February 2, 2025 · 13 min read

Building Trust in Investor Relations Through Transparent Meeting Practices

Shaimaa Badawi

Investor trust reflects how well a company communicates and follows through. Transparent investor meetings ensure stakeholders receive clear, honest, and structured insights into a company’s performance, strategy, and governance. In this article, we’ll explore how transparency impacts investor confidence, the challenges companies face, and the best practices for structuring investor meetings.

Why is trust fundamental in investor relations?

Investor relations (IR) is more than just presenting financial data. It’s about building confidence in a company’s future. Investors commit capital based on how much they trust a company’s leadership, strategy, and integrity. Without trust, even strong financial performance may not be enough to secure long-term investor support.

Trust in investor relations is critical because it

- reduces market skepticism: investors are more likely to hold onto shares during volatility if they believe in a company’s governance and decision-making,

- attracts long-term investors: reliable, transparent communication reassures institutional investors and prevents short-term sell-offs,

- lowers the cost of capital: companies with strong investor trust often benefit from lower financing costs due to reduced perceived risk,

- improves stock valuation: investor confidence directly impacts market perception, influencing stock prices positively.

The role of transparency in strengthening investor trust

Transparency acts as the bridge between corporate actions and investor confidence. When companies communicate openly about their financial health, risks, and strategic plans, investors can make informed decisions, reducing uncertainty.

Transparency strengthens trust through the following:

1. Consistent financial disclosure

- Regular and clear reporting on earnings, financial outlook, and risks reassures investors.

- Providing both positive and negative updates signals integrity, preventing speculation-driven fear.

2. Open communication in investor meetings

- Transparent investor meetings set the tone for honest dialogue.

- Companies that engage in Q&A sessions, provide clear meeting agendas, and disclose meaningful insights foster stronger investor confidence.

3. Timely and proactive updates

- Investors appreciate companies that don’t just meet regulatory disclosure requirements but go beyond by proactively sharing key developments.

- Preempting concerns, especially in downturns, prevents misinformation from shaping market sentiment.

4. Clear governance and decision-making processes

- Transparency in board decisions, leadership transitions, and corporate policies ensures investors understand how the company is run.

- Providing insights into governance structures and ESG (environmental, social, and governance) initiatives reinforces credibility.

5. Handling investor concerns with transparency

- When concerns arise, companies that acknowledge issues instead of deflecting them earn trust.

- Regular investor engagement, through roadshows, town halls, and quarterly calls, helps manage expectations.

How do transparent meeting practices directly impact investor confidence?

Investor confidence is about how well a company communicates and engages with its investors. Transparent meeting practices give investors the clarity they need to make informed decisions, reducing uncertainty and reinforcing trust.

1. Enhancing predictability and reducing uncertainty

Investors dislike surprises. When a company consistently holds structured, transparent meetings, it reassures investors that they will receive timely updates and can anticipate how the company operates.

- Consistent meeting schedules (quarterly earnings calls, annual general meetings, investor roadshows) create predictability.

- Comprehensive agendas shared in advance prevent speculation and misinformation.

- Preemptive risk disclosures in meetings reduce panic-driven sell-offs. Clear financial disclosures and open dialogue help investors make informed investment decision-making choices, reducing uncertainty and speculation.

2. Strengthening investor-company relationships

Transparency in meetings fosters a sense of partnership rather than detachment. Investors feel valued when they are

- given direct access to leadership through Q&A sessions and open forums,

- encouraged to voice concerns, with clear responses from management,

- provided with detailed, data-driven insights rather than generic statements.

Enhancing customer experience in financial services through digital transformation can also influence investor confidence by demonstrating long-term growth strategies.

3. Preventing negative market reactions

Companies that control their narrative through transparency mitigate negative speculation.

- If a company suddenly goes silent on financials or upcoming risks, investors assume the worst.

- Transparent meetings counter misinformation by providing direct, fact-based updates.

- Handling tough questions openly prevents loss of confidence, even during downturns.

4. Aligning investor expectations with business strategy

When investors understand a company’s short-term challenges and long-term vision, they are more likely to stay committed.

- Transparent strategy discussions during meetings ensure investors don’t overreact to quarterly fluctuations. Transparent communication also plays a pivotal role in streamlining mergers and acquisitions, ensuring that stakeholders remain aligned throughout complex transitions.

- Realistic goal-setting and reporting progress against those goals creates confidence.

- Clear explanations of financial decisions, such as stock buybacks or capital expenditures, reassure investors about management’s foresight.

5. Showcasing strong corporate governance

Meetings that emphasize ethics, accountability, and governance send a message that the company is well-managed.

- Disclosing decision-making frameworks reassures investors that leadership acts in the best interest of shareholders. A well-defined reporting framework strengthens corporate governance and enhances financial reporting for boards, enabling more effective decision-making.

- Clarifying voting procedures and governance updates builds credibility in company policies.

- Incorporating ESG discussions strengthens trust among sustainability-focused investors.

What are the biggest challenges in maintaining transparency in investor relations?

Maintaining transparency in investor relations is essential for building trust and fostering strong relationships with stakeholders. However, companies often face significant challenges in achieving and sustaining this transparency. Below are some of the primary obstacles and strategies to overcome them:

1. Balancing transparency with competitive sensitivity

- Challenge: Disclosing detailed financial and operational information can provide valuable insights to investors but may also expose sensitive data to competitors, potentially compromising a company's strategic position.

- Solution: Companies should develop a comprehensive disclosure policy that delineates the scope of information shared. This policy should aim to provide investors with sufficient insights to make informed decisions while safeguarding proprietary information that could be advantageous to competitors.

2. Navigating complex regulatory environments

- Challenge: Companies must adhere to a myriad of regulatory requirements that govern financial disclosures, which can vary significantly across jurisdictions. Non-compliance can lead to legal repercussions and damage to reputation.

- Solution: Establishing a dedicated compliance team is crucial. This team should stay abreast of evolving regulations, ensure that all disclosures meet legal standards, and implement robust internal controls to maintain accuracy and compliance in reporting. Companies that proactively address compliance and risk management concerns not only reduce regulatory risks but also reinforce investor trust.

3. Managing investor expectations

- Challenge: Investors often seek detailed and frequent updates, especially during periods of volatility or uncertainty. Meeting these expectations without overcommitting resources or divulging sensitive information can be challenging.

- Solution: Regularly scheduled communications, such as quarterly reports and investor calls, can help manage expectations. Providing clear guidance on what information will be shared and when can set appropriate boundaries while keeping investors adequately informed.

4. Ensuring consistency across communication channels

- Challenge: Inconsistent messaging across various platforms—such as press releases, social media, and official reports—can lead to confusion and mistrust among investors.

- Solution: Implementing a centralized communication strategy ensures that all information disseminated is accurate, consistent, and aligns with the company's core messages. Regular training for spokespersons and a unified approval process for public communications can further enhance consistency.

5. Addressing negative information transparently

- Challenge: Disclosing unfavorable news, such as financial downturns or operational setbacks, can be daunting, as it may impact investor confidence and stock performance.

- Solution: Embracing a culture of transparency involves openly communicating challenges along with the steps being taken to address them. This approach can enhance credibility and trust, as investors appreciate honesty and proactive problem-solving.

How can companies ensure clear and honest communication with investors?

Effective investor communication leads to building confidence, setting expectations, and maintaining long-term trust. Companies can achieve this by following structured, transparent, and proactive communication strategies.

1. Provide timely and accurate information

Investors expect regular updates on financial performance, strategic initiatives, and market conditions. Transparency about both successes and challenges demonstrates integrity and builds credibility.

- Quarterly earnings calls and annual reports should include not only financial results but also forward-looking insights to help investors make informed decisions.

- Crisis updates should be swift and clear, minimizing speculation and misinformation.

2. Utilize multiple communication channels

Investors consume information through various formats, so a multichannel approach ensures accessibility:

- Press releases and investor meetings for formal updates.

- Webinars and town halls to engage retail investors.

- Social media and digital platforms to provide quick, digestible insights.

For instance, Microsoft is known for using its dedicated investor relations website to provide real-time earnings updates, presentations, and regulatory filings, ensuring broad investor access to key data.

3. Foster open dialogue

Transparency means more than just disclosing facts; it means creating an environment where investors feel heard:

- Dedicated investor Q&A sessions encourage engagement.

- Follow-up responses ensure concerns aren’t ignored.

- Advisory boards or surveys help gauge investor sentiment.

Companies like Tesla frequently hold investor Q&A sessions during earnings calls, allowing direct interaction between shareholders and leadership. Leveraging NLP for stakeholder sentiment in meetings helps companies gauge investor concerns and adjust communication strategies accordingly.

4. Simplify complex information

Not all investors are financial analysts. companies should make reports and presentations clear, concise, and visually engaging:

- Use charts and infographics to break down financial performance.

- Provide executive summaries with key takeaways.

- Ensure accessibility to both institutional and retail investors.

A strong example is Unilever’s ESG reports, which simplify sustainability metrics and impact assessments, making them easier for investors to digest

What are the best practices for structuring transparent investor meetings?

In 2024, several companies faced criticism for limiting shareholder participation during virtual annual meetings. Tactics such as requiring verbatim reading of proposals and muting off-script speakers were employed, leading to concerns about transparency and engagement. This highlights the importance of fostering open dialogue and inclusivity in investor meetings. Here's what you can do:

1. Develop a clear and comprehensive agenda

- Prioritize key topics: Focus on essential subjects such as financial performance, strategic initiatives, and governance updates. Implementing machine learning for meeting preparation ensures that investor discussions are data-driven, well-structured, and impactful.

- Distribute in advance: Share the agenda with investors ahead of the meeting to allow adequate preparation.

2. Ensure accessibility and inclusivity

- Choose appropriate venues: Select locations that are convenient and accessible to a majority of investors.

- Offer virtual participation: Provide options for remote attendance to accommodate all stakeholders. By optimizing meeting structures, companies can enhance the ROI of reduced meeting time, leading to more productive investor engagements.

3. Promote open and honest communication

- Encourage Q&A sessions: Allocate time for investors to ask questions and receive candid responses. AI-driven tools play a crucial role in reducing meeting fatigue with AI, allowing investor meetings to remain focused, efficient, and actionable.

- Address all concerns: Respond to both positive and negative inquiries transparently.

4. Utilize clear and understandable materials

- Simplify complex data: Present information using straightforward language and visuals like charts and graphs.

- Provide supporting documents: Offer detailed reports and summaries to back up presentations.

5. Leverage technology for enhanced engagement

- Use reliable platforms: Implement user-friendly technologies for virtual meetings. Integrating digital transformation in project management enhances operational efficiency and provides transparency in decision-making.

- Record sessions: Make recordings available for those unable to attend live.

6. Maintain consistent and regular communication

- Schedule meetings periodically: Hold meetings at regular intervals to keep investors informed.

- Provide timely updates: Share information promptly, especially regarding significant developments.

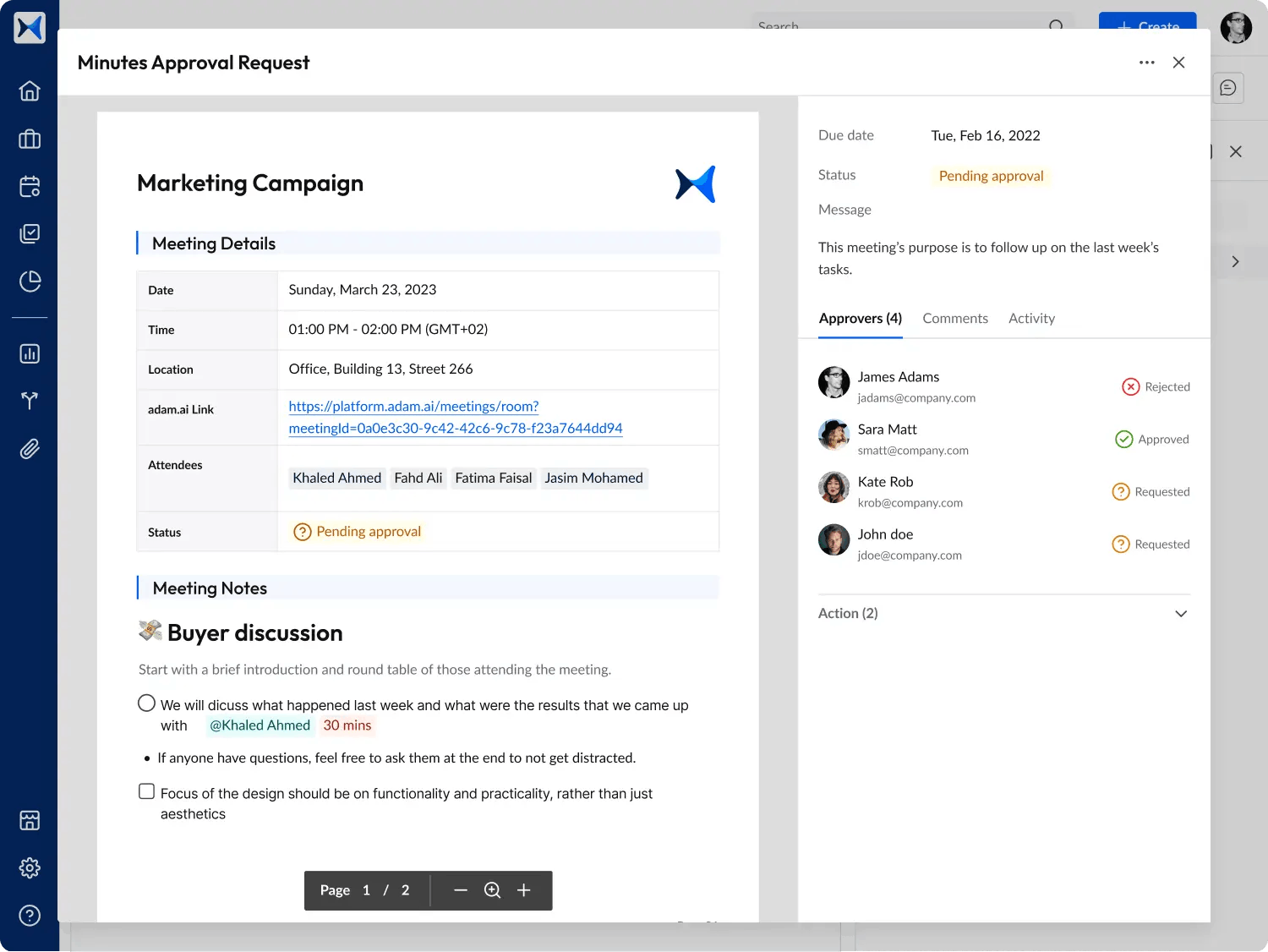

7. Document and share meeting outcomes

- Publish minutes promptly: Ensure that detailed records of discussions and decisions are accessible to all investors.

- Highlight action items: Clearly outline next steps and responsible parties.

How does proactive disclosure of financial and operational data enhance trust?

Proactive disclosure of financial and operational data is a cornerstone of building investor trust and ensuring compliance with regulatory standards.

In 2024, Australia's enforcement of stringent tax disclosure laws required multinational companies to reveal their financial activities in jurisdictions known for tax incentives and secrecy. This move aimed to increase transparency and tackle profit shifting, thereby enhancing investor trust and ensuring regulatory compliance.

Enhancing trust through proactive disclosure

- Building investor confidence: Regular and transparent communication about financial health and operational strategies enables investors to make informed decisions, reducing uncertainty and perceived risk.

- Demonstrating accountability: Openly sharing both successes and challenges showcases a company's commitment to honesty and ethical practices, reinforcing its credibility.

- Reducing information asymmetry: Providing detailed insights into operations and finances levels the playing field between management and investors, minimizing speculation and potential misinformation.

Regulatory requirements for disclosure

Regulatory frameworks mandate specific disclosures to protect investors and maintain market integrity. For instance, the U.S. Securities and Exchange Commission (SEC) has implemented amendments to modernize and enhance financial disclosure requirements, aiming to eliminate duplicative information and improve the quality of disclosures.

Key requirements include the following:

- Financial reporting standards: Companies are obligated to prepare financial statements in accordance with established accounting principles, ensuring accuracy and consistency.

- Periodic filings: Regular submission of reports, such as annual and quarterly filings, provides updates on financial performance and material events.

- Material event disclosure: Timely reporting of significant events that could influence investment decisions is essential to maintain transparency.

How do cultural and regional differences affect investor relations transparency?

Cultural and regional differences significantly influence transparency in investor relations, affecting how companies communicate with stakeholders across various markets. Understanding these nuances is crucial for fostering trust and ensuring effective engagement with a diverse investor base.

1. Communication styles and transparency

Cultural norms dictate preferred communication methods, impacting perceptions of transparency:

- High-context vs. low-context cultures: In high-context cultures (e.g., Japan and Middle Eastern countries), communication relies heavily on implicit messages and context, which may lead to less direct disclosure practices. Conversely, low-context cultures (e.g., the United States and Germany) favor explicit and straightforward communication, aligning with more transparent information sharing.

- Affective vs. instrumental communication: Cultures emphasizing affective communication (expressive and relationship-focused) may prioritize building relationships over detailed information exchange. In contrast, instrumental communication (task-oriented and direct) focuses on clear and concise data dissemination.

A comparative study of Finnish and Italian companies revealed that cultural differences influence IR communication policies, with variations in contextual versus personal and affective versus instrumental communication styles.

2. Regulatory environments and disclosure practices

Regional regulatory frameworks shape the extent and nature of required disclosures:

- Divergent ESG reporting standards: ESG reporting varies globally, with regions like the European Union implementing stringent regulations, while other areas may have less prescriptive requirements. This disparity can lead to inconsistent transparency levels across markets.

- Cross-border regulatory challenges: Companies operating internationally must navigate varying disclosure obligations, which can complicate efforts to maintain uniform transparency standards.

The European Union and the United States have exhibited differing approaches to ESG regulations, influencing how companies disclose related information in these regions.

3. Investor expectations and cultural norms

Investor expectations are often rooted in cultural values, affecting perceptions of transparency:

- Collectivist vs. individualist societies: In collectivist cultures (e.g., many Asian and Middle Eastern countries), emphasis on group harmony and consensus may lead to less emphasis on individual accountability in disclosures. Individualist cultures (e.g., Western countries) often prioritize personal responsibility and detailed transparency.

- Trust-building approaches: Some cultures value personal relationships and face-to-face interactions as foundations of trust, potentially viewing formal disclosures as secondary. Others rely heavily on formal, data-driven communications to establish credibility.

In the Middle East, investor relations practices are heavily influenced by cultural norms that prioritize personal relationships and trust-building, which can impact the transparency and style of communication.

4. Strategies for enhancing transparency across cultures

To navigate cultural and regional differences effectively, companies can adopt the following strategies:

- Cultural sensitivity training: Educate IR teams on cultural communication styles and preferences to tailor disclosures appropriately.

- Localized communication strategies: Adapt messaging and disclosure practices to align with regional norms and regulatory requirements, ensuring relevance and compliance.

- Stakeholder engagement: Foster open dialogues with local investors and stakeholders to understand their expectations and build trust through culturally resonant practices.

How does adam.ai empower enterprises to run transparent investor meetings?

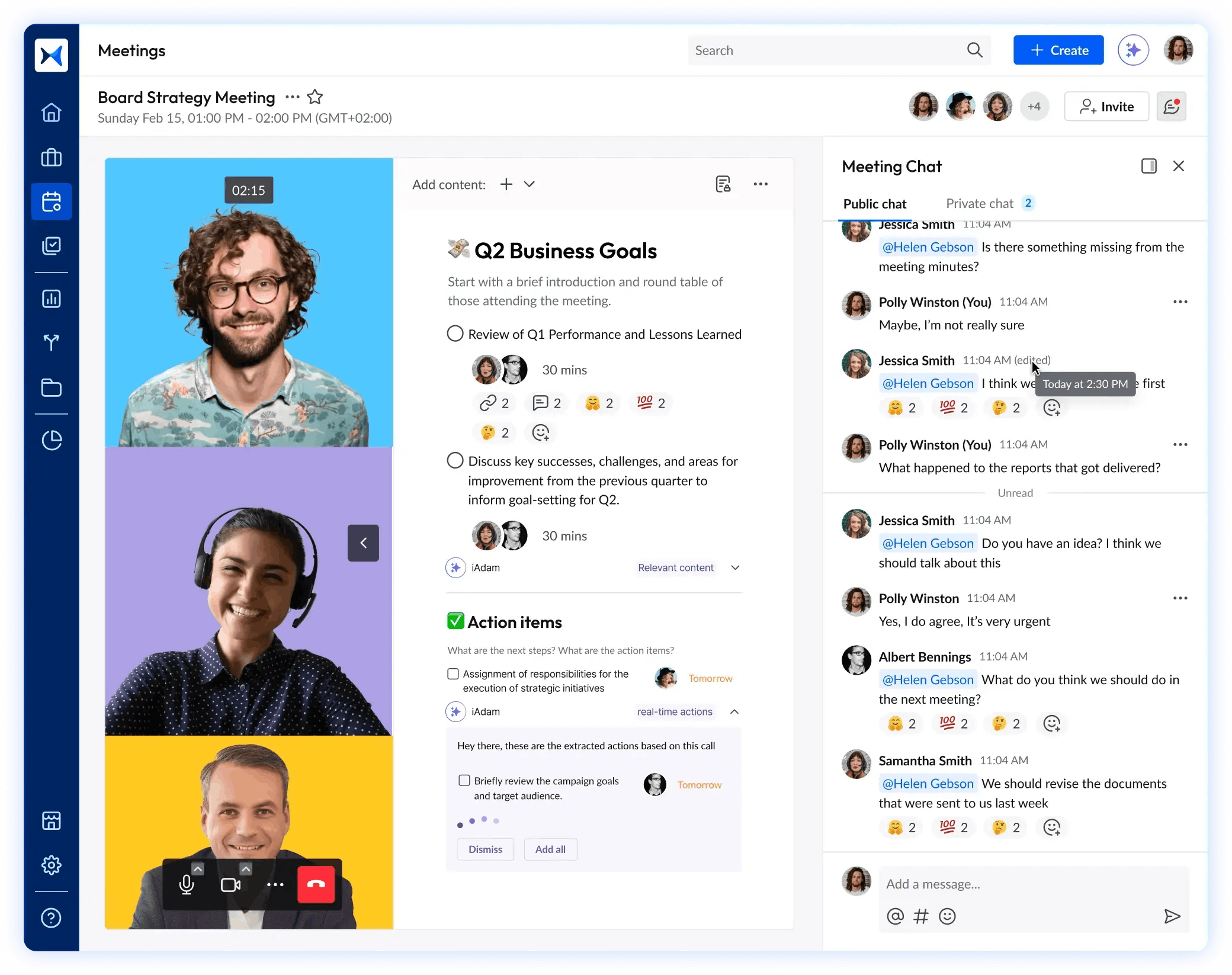

Ensuring transparency in investor meetings requires structured communication, organized documentation, and clear follow-ups. adam.ai provides enterprises with the tools to facilitate open, efficient, and well-documented investor discussions.

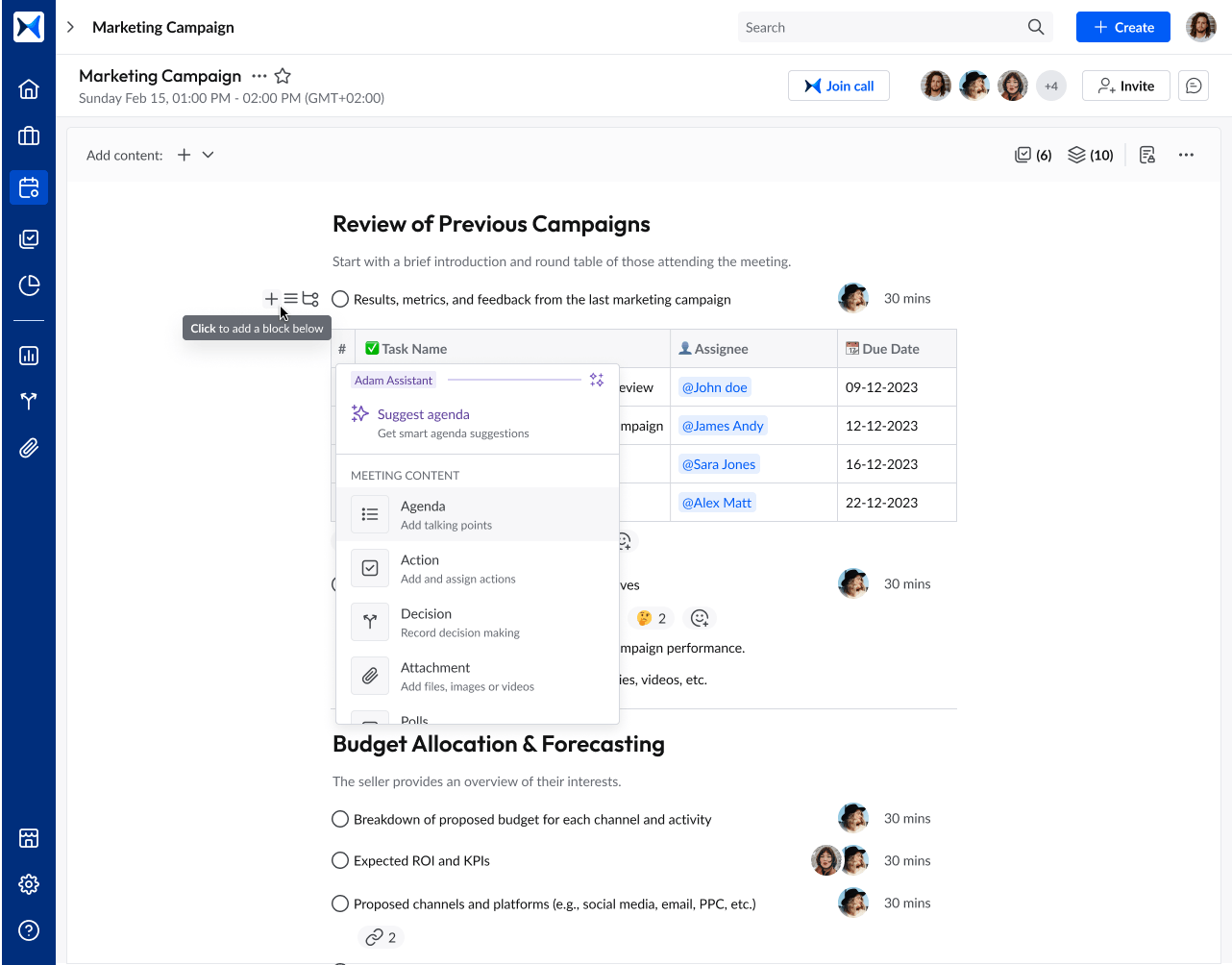

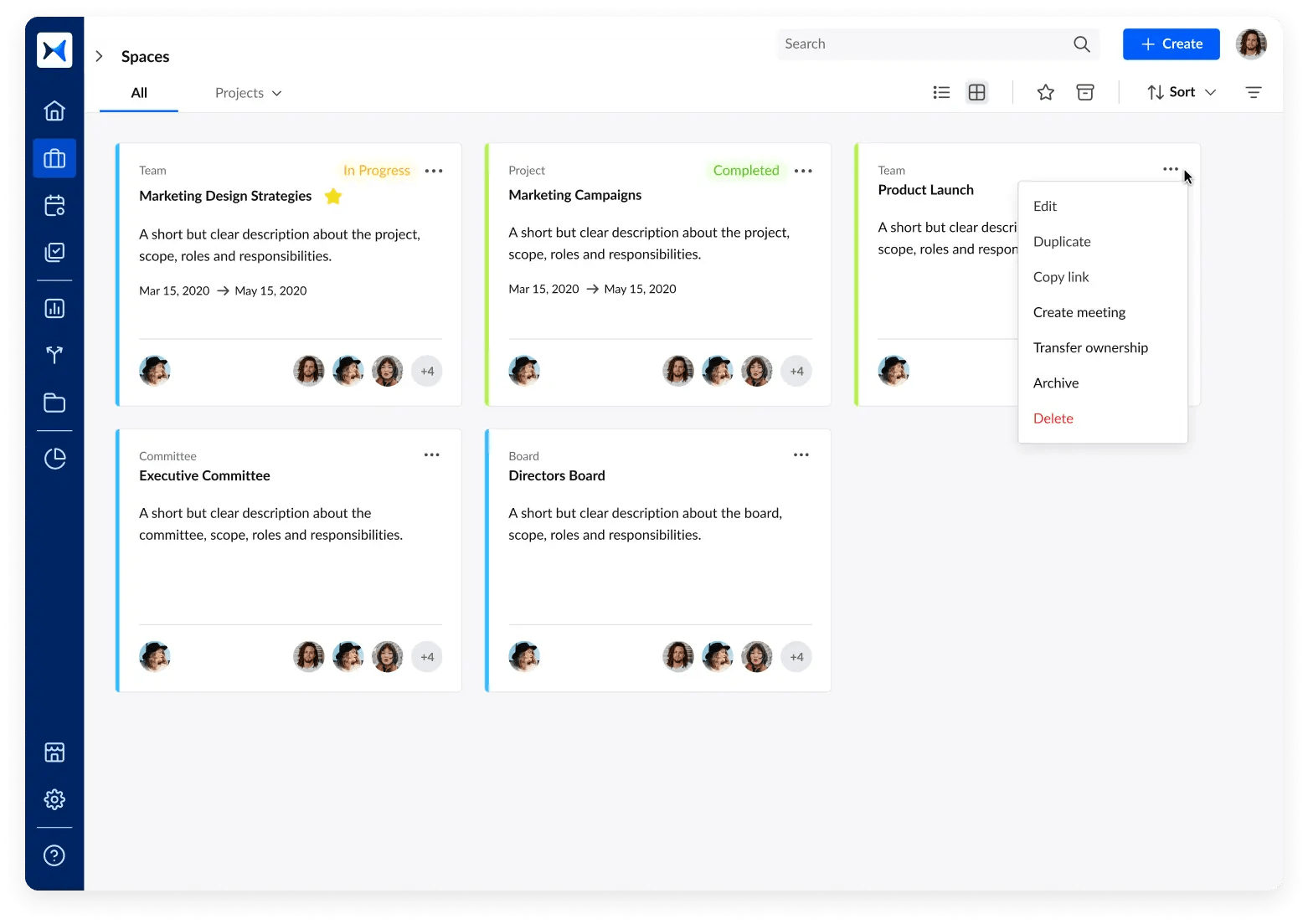

- Agenda management: Set clear meeting objectives, assign topics, and share structured agendas in advance to keep investor discussions focused and transparent.

- Content collaboration: Centralize reports, financial statements, and investor materials in a secure space, ensuring all stakeholders have access to the same accurate information.

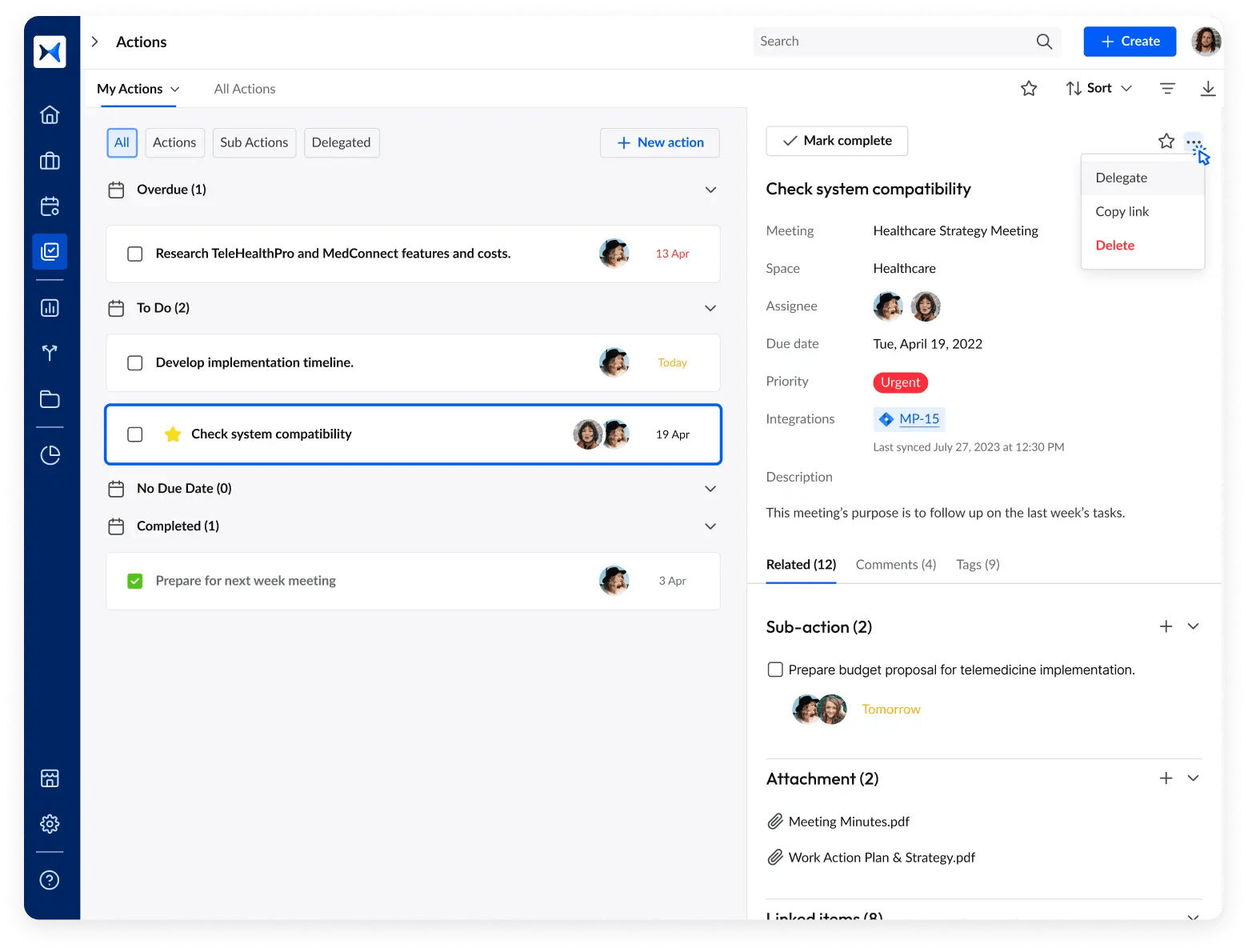

- Action tracking: Assign, monitor, and follow up on key investor concerns and commitments, reinforcing accountability and trust in decision-making.

- Meeting minutes: Automatically capture, document, and distribute meeting summaries, ensuring investors have a verifiable record of discussions and decisions.

- Multi-space management: Organize investor meetings across different boards, committees, and projects while maintaining transparency in every engagement.

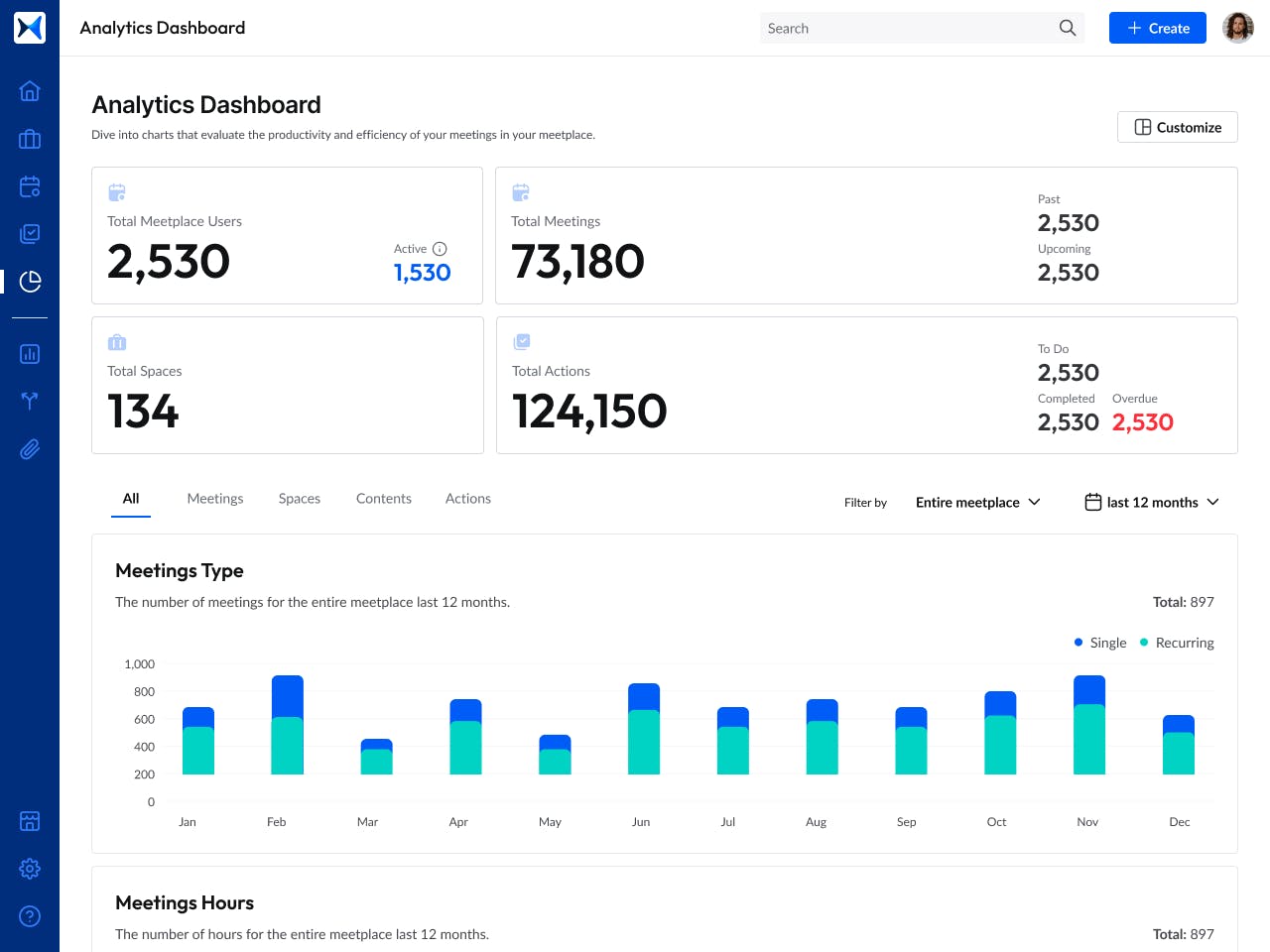

- Analytical dashboards: Provide real-time insights into meeting outcomes, engagement levels, and investor concerns, helping leadership drive informed investor relations strategies.

Transform how you conduct critical meetings—From meticulous preparation to effective execution and insightful follow-up, adam.ai integrates comprehensive analytics, full customization, and intuitive interfaces with powerful meeting management tools.

Easy onboarding. Enterprise-grade security. 24/7 dedicated support.

The bottom line

Transparency in investor relations isn’t optional; it’s a competitive advantage. By implementing clear agendas, structured documentation, and actionable follow-ups, companies can foster trust, manage investor expectations, and maintain long-term stakeholder confidence.

And while there may be multiple solutions available, here is why adam.ai is the meeting management software platform you can trust:

- adam.ai is one of Atlassian Ventures' portfolio companies.

- In the meeting management software category on G2, adam.ai has been ranked a leader and a high performer for successive quarters in the past years.

- adam.ai has been included in the Forrester Report in the AI-enabled meeting technology landscape.

- adam.ai is trusted and used by powerful teams and organizations worldwide for all types of critical meetings, like board, committee, project management, and business development meetings.

- And most importantly, adam.ai integrates with your existing workflow, is SOC2 compliant, provides dedicated support and success, and has a free trial option.

Subscribe to adam.ai blog

Stay ahead with the latest insights—get our newest blog posts, tips, and updates sent straight to your inbox.