May 27, 2024 · 12 min read

Optimizing Customer Experience in Financial Services: A Comprehensive Guide

Shaimaa Badawi

In the fiercely competitive world of financial services, providing an exceptional customer experience is no longer just a differentiator—it's a necessity. As customer expectations continue to evolve, financial institutions must adopt innovative strategies to enhance every touchpoint of their customer interactions. From personalized service to seamless digital experiences, the key to success lies in understanding and exceeding customer needs. This article delves into how financial institutions can leverage advanced tools and techniques to transform customer experience, ensuring loyalty and satisfaction in a rapidly changing landscape.

What is customer experience in financial services?

Customer experience (CX) in financial services refers to the overall perception and emotions that customers have regarding their interactions with a financial institution. This encompasses every touchpoint along the customer journey, from the initial engagement to ongoing support and service. In today's digital age, delivering a positive customer experience is crucial for financial institutions to retain and attract customers.

What are the key aspects of customer experience in financial services?

1. Comprehensive interaction

- Total engagement: CX includes all interactions between a customer and a financial institution. This starts from the moment a customer considers opening an account and continues through every transaction, inquiry, and service request. Each interaction contributes to the customer's overall perception of the institution.

- Touchpoints: These interactions happen across various touchpoints such as online banking, mobile apps, in-branch visits, and customer service calls. Ensuring a cohesive and seamless experience across all these touchpoints is essential.

2. Ease of use and functionality

- User-friendly interfaces: Customers expect intuitive, easy-to-navigate platforms for managing their finances. The ease with which customers can perform tasks like checking balances, transferring funds, or applying for loans greatly impacts their satisfaction.

- Streamlined processes: Simplifying processes to reduce complexity and time spent on tasks enhances the customer experience. Financial institutions must prioritize creating frictionless interactions that meet customer needs efficiently.

3. Omnichannel consistency

- Seamless transitions: Customers should experience consistent service quality regardless of the channel they use. Whether interacting online, via mobile, or in person, the transition between these channels should be smooth and seamless.

- Unified approach: An omnichannel strategy ensures that customers can access services and information effortlessly, maintaining a high level of service continuity and convenience.

4. Personalization and innovation

- Tailored services: Personalization involves leveraging customer data to offer customized financial advice, products, and services. This helps in addressing individual customer needs more effectively.

- Embracing technology: Financial institutions that embrace technological innovations and data-driven insights can better anticipate and meet customer expectations. This agility is key in a rapidly changing market.

5. Measuring and improving CX

- Feedback mechanisms: Financial institutions can use tools like customer satisfaction surveys, net promoter scores (NPS), and direct feedback to gauge the effectiveness of their CX initiatives. These metrics provide valuable insights into areas needing improvement.

- Continuous improvement: By analyzing feedback and customer interactions, institutions can make informed decisions to enhance the overall customer experience. This continuous refinement is crucial for maintaining customer satisfaction and loyalty.

6. Convenience

- Accessibility: Convenience is paramount in delivering a positive customer experience. This includes easy access to accounts, transactions, and support channels. Providing seamless digital banking experiences, intuitive mobile apps, and 24/7 customer support ensures that customers can manage their finances efficiently and access assistance whenever needed.

7. Security and trust

- Data protection: Security and trust are foundational elements of a positive customer experience in financial services. Customers entrust institutions with sensitive financial information. By implementing robust security measures, ensuring data protection, and transparently communicating privacy policies and security protocols, financial institutions can build trust and confidence, reassuring customers that their assets and information are safeguarded.

8. Transparency and clarity

- Open communication: Transparent communication of fees, terms, and conditions is essential for fostering trust and confidence among customers. Financial institutions should provide clear and easy-to-understand disclosures, avoiding hidden fees or complicated jargon that may confuse or frustrate customers. Transparent practices build credibility and strengthen the relationship between the institution and its customers.

9. Efficiency and responsiveness

- Timely support: Timely resolution of inquiries and issues is crucial for delivering a positive customer experience and demonstrating responsiveness to customer needs. Streamlined processes, quick turnaround times for requests and inquiries, and proactive communication throughout the customer journey ensure that customers feel valued and supported.

What’s the importance of customer experience in financial services?

With heightened competition and evolving customer expectations, financial institutions must prioritize customer experience to remain competitive and drive sustainable growth.

Here’s why CX is crucial in financial services:

1. Customer retention

- Loyalty: Exceptional CX fosters loyalty and encourages customers to remain with their financial institution over the long term. By delivering superior service and addressing customer needs proactively, organizations can reduce churn and retain valuable customers.

- Reducing churn: A positive CX mitigates churn by reducing the likelihood of customers switching to competitors. Investing in CX initiatives that enhance satisfaction and address pain points can help organizations maintain customer relationships and minimize attrition.

2. Brand reputation

- Positive perception: CX plays a significant role in shaping brand perception and reputation within the financial services industry. Positive experiences lead to favorable word-of-mouth recommendations and enhance brand trust and credibility, while poor experiences can tarnish reputation and deter potential customers.

- Trust and credibility: Building trust through transparency in fee structures, accurate information, and secure transactions is essential for maintaining a strong brand reputation.

3. Customer lifetime value (CLV)

- Repeat business: Satisfied customers are more likely to engage in repeat business and generate higher revenue over their lifetime. By focusing on CX and building strong customer relationships, financial institutions can maximize CLV and extract greater value from their customer base.

- Increased engagement: Customers who have positive experiences are more likely to adopt additional products and services, leading to increased engagement and revenue.

4. Revenue growth

- Acquisition and retention: CX directly impacts revenue generation by influencing customer acquisition, retention, and upsell opportunities. Satisfied customers are more likely to expand their relationship with a financial institution, leading to increased product adoption, cross-selling, and ultimately, revenue growth.

- Operational efficiency: Implementing new technologies like AI-powered chatbots or mobile banking apps can improve operational efficiency, reduce wait times, and lower operational costs, contributing to revenue growth.

5. Competitive differentiation

- Unique positioning: In a market where product offerings can quickly become commoditized, CX stands out as a key differentiator. Financial institutions that prioritize CX can differentiate themselves through personalized experiences, omnichannel interactions, and innovative product offerings.

- Engagement: Modern customers seek more than just the service itself. They look for a provider that understands their needs and can offer a seamless, engaging experience across all touchpoints—from sign-up and onboarding to executing transactions and reaching customer support.

6. Building trust and transparency

- Clear communication: Transparency in fee structures and providing accurate information helps in building trust with customers. Ensuring secure transactions further strengthens this trust.

- Customer feedback: Regularly gathering customer feedback and addressing any issues promptly can improve customer satisfaction and loyalty.

What are the CX challenges in financial institutions?

Meeting customer expectations in the financial services industry is fraught with unique challenges. Here are some of the primary CX challenges faced by financial institutions and how they can turn these challenges into opportunities.

1. Ensuring consistent multichannel experiences

- Consistency across touchpoints: Customers expect a smooth and consistent experience across all channels, whether online, in-person, or via mobile interactions. However, many institutions struggle to integrate these channels effectively.

- Strategic channel integration: Financial institutions must strategically integrate new communication channels to avoid a disconnected multichannel approach. Using cloud-based contact center solutions can help add new channels that integrate with existing platforms, ensuring a unified customer experience.

2. Safeguarding customer information

- Data protection: Customers trust financial institutions with sensitive information, including financial records and personal identification data. While automation tools like chatbots and AI enhance user engagement, they also introduce new cybersecurity risks.

- Trust and transparency: Implementing robust security measures and transparently communicating privacy policies and security protocols is essential. Financial institutions must balance security with a positive customer experience.

3. Eliminating departmental barriers

- Overcoming silos: Financial institutions often have many products, services, and departments operating in silos. This creates barriers to collaboration and information sharing, leading to fragmented decision-making and disconnected experiences.

- Unified operations: To provide a seamless digital experience, institutions need to eliminate these silos. Encouraging cross-departmental collaboration and integrating systems can help create a more cohesive and efficient operation.

4. Adapting to new communication channels

- Modernizing legacy systems: Many longstanding financial institutions rely on outdated legacy systems, making it difficult to add new communication channels and meet the demand for digital experiences.

- Digital engagement: Investing in digital customer engagement is crucial. Financial institutions can implement new channels strategically using cloud-based solutions, ensuring they scale and adapt as needed while avoiding disconnected customer experiences.

5. Integrating digital and in-person services

- Holistic experience: Customers prefer digital channels for routine tasks but still value in-person interactions for complex issues. Financial institutions must integrate these interactions to create a seamless, holistic experience.

- Context-aware support: Equipping employees with tools to provide contextual support across all channels can prevent repetitive questions and ensure consistent, positive experiences.

6. Connecting disparate data sources

- Unified customer data: To provide personalized experiences, financial institutions need seamless data flow between platforms and channels. However, disconnected data can hinder personalization efforts.

- Comprehensive data platforms: Adopting a customer data platform (CDP) can help create complete customer profiles by unifying data from different sources. This allows for tailored communications based on customer preferences and behaviors.

7. Building strong customer relationships

- Meaningful interactions: Long-term customer relationships depend on frequent, meaningful interactions. Collecting customer feedback and leveraging it to detect key moments for engagement can strengthen these relationships.

- Proactive communication: Using customer feedback platforms, financial institutions can identify opportunities to re-engage customers and transform these interactions into transactions.

8. Reaching all customer segments

- Comprehensive feedback: Financial institutions must ensure they gather feedback from all customers, including those who interact remotely. Often, these "unseen customers" may be more dissatisfied and require attention.

- Broad feedback mechanisms: Creating multiple opportunities to collect feedback from all customer segments ensures that no group is overlooked and helps improve overall satisfaction.

How to improve customer experience in financial services

Improving customer experience in financial services is essential for maintaining competitiveness and fostering customer loyalty. Financial institutions must employ various strategies to measure and enhance CX effectively, ensuring that customers receive exceptional service at every touchpoint.

1. Collect and analyze feedback

- Multi-channel feedback collection: Establish mechanisms to gather feedback from various touchpoints, such as NPS surveys, social media, and customer support interactions. Analyzing this feedback allows teams to identify trends, pain points, and areas for improvement, enabling targeted initiatives to enhance CX.

- Customer satisfaction metrics: Use tools like customer satisfaction surveys, net promoter scores (NPS), and direct feedback to gauge the effectiveness of CX initiatives. These metrics provide valuable insights into areas needing improvement.

2. Leverage data and analytics

- Utilizing analytics: Leverage data analytics to gain insights into customer behavior and preferences. Automating routine tasks through data-driven processes can enhance efficiency, freeing up resources for more meaningful customer interactions.

- Predictive analytics: Implement predictive analytics to anticipate customer needs and tailor services accordingly. This proactive approach ensures that financial institutions can meet and exceed customer expectations.

3. Educate and empower frontline teams

- Employee training programs: Provide ongoing training and support to frontline teams to ensure they have the knowledge, skills, and tools necessary to deliver exceptional CX. Empower employees to understand customer needs, anticipate concerns, and provide personalized solutions.

- Customer-centric culture: Foster a culture of customer-centricity by encouraging employees to prioritize customer needs and deliver outstanding service.

4. Streamline processes and automate routine tasks

- Process automation: Streamline processes and automate routine tasks to enhance efficiency and free up resources for more meaningful customer interactions. Leveraging automation tools for onboarding processes, account management, and customer support enables teams to deliver faster, more consistent service while reducing manual errors and workload burdens.

- Seamless integration: Ensure that new workflows and practices are seamlessly embedded into the day-to-day work of customer-facing teams, minimizing disruption and maximizing effectiveness.

5. Track progress and refine strategies

- Key performance indicators (KPIs): Establish KPIs and metrics to measure CX effectiveness and track progress over time. Regularly assess performance against these metrics, solicit feedback from employees and customers, and iterate on strategies to continually refine and improve the CX process.

- Feedback integration: Continuously gather and integrate feedback from various sources to adapt and improve CX initiatives, ensuring they remain relevant and effective.

6. Establish a unified CX strategy

- Single CX strategy: Agree on a single CX strategy and set of metrics by bringing together cross-functional teams to align on a vision for customer experience. This ensures that every key stakeholder buys into the program from the outset.

- Executive ownership: Assign a single, executive-level owner for the CX program to drive investments based on results and report to the leadership team. This ownership ensures that CX remains a top priority within the organization.

Enhance financial customer experience with adam.ai

By leveraging advanced meeting management technology like adam.ai, financial institutions can streamline interactions, improve service delivery, and foster stronger relationships with their customers.

Here’s what you can do with adam.ai:

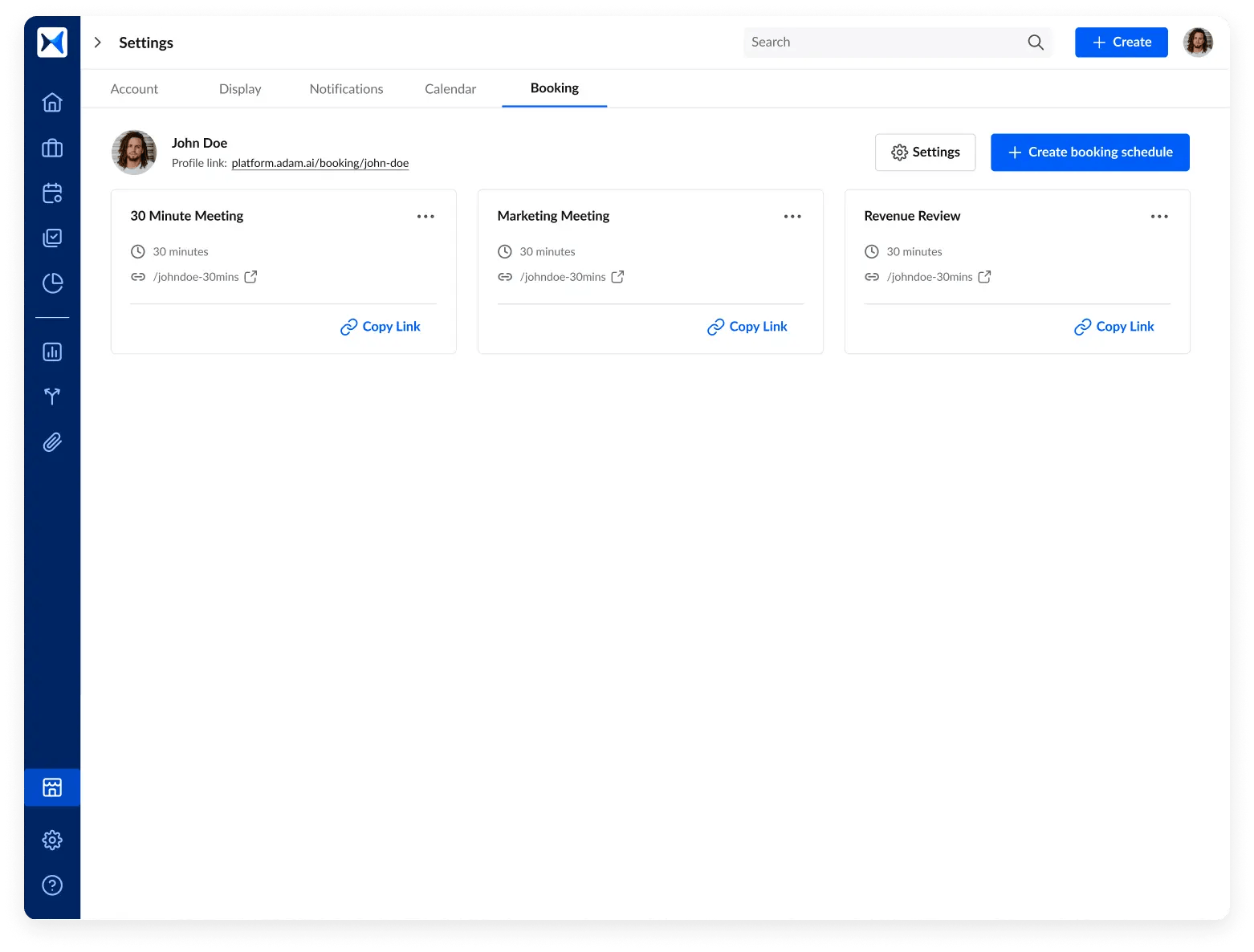

1. Unlimited booking pages: Easily schedule meetings with customers, ensuring timely and convenient interactions. This feature simplifies the appointment process, reducing wait times and enhancing customer satisfaction by making it easy for customers to book appointments at their convenience.

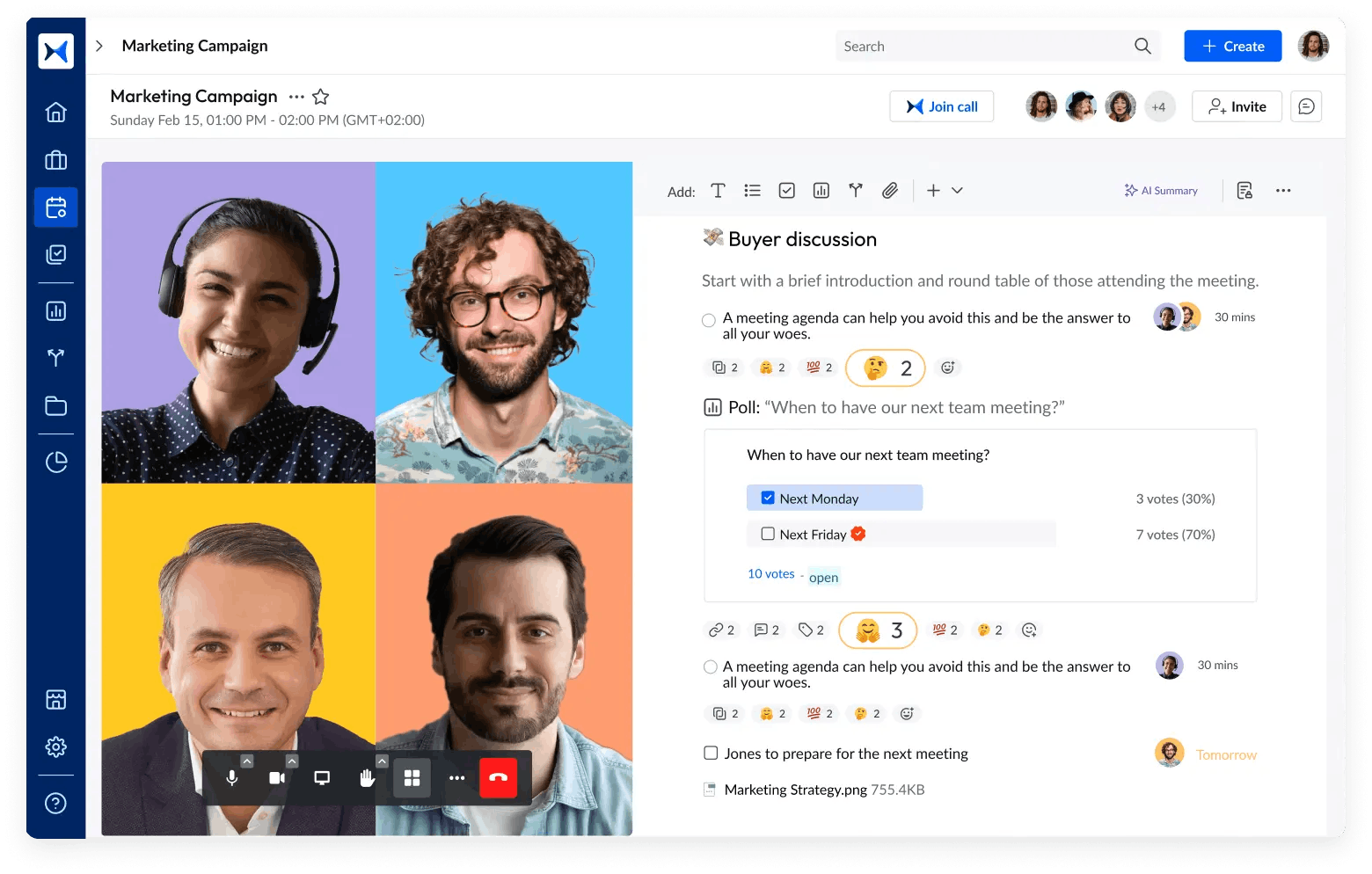

2. Smart note-taking system: During customer meetings, representatives can record agenda items, customer inquiries, decisions, and follow-up actions seamlessly. This ensures that all customer interactions are well-documented and actionable, providing a clear record that can be referenced in future interactions to maintain continuity and context.

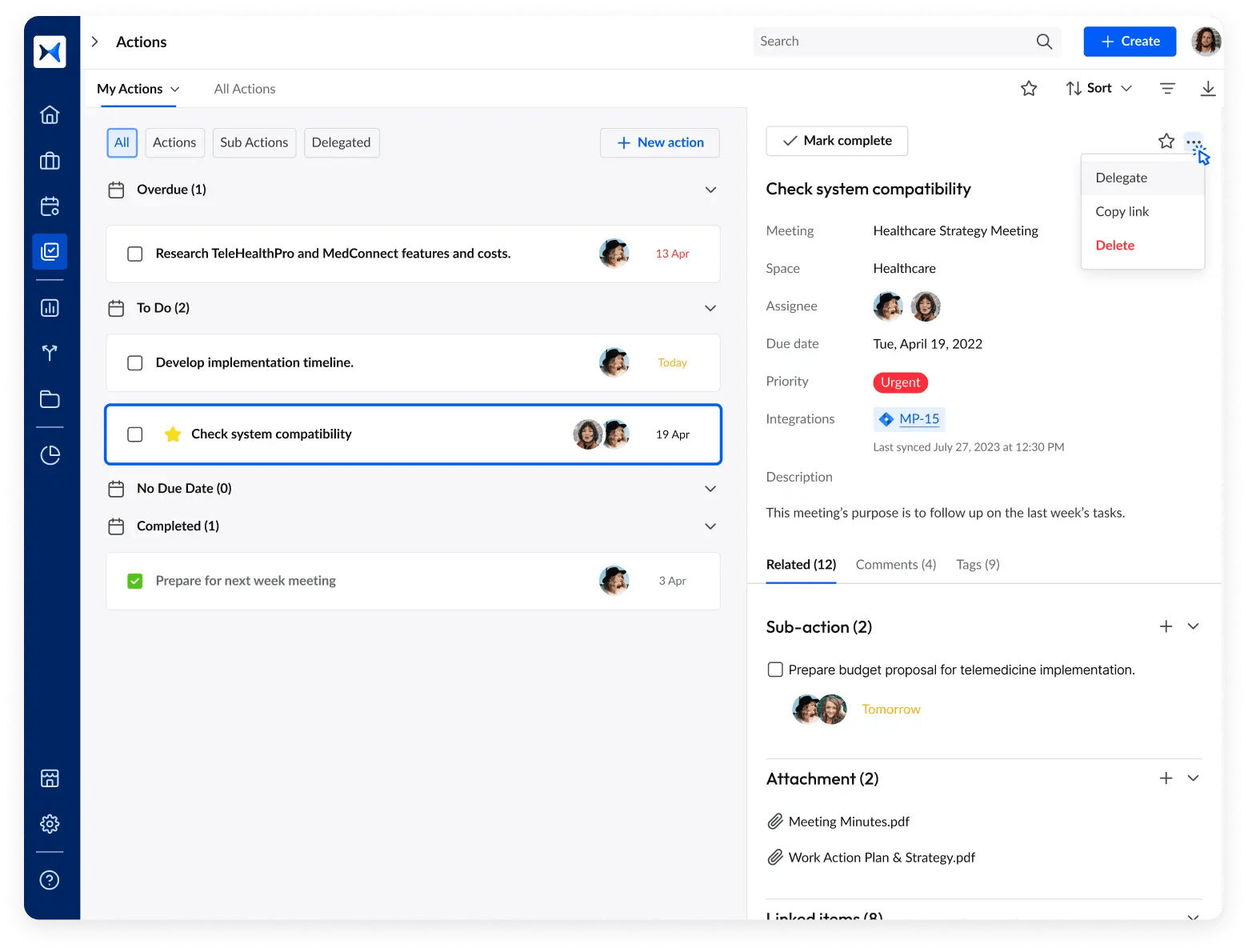

3. Action and decision tracking: Follow up on actions and decisions to ensure all customer requests and queries are addressed promptly. This improves accountability and ensures that no customer issue goes unresolved, enhancing the overall experience by demonstrating reliability and responsiveness.

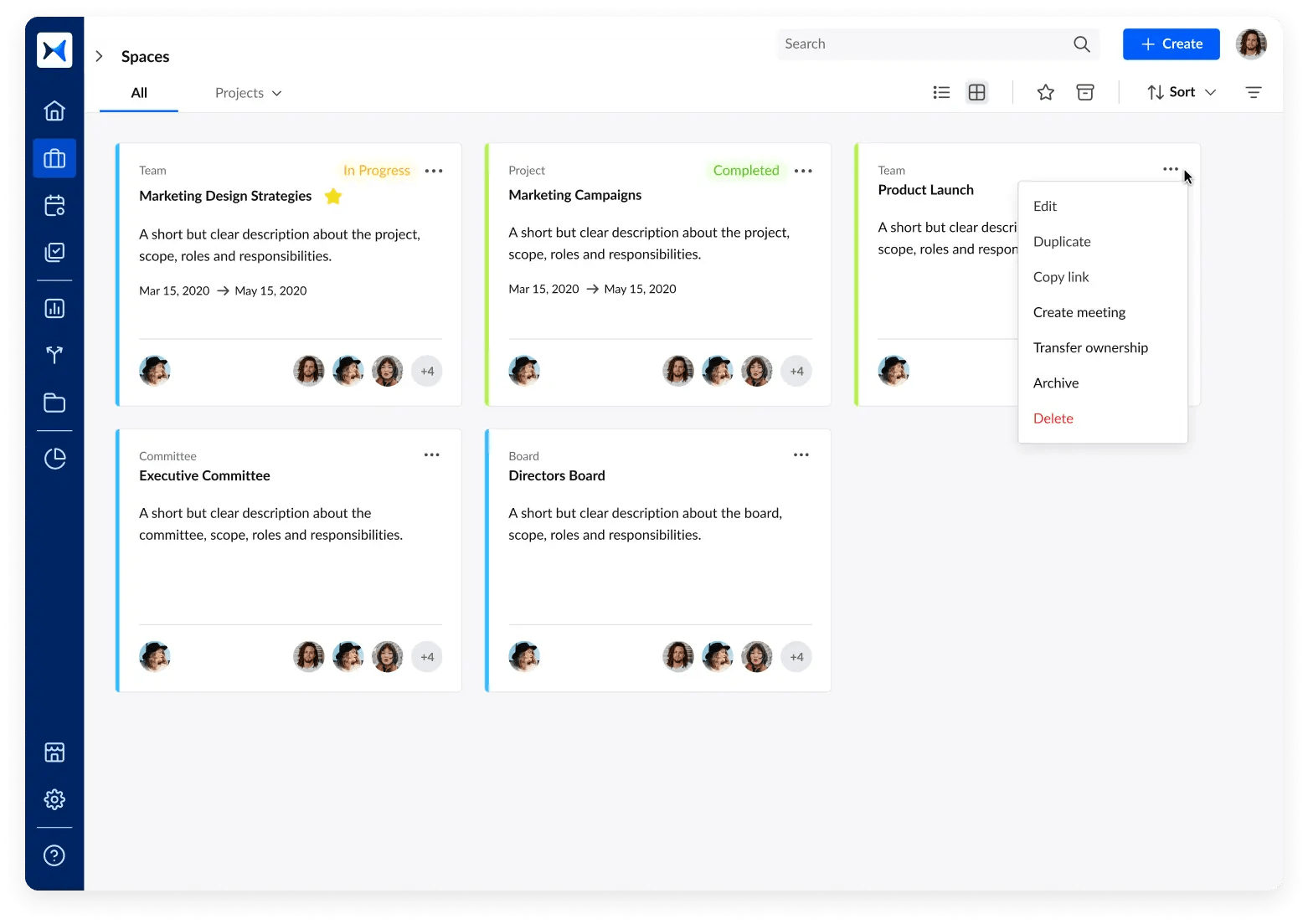

4. Categorizing meetings into spaces: Organize customer meetings into specific spaces for different types of services, such as loans, investments, or account management. This helps maintain clear records and focus on specific customer needs, making it easier to manage and track interactions related to each service area.

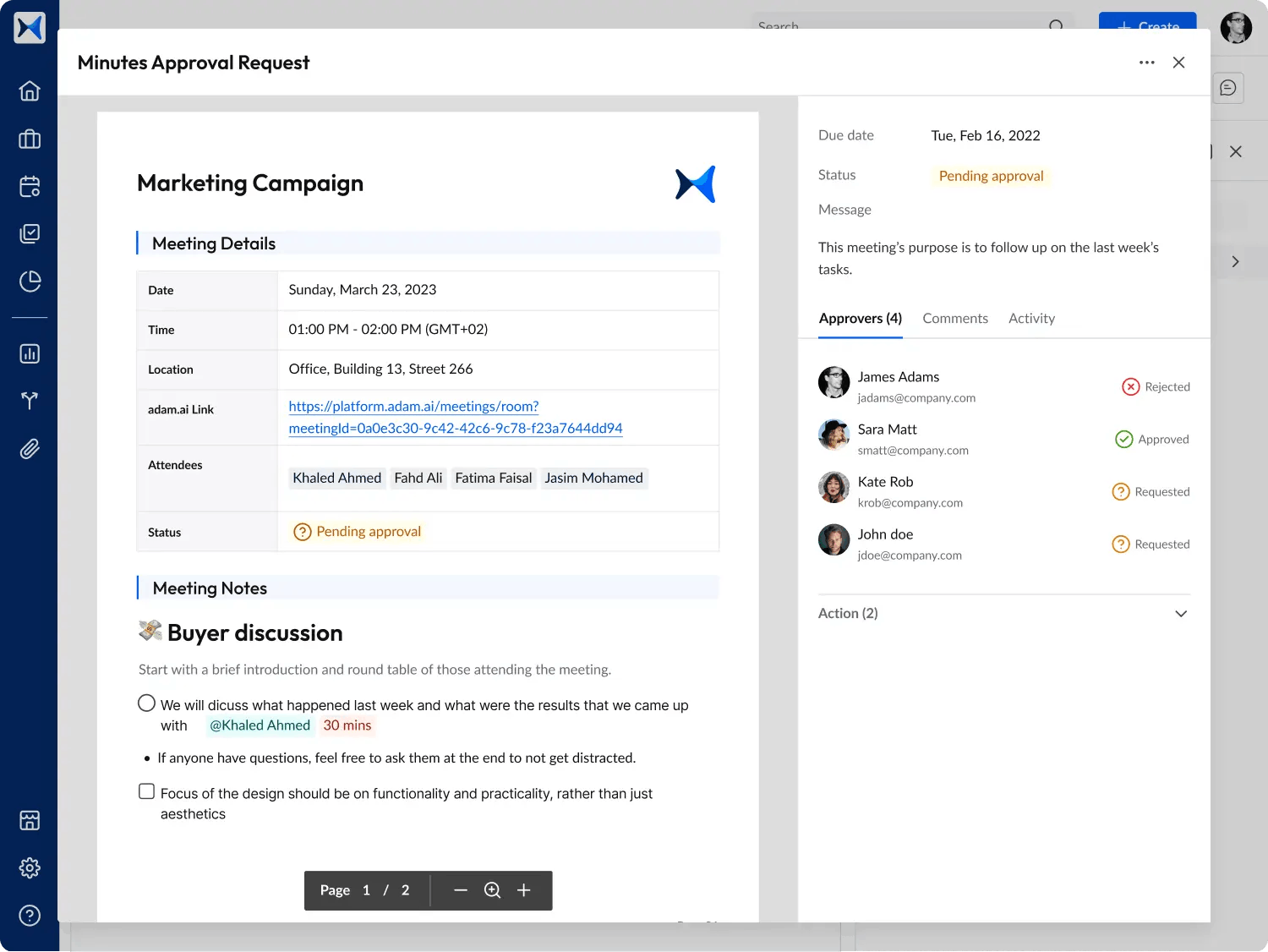

5. Minutes generation and approval cycle: Automatically generate and share meeting minutes with customers to ensure transparency and maintain a comprehensive record for future reference. This builds trust and enhances customer confidence in the institution’s services by providing clear and accessible documentation of all discussions and decisions.

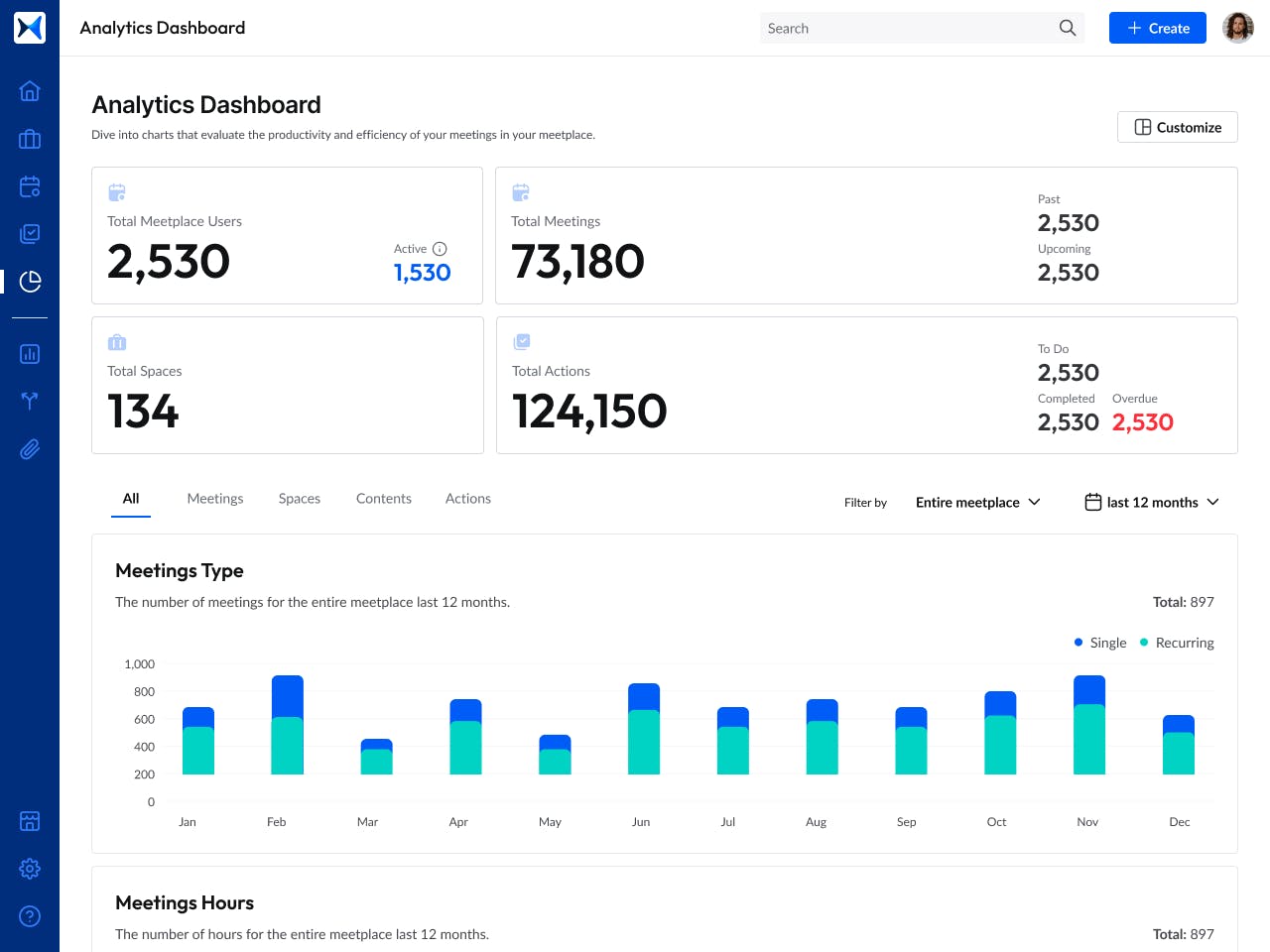

6. Customer interaction analytics: Use the analytics dashboard to assess customer interaction metrics, such as meeting participation rates and follow-up outcomes. This data-driven approach helps financial institutions identify areas for improvement and enhance overall service quality, ensuring that customer interactions are always optimized for the best possible experience.

Transform how you conduct critical meetings—From meticulous preparation to effective execution and insightful follow-up, adam.ai integrates comprehensive analytics, full customization, and intuitive interfaces with powerful meeting management tools.

Easy onboarding. Enterprise-grade security. 24/7 dedicated support.

The bottom line

Exceptional customer experience in financial services is the cornerstone of sustained success. By implementing advanced meeting management tools and adopting a customer-centric approach, financial institutions can streamline interactions, foster trust, and enhance service delivery. The result is a seamless, personalized experience that meets and exceeds customer expectations, driving loyalty and growth.

And while there may be multiple meeting management solutions available, here is why adam.ai is the board management software platform you can trust:

- adam.ai is one of Atlassian Ventures' portfolio companies.

- In the meeting management software category on G2, adam.ai has been ranked a leader and a high performer for successive quarters in the past years.

- adam.ai has been included in the Forrester Report in the AI-enabled meeting technology landscape.

- adam.ai is trusted and used by powerful teams and organizations worldwide for all types of critical meetings, like board, committee, project management, and business development meetings.

- And most importantly, adam.ai integrates with your existing workflow, is SOC2 compliant, provides dedicated support and success, and has a free trial option.

Subscribe to adam.ai blog

Stay ahead with the latest insights—get our newest blog posts, tips, and updates sent straight to your inbox.