Traditional banks are increasingly collaborating with fintech companies to stay competitive in an evolving financial landscape. Fintech firms bring agility, innovation, and AI-driven efficiencies, while banks offer customer trust, regulatory expertise, and infrastructure. This partnership allows both to leverage each other’s strengths for enhanced services and operational efficiencies.

Why banks are partnering with fintech companies

- Faster digital transformation: Fintechs offer plug-and-play digital solutions that allow banks to modernize their services without the need for costly in-house development.

- Improved customer experience: Banks integrate fintech solutions such as AI-powered chatbots, robo-advisors, and real-time payment processing to meet modern customer expectations.

- Regulatory compliance and risk management: Some fintech firms specialize in RegTech (Regulatory Technology), helping banks automate compliance, reduce fraud, and streamline reporting processes.

- Cost reduction: Automating services like loan approvals, fraud detection, and customer inquiries through AI-powered fintech solutions helps banks lower operational costs.

How AI-powered collaboration benefits both banks and fintechs

For traditional banks:

- Enhanced decision-making: AI-driven analytics provide deeper customer insights, enabling banks to personalize financial services and improve risk assessment.

- Automated processes: AI reduces manual labor in areas like loan underwriting, fraud detection, and document verification, speeding up approvals and minimizing errors. The role of AI in driving digital transformation in project management ensures that financial institutions can streamline operations, reduce costs, and increase collaboration across teams.

- Fraud prevention: AI models detect anomalous transactions in real time, preventing cyber threats more effectively than traditional methods.

- Scalability and speed: Banks can implement fintech solutions much faster than building their own AI infrastructure, accelerating digital transformation.

For fintech companies:

- Access to large customer bases: Banks have millions of existing customers, giving fintech startups a ready-made audience to scale their solutions.

- Regulatory leverage: Banks provide established compliance frameworks, allowing fintech firms to operate within secure and regulated environments.

- Brand credibility: Partnering with well-known banks enhances fintech credibility, increasing trust and adoption among consumers.

- Data access for AI training: Banks have vast amounts of customer data, which can be used to train AI models for better fraud detection, predictive analytics, and hyper-personalized services.

Real-world example: JPMorgan and AI-powered fintech collaboration

JPMorgan Chase, one of the largest banks globally, collaborates with AI-driven fintechs to improve its services. In 2023, the bank launched an AI-powered fraud detection system in partnership with a fintech firm, reducing false transaction declines by 70% while improving fraud detection accuracy. This collaboration helped streamline payment security and maintain customer trust.

What are the key challenges traditional banks face in digital transformation?

Traditional banks recognize the need for digital transformation, but the process comes with significant challenges. Here are the key challenges banks face in their digital transformation journey:

1. Legacy systems and infrastructure

Most traditional banks operate on outdated core banking systems that were built decades ago. These legacy systems are difficult to integrate with modern cloud-based solutions, AI-driven analytics, and real-time transaction processing. Upgrading or replacing these systems is costly and risky, as even minor disruptions can impact millions of customers.

For example, in 2023, major UK banks faced multiple outages due to legacy system failures, leading to transaction delays and regulatory scrutiny.

2. Resistance to change and organizational silos

Digital transformation requires a cultural shift within banks. Many employees and executives are resistant to change, especially in organizations where traditional banking practices have been in place for decades.

Additionally, banks are often structured in siloed departments (retail banking, corporate banking, risk management, IT, etc.), making cross-functional digital initiatives difficult to implement.

3. Regulatory and compliance complexities

Banks must comply with strict regulations, such as GDPR (Europe), CCPA (California), and Basel III (global banking standards). These regulations ensure data protection, financial stability, and anti-money laundering (AML) compliance. However, adapting to digital transformation while maintaining regulatory compliance is a challenge.

Fintech companies often operate with less regulatory burden. Banks, on the other hand, must navigate complex approval processes before implementing AI, blockchain, or cloud solutions.

4. Cybersecurity risks and fraud prevention

As banks digitize their operations, they become prime targets for cyberattacks, fraud, and data breaches. AI-driven cyber threats, phishing attacks, and ransomware can disrupt banking services and lead to massive financial losses.

Banks must invest heavily in AI-powered fraud detection systems, biometric authentication, and blockchain-based security solutions to mitigate risks. However, balancing security with a seamless user experience remains a major challenge.

5. High costs of digital transformation

Transitioning to cloud-based infrastructure, AI-driven automation, and digital-first customer services requires significant financial investment. Large banks may allocate billions of dollars to digital transformation, but smaller financial institutions struggle with limited budgets.

In 2023, Bank of America reported spending over $14 billion on digital transformation initiatives, including AI-powered chatbots and cybersecurity upgrades. While large banks can afford such investments, smaller institutions may lag behind.

6. Customer expectations for seamless digital banking

Customers now expect instant transactions, AI-powered financial advice, and 24/7 digital support. Fintech companies like Revolut and Chime have set a new standard by offering seamless mobile experiences and fee-free international transactions.

Traditional banks struggle to keep up, as their existing systems lack the agility to offer real-time banking experiences. Failing to meet customer expectations can lead to customer attrition and loss of market share.

7. Competition from fintech and big tech

Banks are no longer competing only with each other. Fintech startups and tech giants (Google, Apple, Amazon, etc.) are entering the financial services space. Apple Pay, Google Wallet, and Amazon’s digital lending services are disrupting traditional banking models.

If banks do not accelerate their digital transformation, they risk losing customers to tech-driven financial platforms that offer faster, more intuitive banking experiences.

How is AI transforming banking operations and customer experience?

Banks are leveraging AI-driven automation, predictive analytics, and machine learning to deliver faster, more efficient, and highly personalized services. Here’s how:

1. AI in banking operations

Faster and smarter decision-making

AI-powered analytics help banks process vast amounts of data in real time, leading to quicker loan approvals, accurate risk assessments, and fraud detection. AI models analyze customer spending patterns, financial history, and external data to provide personalized credit scoring and optimized investment strategies. The accuracy and efficiency of AI-powered financial reporting for boards allow organizations to make well-informed decisions based on real-time insights and compliance-driven data.

Example: JPMorgan Chase uses an AI tool called COiN (Contract Intelligence) to review legal documents. It can process thousands of loan agreements in seconds, saving over 360,000 hours of manual work per year. Leveraging machine learning in meeting preparation enables financial teams to analyze historical meeting data, anticipate discussion points, and automate agenda creation.

AI-powered fraud detection and risk management

AI detects anomalies in financial transactions, helping banks identify fraudulent activities in real-time. Machine learning models continuously analyze transaction patterns to flag suspicious behavior and prevent cyber threats before they escalate.

Example: Mastercard’s AI-driven security system has reduced false fraud declines by 70%, ensuring that customers experience fewer transaction disruptions while improving fraud detection accuracy.

Process automation and cost reduction

AI-driven Robotic Process Automation (RPA) reduces human intervention in repetitive banking tasks like data entry, compliance reporting, and customer onboarding. This minimizes errors and operational costs, allowing banks to focus on strategic initiatives.

Example: Wells Fargo uses AI-driven automation to improve call center efficiency, ensuring that customer inquiries are resolved 40% faster by predicting user intent and directing them to the right service representative. Organizations that leverage AI for meeting management can see a significant ROI of reduced meeting time, improving efficiency while maintaining high-quality decision-making.

2. AI in customer experience

AI-powered chatbots and virtual assistants

AI chatbots provide 24/7 customer support, handling inquiries related to account balances, transactions, and loan applications without human intervention. These virtual assistants understand natural language and continuously improve through machine learning. AI-driven meeting solutions help in reducing meeting fatigue with AI by automating documentation, decision tracking, and follow-ups, ensuring more productive discussions.

Example: Bank of America’s AI-powered chatbot, Erica, has assisted over 32 million customers, handling 98% of requests without human assistance while proactively suggesting financial tips. AI-driven personalization and automation are key to enhancing customer experience in financial services, allowing institutions to provide seamless, tailored interactions.

Personalized banking and AI-driven financial advice

AI enables hyper-personalized financial services by analyzing customer behavior and predicting their financial needs. Banks use AI to recommend tailored credit cards, savings plans, and investment opportunities based on user habits.

Example: HSBC uses AI-powered analytics to provide customized savings recommendations, boosting customer engagement and improving financial well-being.

AI-powered voice and biometric banking

AI is enabling secure and frictionless banking experiences through voice recognition, facial authentication, and biometric security. Customers can access accounts and authorize payments without passwords, making banking both safer and more convenient.

Example: Citibank has introduced AI-powered voice recognition, allowing customers to securely verify their identity over the phone in less than 10 seconds, eliminating the need for security questions.

Real-time customer insights and predictive engagement

AI anticipates customer needs by analyzing spending patterns and transaction history. If a customer’s behavior indicates financial distress, AI can suggest budgeting tools or loan restructuring options before a problem arises.

Example: Revolut’s AI-driven analytics notify users when they are overspending and automatically categorize transactions for smarter financial planning. Financial institutions are increasingly using NLP in meetings for stakeholder sentiment analysis, helping executives gauge reactions and make data-driven decisions.

What role does AI play in risk management and fraud detection for financial institutions?

AI is transforming risk management and fraud detection by enabling real-time threat detection, predictive analytics, and automated compliance monitoring. Financial institutions leverage AI-driven models to analyze vast datasets, identify suspicious patterns, and reduce both financial and operational risks.

1. AI in risk management

AI-powered credit risk assessment

Traditional credit scoring models rely on static data (e.g., credit history, income levels), but AI enables a dynamic risk evaluation by analyzing alternative data sources, such as spending behavior, employment patterns, and even social signals.

Example: AI-driven credit assessment platforms like Zest AI analyze thousands of non-traditional data points to offer better credit risk predictions, making lending more inclusive and reducing default rates.

Predictive analytics for market and liquidity risks

AI models process real-time financial data, monitoring market fluctuations, liquidity levels, and global economic trends to help banks anticipate financial risks before they escalate.

Example: JPMorgan Chase uses AI for predictive analytics, allowing traders to identify market risks and optimize investment portfolios based on real-time economic indicators.

AI for compliance and regulatory risk management

AI-powered compliance tools help banks monitor regulatory changes and automate compliance checks, reducing the risk of fines and penalties. AI also assists in detecting money laundering patterns, a critical aspect of Anti-Money Laundering (AML) efforts.

Example: HSBC’s AI-powered AML surveillance system flags high-risk transactions, improving compliance with global financial regulations. The system has helped reduce false alerts by 20%, improving operational efficiency. AI-driven compliance risk management helps financial institutions automate regulatory monitoring, reducing human error and ensuring adherence to evolving financial regulations.

2. AI in fraud detection

AI-powered anomaly detection

AI models analyze transaction patterns in real time, flagging anomalies that deviate from a customer’s usual behavior. Unlike rule-based fraud detection, which relies on predefined parameters, AI uses machine learning to continuously evolve and detect new fraud tactics.

Example: Mastercard’s AI fraud detection system reduced false positives by 70%, improving both security and the customer experience.

Behavioral biometrics and AI-driven identity verification

AI enhances security through behavioral biometrics, like analyzing typing speed, mouse movements, and mobile usage patterns to detect account takeovers and unauthorized access attempts.

Example: Citibank’s AI-driven voice authentication system recognizes individual voice patterns, allowing customers to securely access their accounts without passwords or PINs, reducing fraud risks in phone banking.

Deep learning in payment fraud detection

AI-driven deep learning models monitor millions of transactions per second, detecting fraud without disrupting legitimate payments. These systems cross-check transaction details with historical fraud data, identifying suspicious activities before money is lost.

Example: PayPal uses AI-powered fraud detection to monitor over 600 transactions per second, preventing fraudulent payments with over 90% accuracy.

How can adam.ai enhance decision-making in fintech and banking?

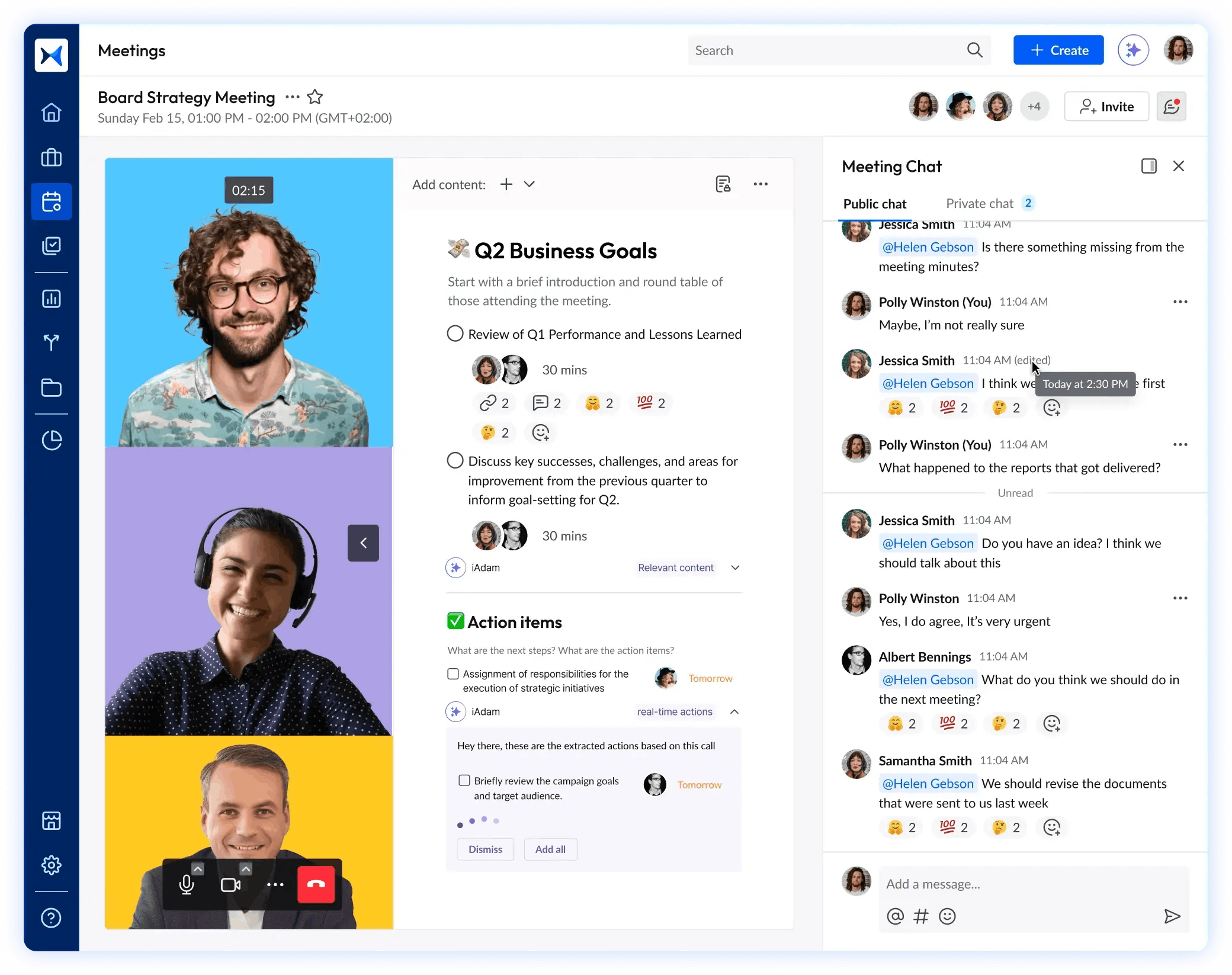

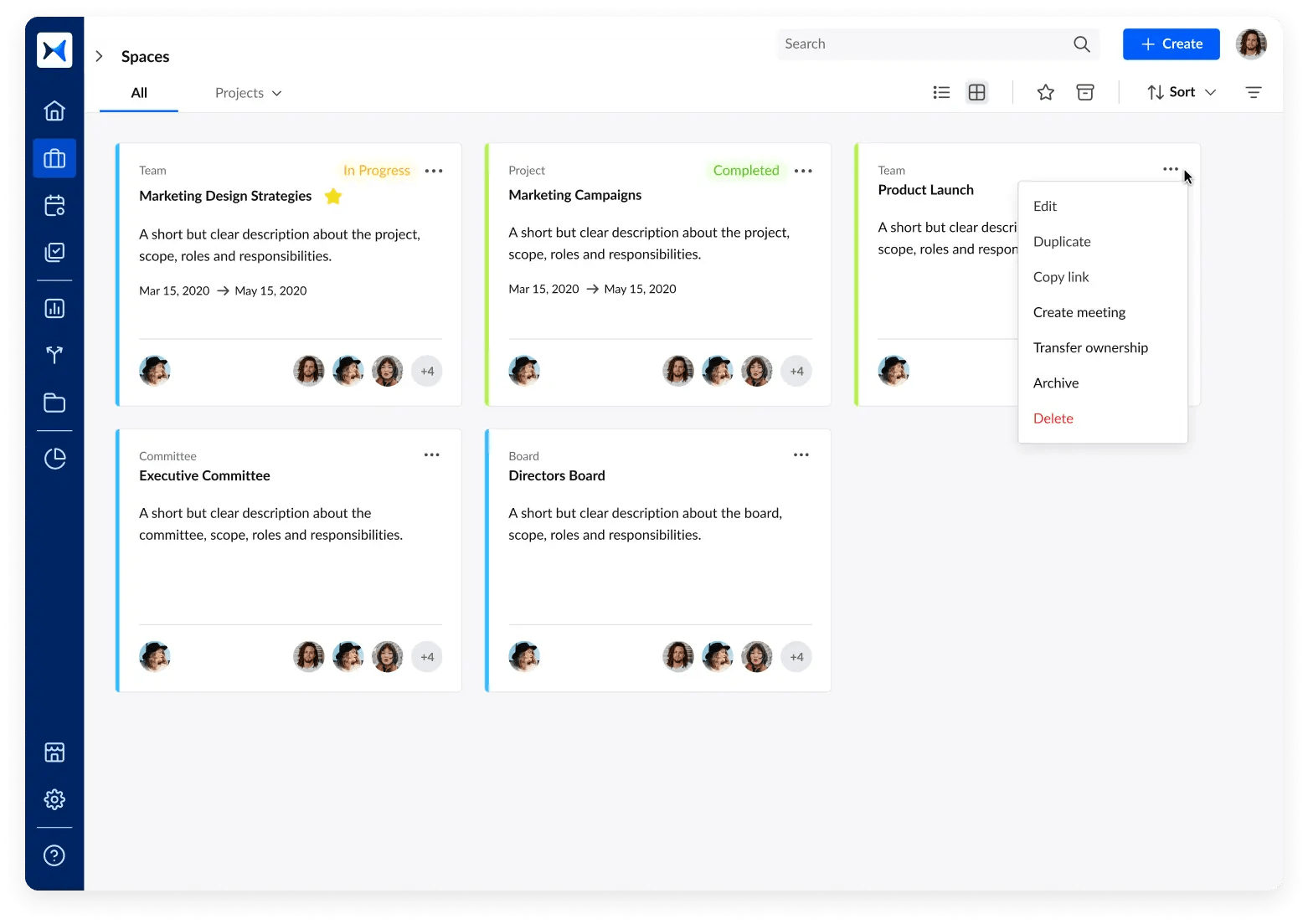

In fintech and banking, where precision, compliance, and real-time decision-making are critical, AI-driven meeting management platforms like adam.ai help streamline collaboration and execution. Here's what you can do with adam.ai:

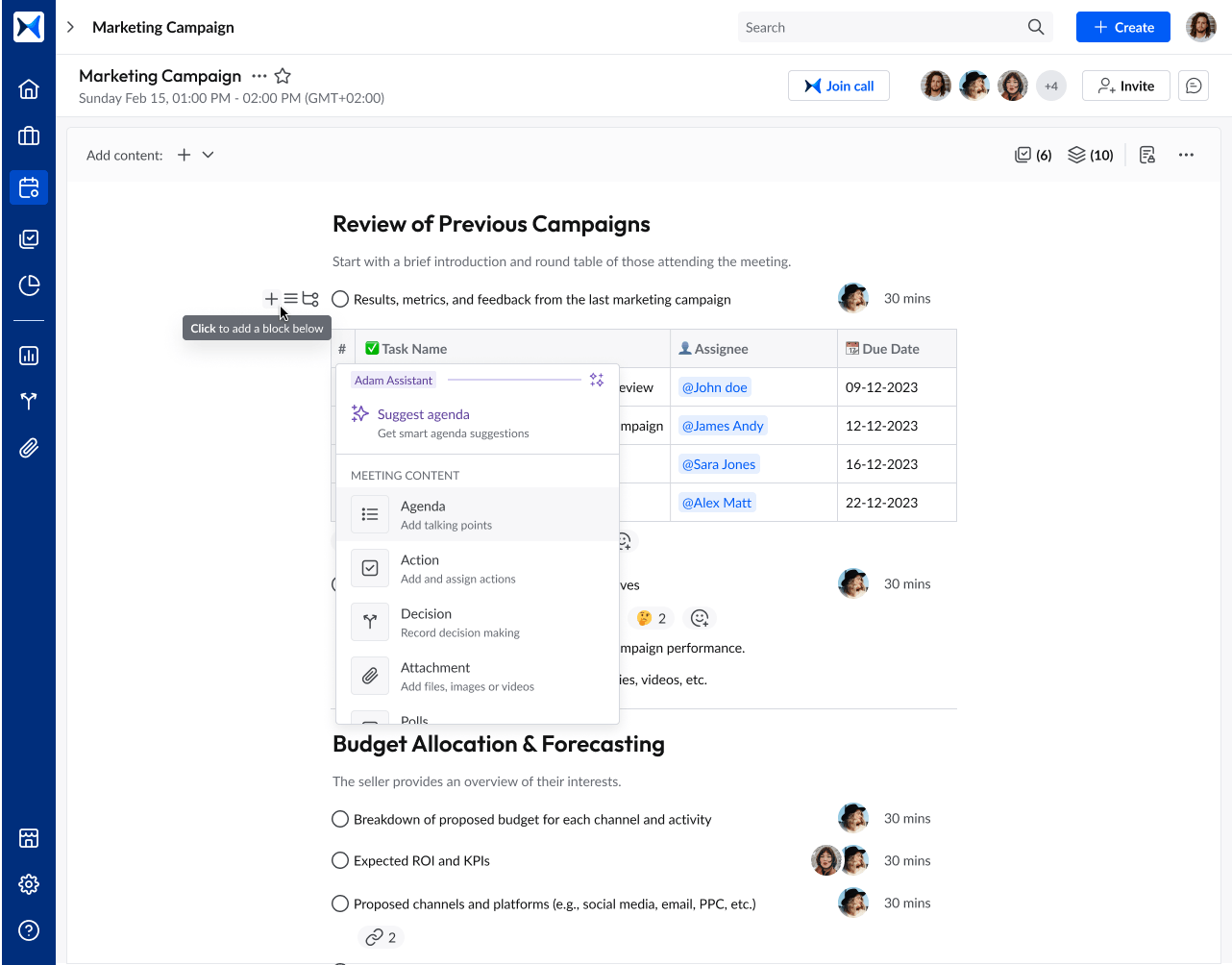

- Agenda management: AI-enhanced agenda planning ensures structured, outcome-driven discussions by prioritizing key financial topics, from risk management to regulatory updates.

- Content collaboration: Secure AI-powered document sharing enables real-time access to reports, contracts, and regulatory documents within the platform. This ensures financial teams can work on compliance documents, audit reports, and investment proposals without version conflicts.

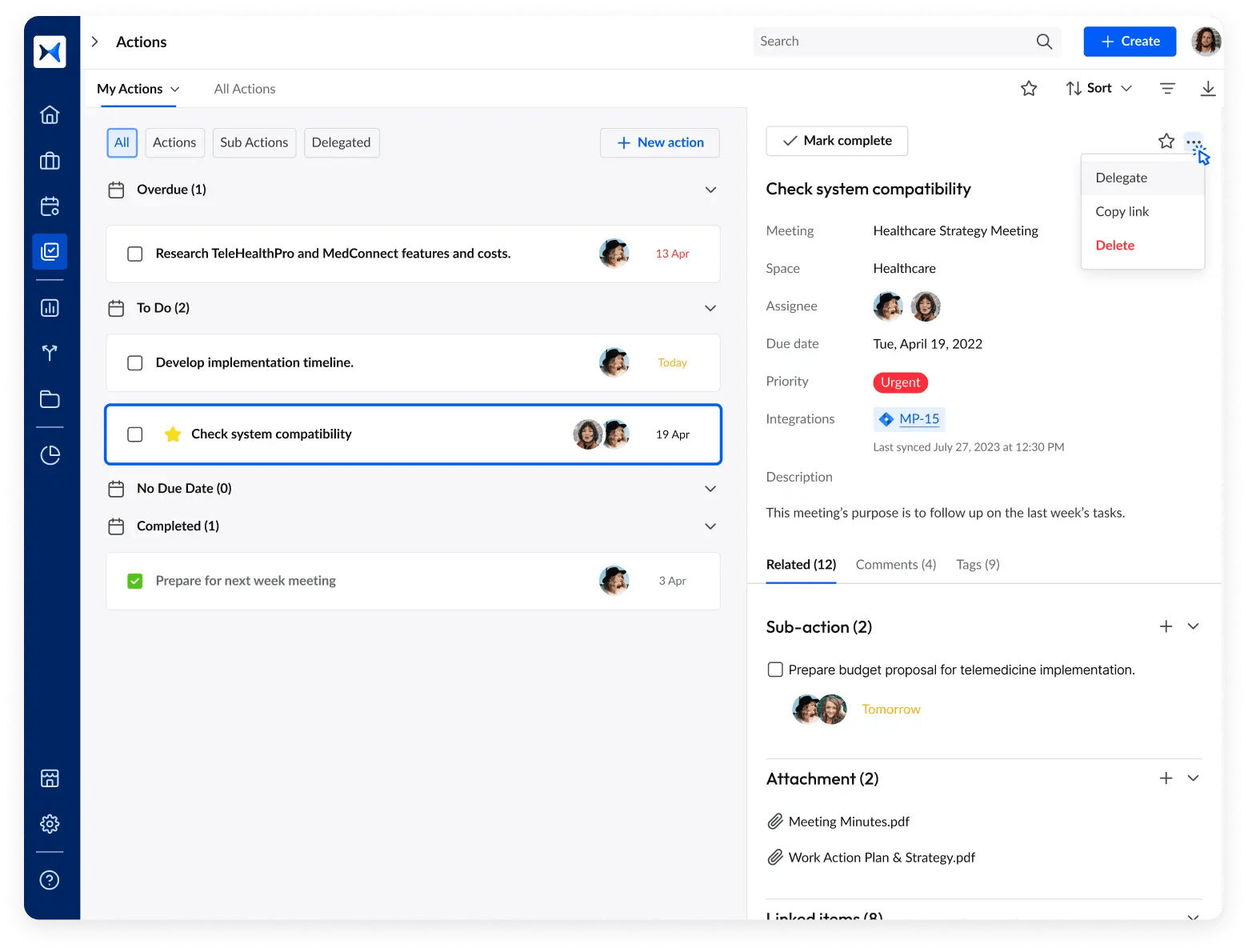

- Action management: Automated tracking of decisions and tasks ensures follow-through on critical financial actions, such as regulatory filings, loan approvals, or fraud investigations. AI-powered reminders prevent delays, keeping fintech and banking teams aligned on compliance deadlines and business goals.

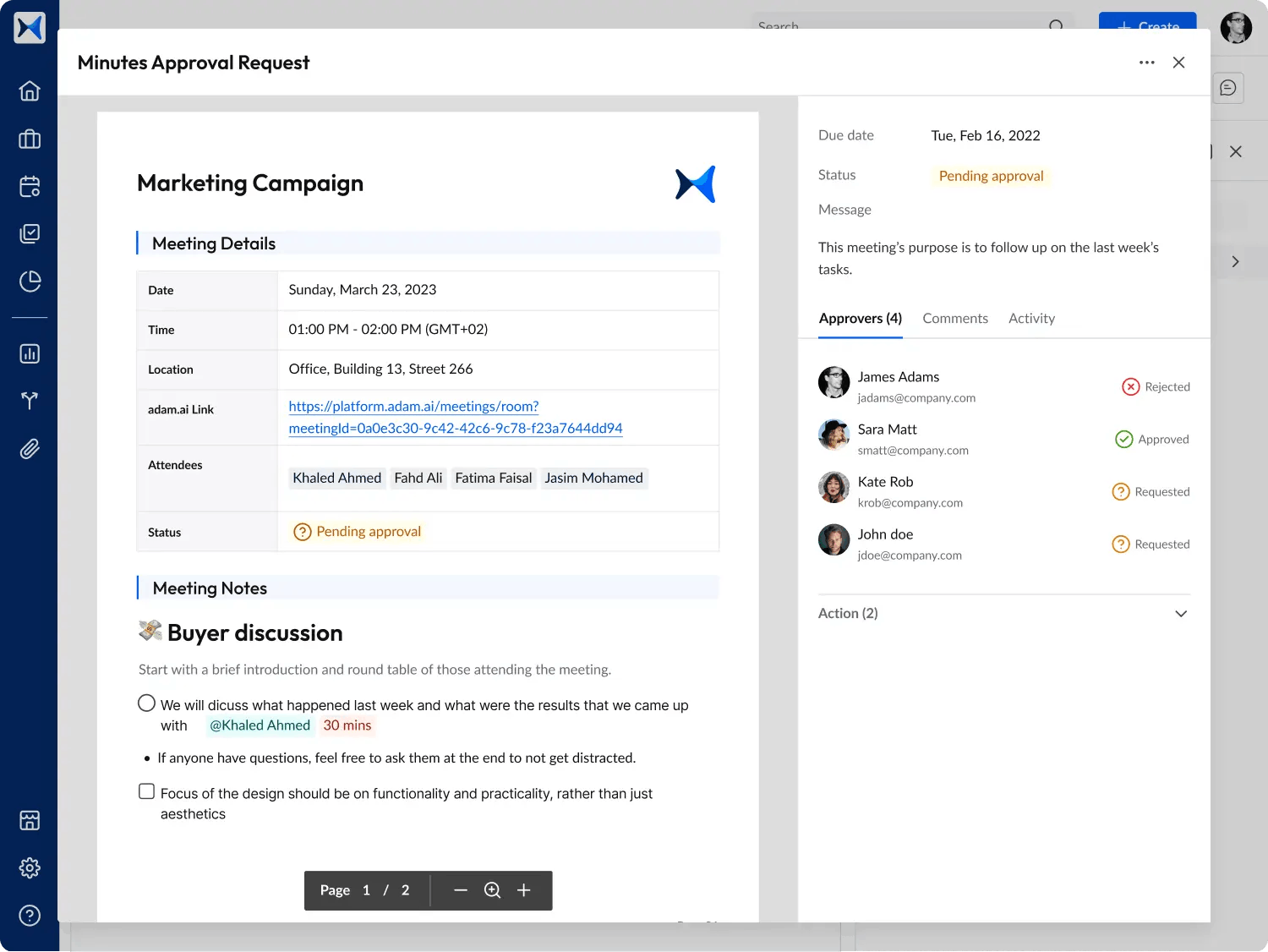

- Meeting minutes: AI-generated summaries capture key discussions, decisions, and action points, ensuring that all stakeholders stay informed. In fintech, this feature streamlines audit trails and ensures regulatory bodies have clear records of risk assessments and compliance reviews.

- Multi-space management: Financial institutions deal with multiple departments, branches, and regulatory bodies. This feature centralizes discussions across spaces while maintaining data security. It enables seamless collaboration between compliance officers, risk analysts, and executive teams managing multiple banking entities.

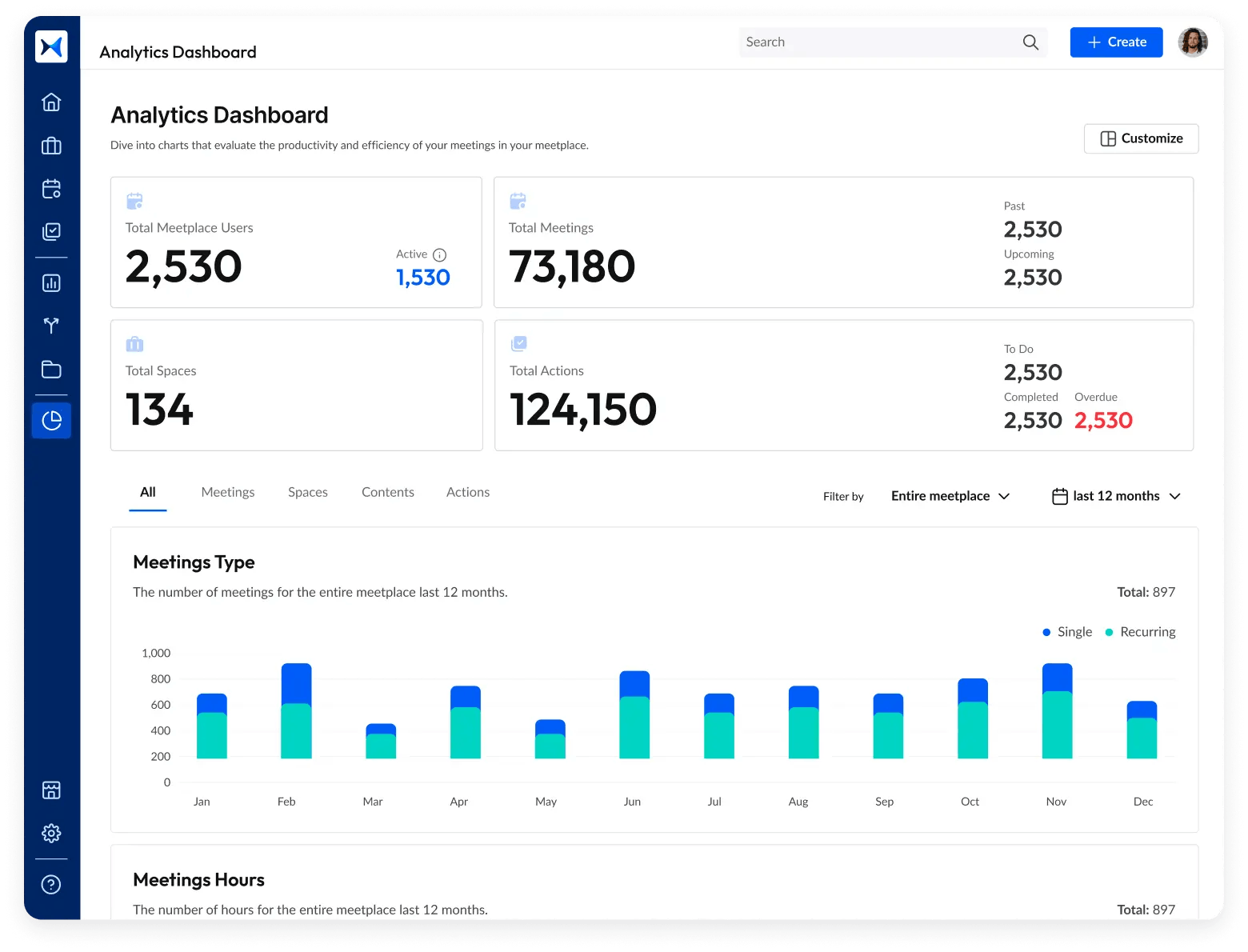

- Analytical dashboards: AI-powered dashboards turn meeting insights into actionable data, helping banking executives track financial risks, performance trends, and regulatory adherence. Fintech firms can use these analytics to refine business strategies, monitor investment opportunities, and optimize financial workflows.

The bottom line

The transition from traditional banking to fintech is accelerating, and AI-driven collaboration is making it seamless. Banks and fintech firms that embrace AI-driven platforms can enhance strategic decision-making, streamline collaboration, and drive more efficient, compliant financial operations.

And while there may be multiple solutions available, here is why adam.ai is the meeting management software platform you can trust:

- adam.ai is one of Atlassian Ventures' portfolio companies.

- In the meeting management software category on G2, adam.ai has been ranked a leader and a high performer for successive quarters in the past years.

- adam.ai has been included in the Forrester Report in the AI-enabled meeting technology landscape.

- adam.ai is trusted and used by powerful teams and organizations worldwide for all types of critical meetings, like board, committee, project management, and business development meetings.

- And most importantly, adam.ai integrates with your existing workflow, is SOC2 compliant, provides dedicated support and success, and has a free trial option.

Subscribe to adam.ai blog

Stay ahead with the latest insights—get our newest blog posts, tips, and updates sent straight to your inbox.