May 22, 2024 · 11 min read

Effective Compliance Risk Management for Financial Institutions

Shaimaa Badawi

As regulatory requirements become more stringent and the consequences of non-compliance grow more severe, financial institutions must adopt robust strategies to navigate these challenges. Effective compliance risk management is not just about avoiding penalties; it's about safeguarding your institution's reputation, ensuring operational integrity, and fostering long-term success. Dive into our comprehensive guide to discover how your financial institution can implement a powerful compliance risk management strategy that stands up to the toughest regulatory demands.

What is compliance risk in the financial sector?

Compliance risk in the financial sector refers to the potential for regulatory sanctions, financial losses, or reputational damage that a financial institution might face due to non-compliance with laws, regulations, and industry standards. This type of risk is a significant concern for financial institutions due to the highly regulated nature of the industry, where compliance failures can result in severe consequences.

What are the key components of compliance risk?

Regulatory and legal risk

- Anti-money laundering (AML): Financial institutions must adhere to rigorous AML regulations to prevent illegitimate funds from entering the legitimate financial system. Non-compliance can result in severe legal repercussions, including hefty fines and reputational damage. In the first half of 2023 alone, global regulators issued fines amounting to approximately $189 million for AML violations.

- Know your customer (KYC) and customer due diligence (CDD): This involves verifying client identities and understanding their financial behaviors and risk profiles. Effective KYC and CDD processes are crucial in preventing financial crimes and ensuring compliance. In 2023, enforcement actions for KYC and CDD non-compliance reached $219 million.

- Data privacy and cybersecurity: Protecting personally identifiable information (PII) is essential. Banks must implement robust cybersecurity measures to prevent data breaches and ensure the confidentiality of sensitive client information. Failure to protect data can lead to significant fines and damage to the institution's reputation.

- Consumer protection: Ensuring fair and transparent dealings with consumers is critical. Violations in consumer protection, such as deceptive practices or unfair fees, can lead to reputational harm and loss of clients.

- Sanctions compliance: Adhering to international and national sanctions is essential to avoid legal issues and fines. Banks must ensure they do not engage in transactions with sanctioned entities and countries.

- Regulatory reporting: Accurate and timely submission of required regulatory reports is crucial. Non-compliance in this area can lead to penalties and reputational damage.

Operational risk

- Internal policies and procedures: Establishing and maintaining robust internal policies that align with legal requirements and industry standards is essential. This includes regular training for employees to ensure they understand and adhere to compliance responsibilities.

- Regular monitoring and testing: Conducting continuous monitoring and periodic testing of compliance programs helps detect and address potential issues proactively.

Technological and cybersecurity risk

- Technology compliance: Meeting regulatory requirements related to technology, such as secure data storage and cybersecurity measures, is critical. The intersection of technology and compliance is a critical area, as failures here can lead to significant penalties.

- Adapting to innovations: Managing risks associated with new technologies like cryptocurrency, cloud computing, and big data analytics brings new regulatory challenges.

What are the implications of compliance risk?

Financial loss

Non-compliance can result in hefty fines and financial penalties, significantly impacting the financial health of an institution.

Reputational damage

Failures in compliance can lead to negative publicity and loss of customer trust, which can be difficult to rebuild.

Operational disruptions

Regulatory sanctions can lead to operational disruptions, affecting the institution’s ability to conduct business efficiently.

Why is compliance and risk management important in financial services?

Maintaining financial health

Risk management is essential for preserving the financial health of financial institutions. By identifying, evaluating, and mitigating potential threats, these institutions can avert unexpected financial setbacks. Effective risk management ensures that financial institutions remain financially robust, which is crucial for their long-term success. Without these practices, institutions may face significant financial losses that could endanger their operations and solvency.

Meeting regulatory requirements

Financial institutions operate under stringent regulatory frameworks that mandate adherence to various laws and standards. Effective compliance risk management ensures that these institutions meet their regulatory obligations, thereby avoiding legal penalties, sanctions, and reputational harm. Compliance with regulations not only shields institutions from legal repercussions but also builds trust among regulators, customers, and investors.

Preserving reputation

The reputation of a financial institution is a vital asset that directly influences customer trust and loyalty. Effective risk management practices help mitigate threats that could tarnish the institution's reputation, such as fraud, data breaches, or regulatory non-compliance. By protecting their reputation, financial institutions can maintain customer trust, attract new clients, and retain existing ones, all of which are crucial for sustained success.

Safeguarding customers

Protecting customers from potential risks such as fraud, identity theft, and data breaches is a top priority for financial institutions. Implementing robust risk management frameworks helps these institutions safeguard customer interests and maintain their trust. Effective risk management not only protects customers but also boosts their confidence in the institution's ability to manage their finances securely.

Gaining market edge

Financial institutions that demonstrate strong risk management and compliance capabilities can gain a market edge. Effective risk management practices can enhance operational efficiency, optimize processes, and minimize the likelihood of financial losses. This ability to manage risks effectively can attract and retain customers, investors, and business partners, giving institutions a competitive advantage over less diligent competitors.

What is compliance management in finance?

Compliance management in finance refers to the systematic approach of ensuring that a financial institution's operations and activities conform to applicable laws, regulations, and industry standards. It encompasses the development, implementation, and continuous monitoring of policies and procedures designed to manage compliance risks and uphold regulatory requirements. Here are the core components of compliance management.

Legislative environment

Financial institutions must develop compliance frameworks that align with the legal obligations specific to their jurisdiction. This involves staying current with changes in regulations and ensuring that all practices meet local, national, and international legal standards.

Risk exposure

A well-structured compliance management framework aims to minimize the institution's exposure to regulatory risks and potential penalties. This involves regular risk assessments to identify and evaluate compliance risks, including those related to cybersecurity, money laundering, and other financial crimes.

Internal controls

Implementing robust internal controls is crucial for fulfilling compliance obligations. These controls include policies and procedures that guide daily operations and ensure that all activities are conducted in accordance with regulatory requirements.

Accountability

Effective compliance management fosters a culture of accountability within the institution. This involves assigning clear compliance responsibilities to employees at all levels, from front-line staff to C-suite executives, and promoting collective responsibility for maintaining compliance.

What is the difference between risk and compliance in financial services?

Understanding the distinction between risk management and compliance in financial services is crucial for ensuring the effective governance and stability of an institution. While both concepts are interrelated, they serve distinct purposes and involve different processes.

Risk management

Risk management is a comprehensive approach that involves identifying, predicting, monitoring, and mitigating potential threats to a financial institution’s assets and income. The primary goal of risk management is to ensure the institution's long-term viability and resilience by addressing a wide range of risks, including financial, operational, strategic, and reputational risks.

Key aspects of risk management

- Predictive nature: Risk management is proactive, focusing on anticipating future risks and preparing responses to mitigate their impact. This includes assessing market conditions, cybersecurity threats, and changes in regulatory environments.

- Strategic approach: It involves formulating strategies that align with the institution's overall goals and risk appetite. This strategic approach ensures that risk management is integrated into all levels of decision-making and operational processes.

- Integrated process: Effective risk management requires collaboration across all departments and functions within the institution. This integration helps in creating a risk-aware culture where all employees understand their role in managing risks.

Compliance management

Compliance management, on the other hand, is a more specific function that ensures a financial institution adheres to all applicable laws, regulations, and industry standards. Compliance management is critical for avoiding legal penalties, maintaining reputation, and ensuring operational integrity.

Key aspects of compliance management

- Prescriptive nature: Compliance is largely about meeting prescribed regulations and standards. Governments and regulatory bodies establish these requirements to ensure the stability and integrity of the financial sector.

- Tactical implementation: Compliance involves implementing specific policies and procedures to meet regulatory requirements. This often includes regular audits, employee training, and reporting to regulatory bodies.

- Siloed function: In many institutions, compliance is handled by specialized teams that focus exclusively on regulatory adherence. This can sometimes lead to compliance being viewed in isolation from broader risk management activities.

Comparing risk management and compliance

Scope and focus

- Risk management: Broadly focused on identifying and mitigating all types of risks that could affect the institution's objectives and operations.

- Compliance management: Narrowly focused on ensuring adherence to legal and regulatory requirements.

Nature of activities

- Risk management: Predictive and strategic, aiming to anticipate and prepare for potential future risks.

- Compliance management: Prescriptive and tactical, aiming to ensure current operations meet regulatory standards.

Integration and implementation

- Risk management: Requires an integrated approach involving all departments and functions within the institution.

- Compliance management: Often siloed, handled by specialized teams, but ideally should be integrated into the broader risk management framework.

Goals and outcomes

- Risk management: Aims at value creation by protecting against potential losses and ensuring long-term sustainability.

- Compliance management: Aims at risk aversion by preventing legal penalties and maintaining regulatory adherence.

Harmonizing risk and compliance

To achieve effective governance, financial institutions must harmonize risk management and compliance activities.

- Unified reporting: Implementing lines of reporting that incorporate compliance within the overall risk management strategy to provide a cohesive view of all risks.

- Collaborative culture: Promoting a culture where compliance and risk management are seen as complementary functions that work together to protect the institution.

- Technology integration: Utilizing risk management technologies to streamline processes, provide real-time views of compliance risks, and ensure that policies are communicated and adhered to across the institution.

How to implement an effective compliance management strategy

Evaluate the existing compliance framework

Start by thoroughly evaluating the current systems and processes to ensure they meet regulatory standards. This evaluation helps identify gaps and areas for improvement, allowing the institution to enhance its compliance framework and mitigate risks effectively.

- Comprehensive review: Conduct a detailed review of current compliance protocols and systems to assess their effectiveness.

- Identifying deficiencies: Pinpoint any shortcomings in the existing compliance measures and plan for necessary enhancements.

Conduct a detailed risk assessment

Perform a thorough risk assessment to understand the types of compliance risks the institution faces. Create a risk matrix to evaluate the likelihood and impact of each risk, ensuring that all potential threats are adequately addressed.

- Risk identification: Identify potential compliance risks, including financial crimes, cybersecurity threats, and regulatory changes.

- Risk prioritization: Rank risks based on their potential impact and likelihood of occurrence, using both qualitative and quantitative measures.

Identify and address compliance gaps

Pinpoint areas where the institution does not fully meet compliance requirements. Implement new practices and procedures or modify existing ones to fill these gaps, ensuring full compliance with industry standards and regulations.

- Gap analysis: Assess where current practices fall short of regulatory standards.

- Policy and procedure enhancement: Establish or update policies to address identified gaps.

Cultivate a compliance-focused culture

Promote an internal culture where compliance is prioritized. This involves conducting regular training programs to educate employees about compliance policies and procedures, encouraging proactive involvement in compliance activities, and establishing clear accountability measures.

- Ongoing training: Provide continuous training tailored to employees' roles and responsibilities.

- Employee engagement: Encourage employees to take an active role in compliance activities.

Stay updated with regulatory changes

Keep up with changes in regulations and ensure that compliance frameworks are updated accordingly. Collaborate with legal counsel to implement new standards and policies promptly, avoiding legal issues arising from non-compliance with updated regulations.

- Continuous monitoring: Track changes in relevant laws and regulations regularly.

- Policy revisions: Regularly update internal policies to align with the latest regulatory requirements.

Core activities for compliance management

- Regulatory change monitoring: Consistently track changes in laws and regulations to maintain ongoing compliance.

- Policy and procedure updates: Periodically revise internal policies and procedures to reflect the latest regulatory requirements.

- Employee education: Conduct regular training sessions to ensure that all employees understand and adhere to compliance protocols.

- Compliance risk evaluation: Continuously assess the institution's compliance risks and adjust strategies to mitigate these risks effectively.

- Monitoring, auditing, and reporting: Implement regular monitoring and auditing processes to detect and address compliance issues promptly. Maintain comprehensive reporting to document compliance efforts and outcomes.

- Issue remediation: Develop and execute remediation plans to address identified compliance issues and prevent recurrence.

Streamline compliance and risk management with adam.ai

For financial institutions, effective compliance and risk management are crucial to maintaining stability, meeting regulatory requirements, and protecting their reputation. Adam.ai offers a powerful solution to streamline these processes, ensuring that your institution remains compliant and operates efficiently.

Here’s how adam.ai can help financial institutions:

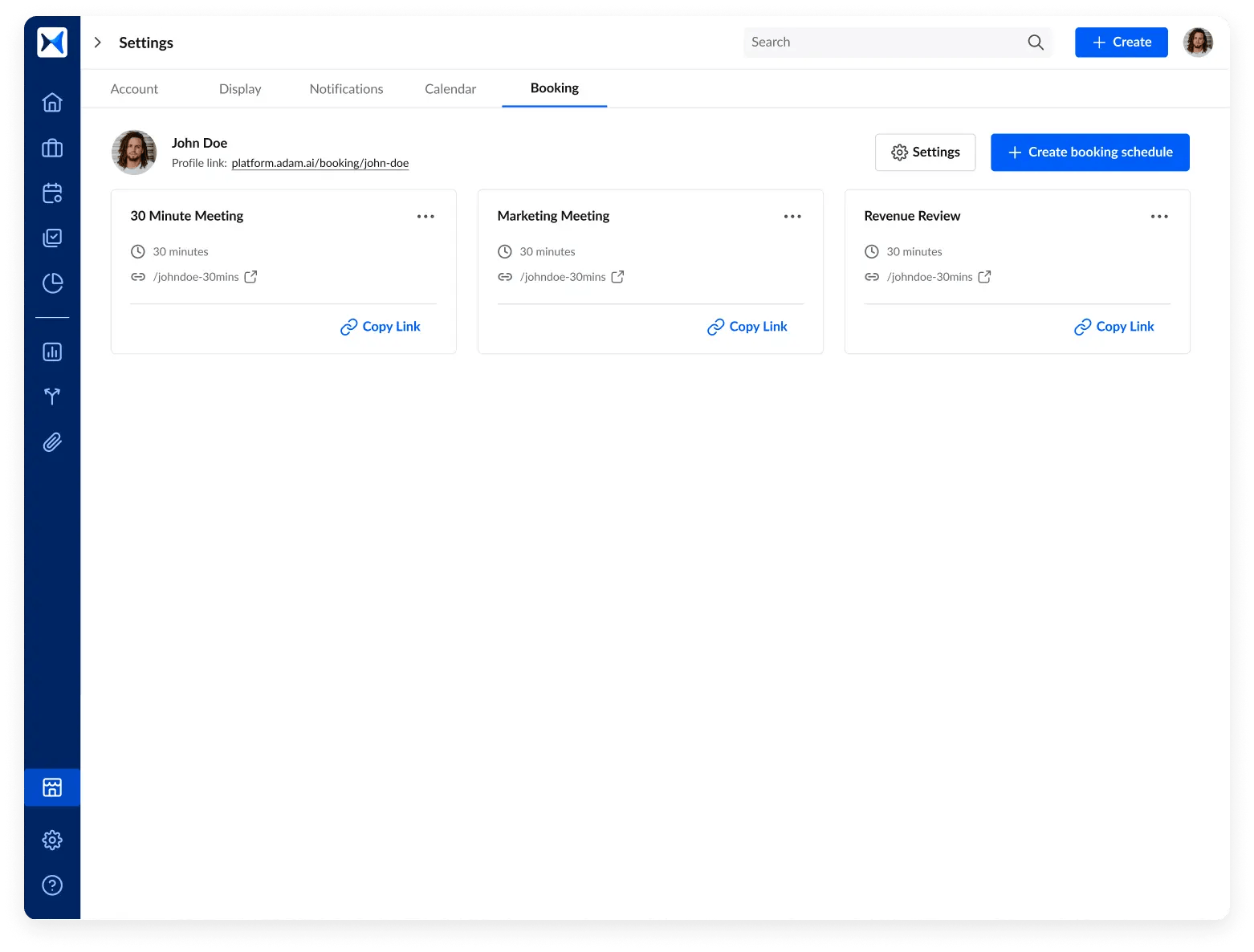

1. Unlimited booking pages: Organize meetings between compliance officers, risk managers, and other stakeholders seamlessly. Simplify the scheduling process to ensure timely and regular interactions.

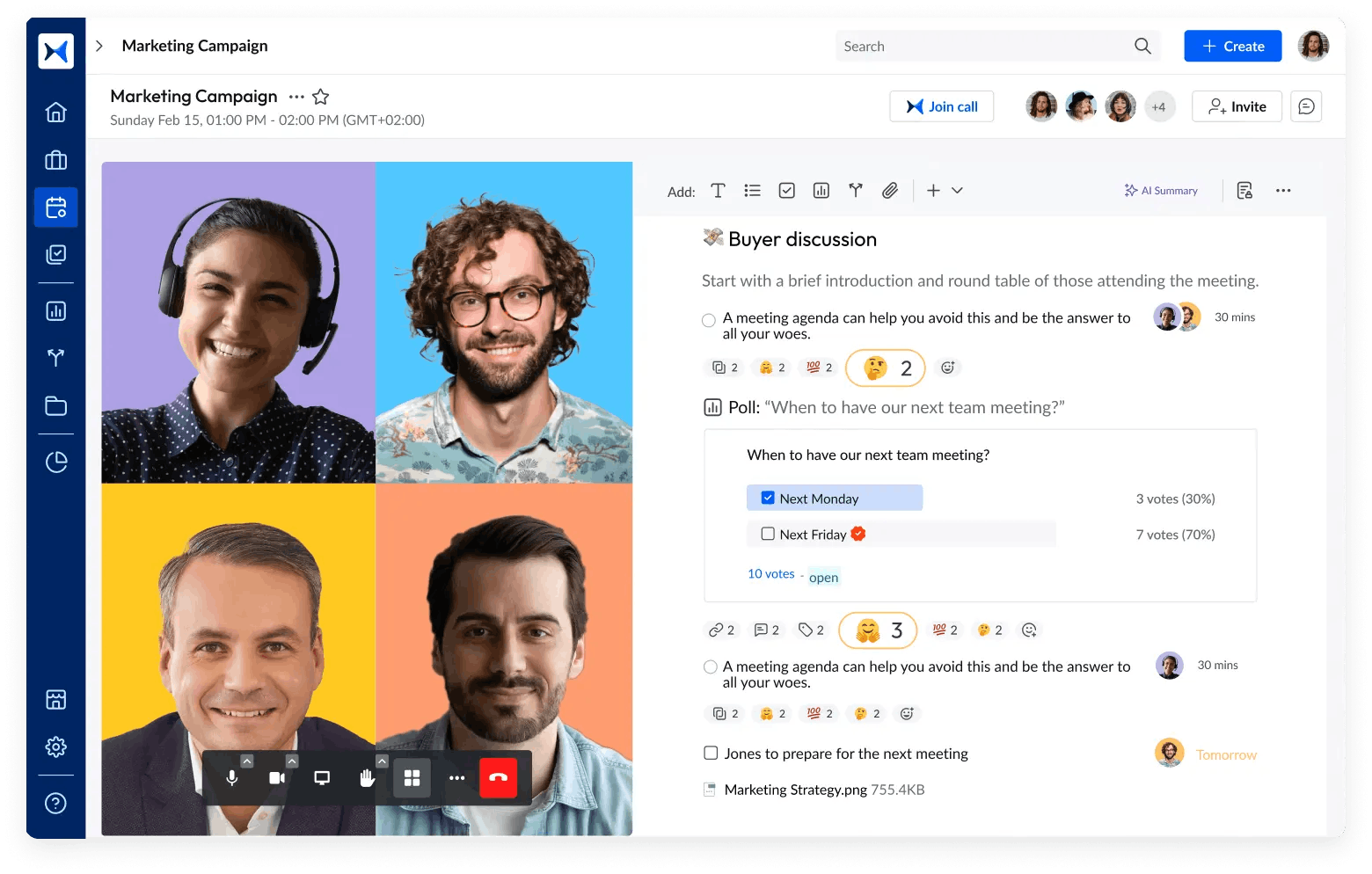

2. Smart note-taking system: Record agenda items, compliance requirements, risk assessments, decisions, and notes with an intuitive interface. Integrated video conferencing allows for real-time discussion and decision-making, minimizing delays.

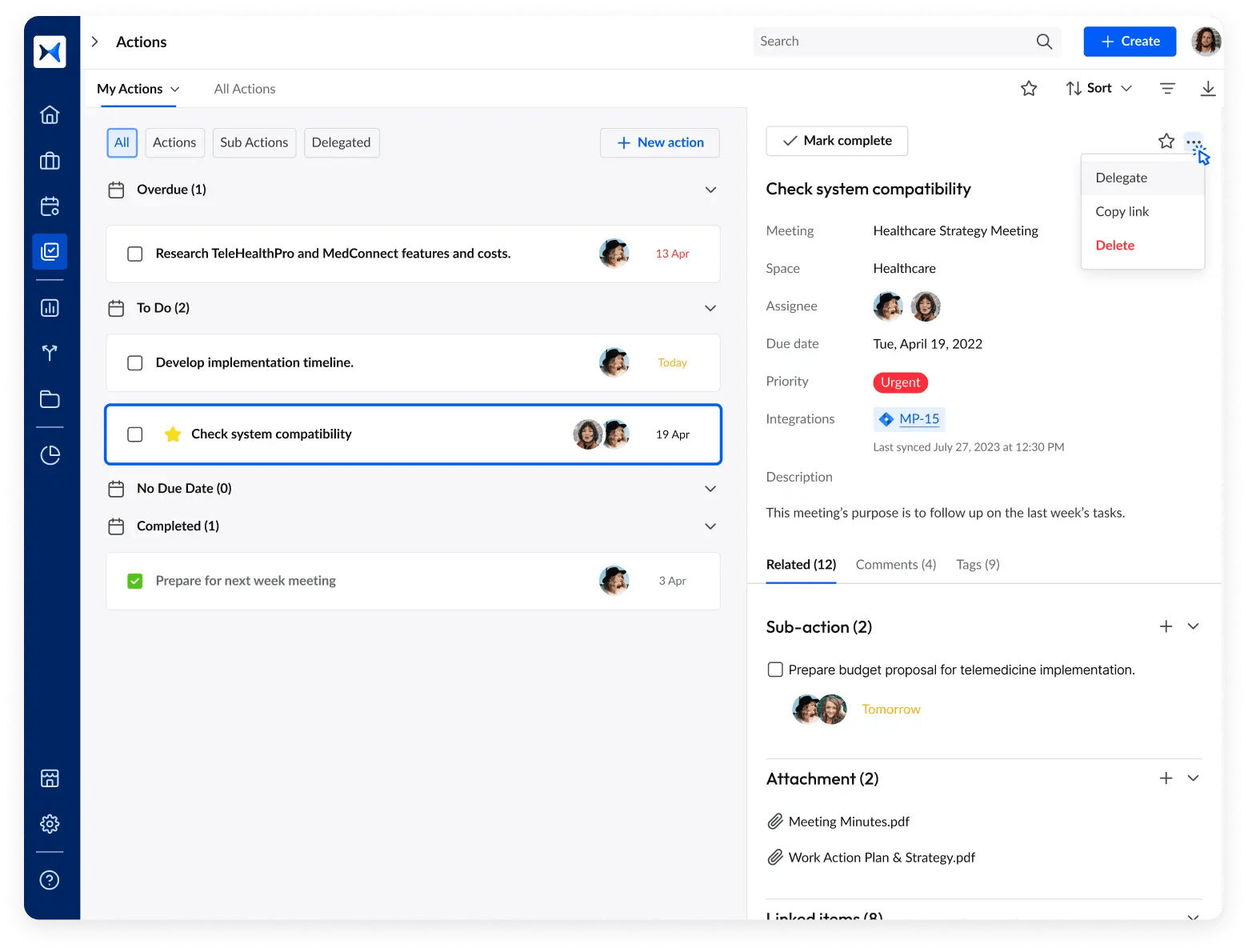

3. Action and decision tracking: Track actions and decisions made during compliance and risk management meetings to ensure follow-through. This feature helps your team stay updated on progress and outcomes, enhancing accountability.

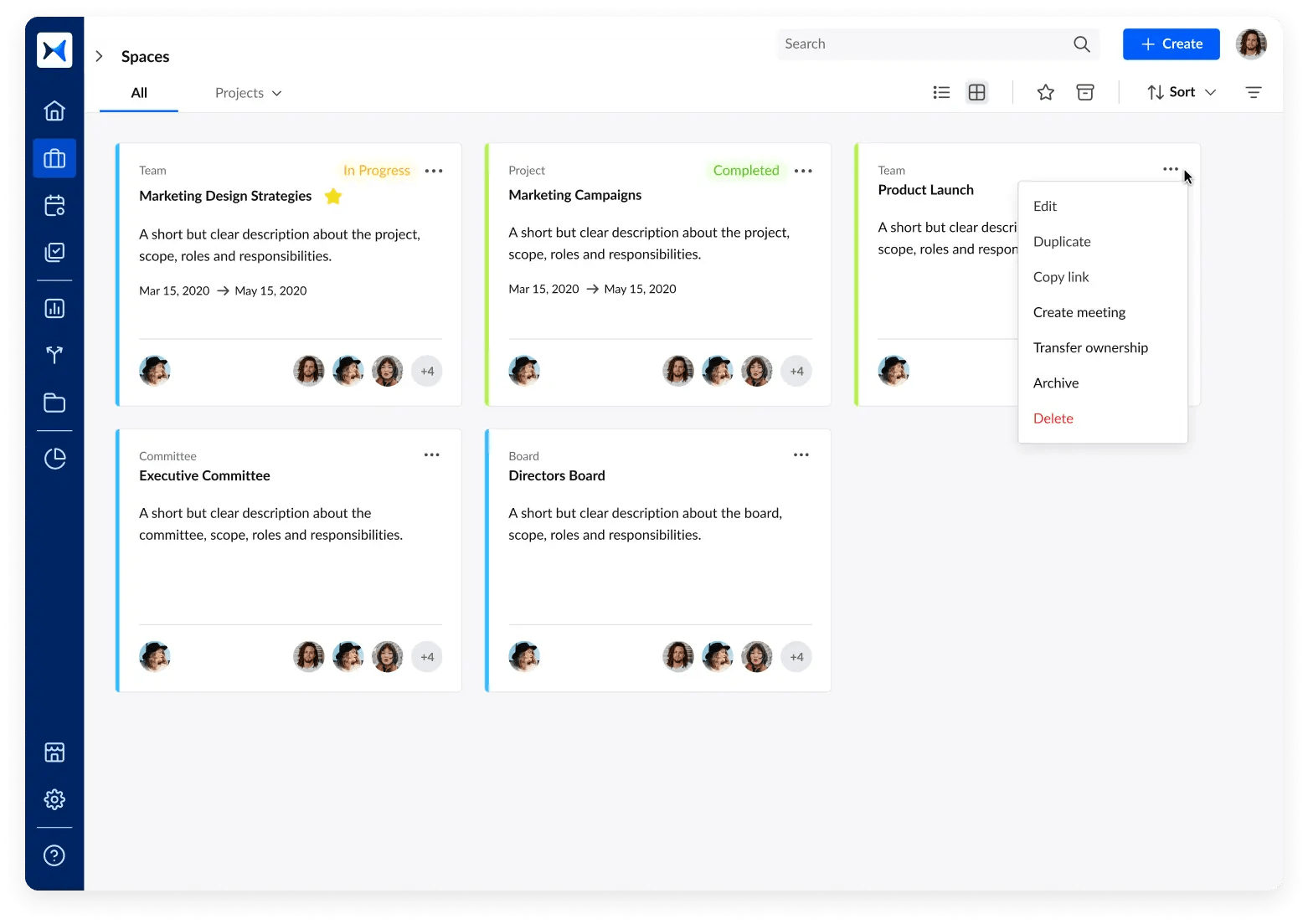

4. Categorizing meetings into spaces: Organize meetings into specific spaces for various departments, regulatory bodies, and risk management projects. This categorization helps maintain clear records and focus on specific areas of compliance.

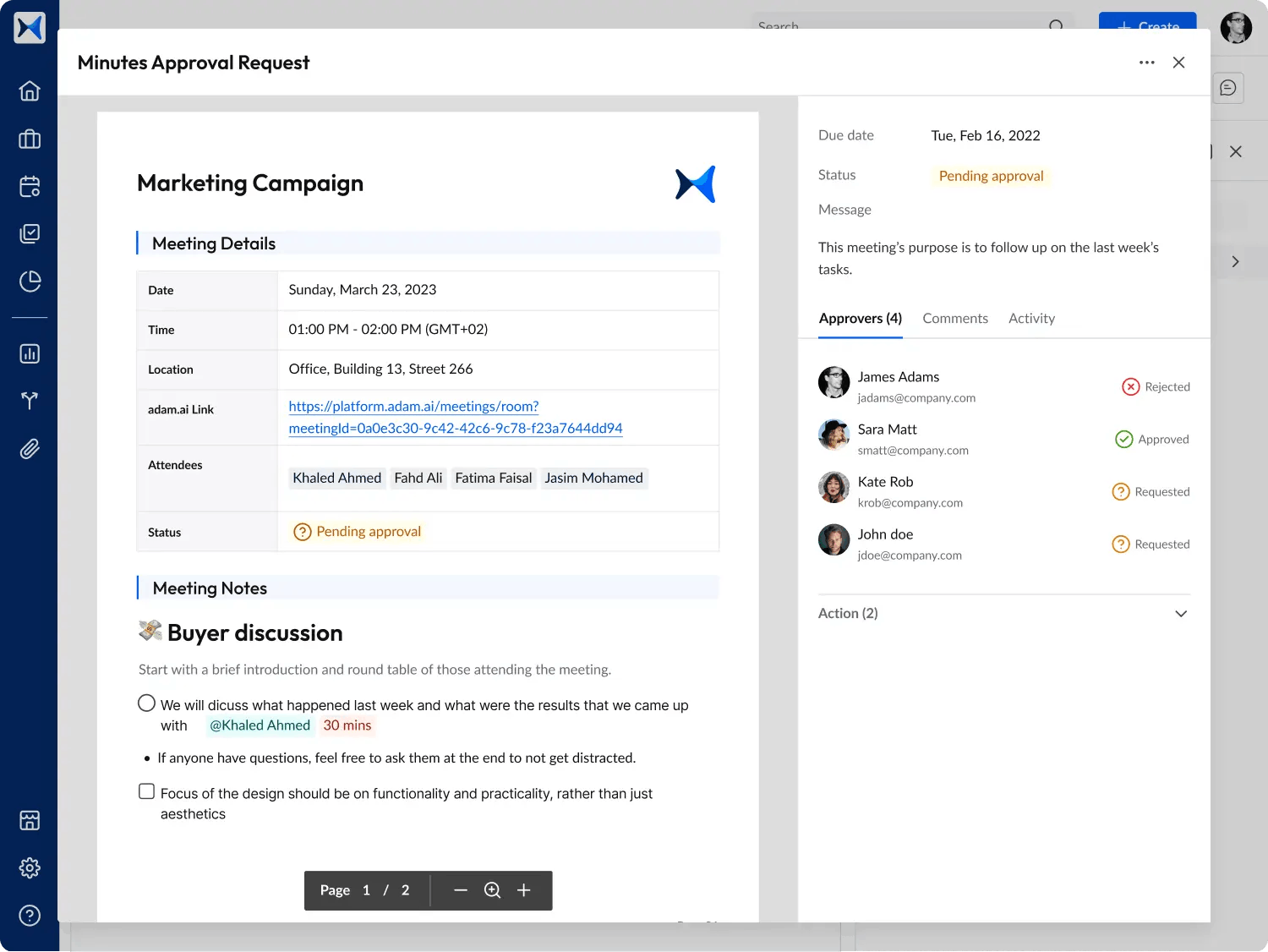

5. Meeting minutes and approval cycle: Automatically generate and share meeting minutes to ensure transparency and share with attendees for approval in critical meetings.

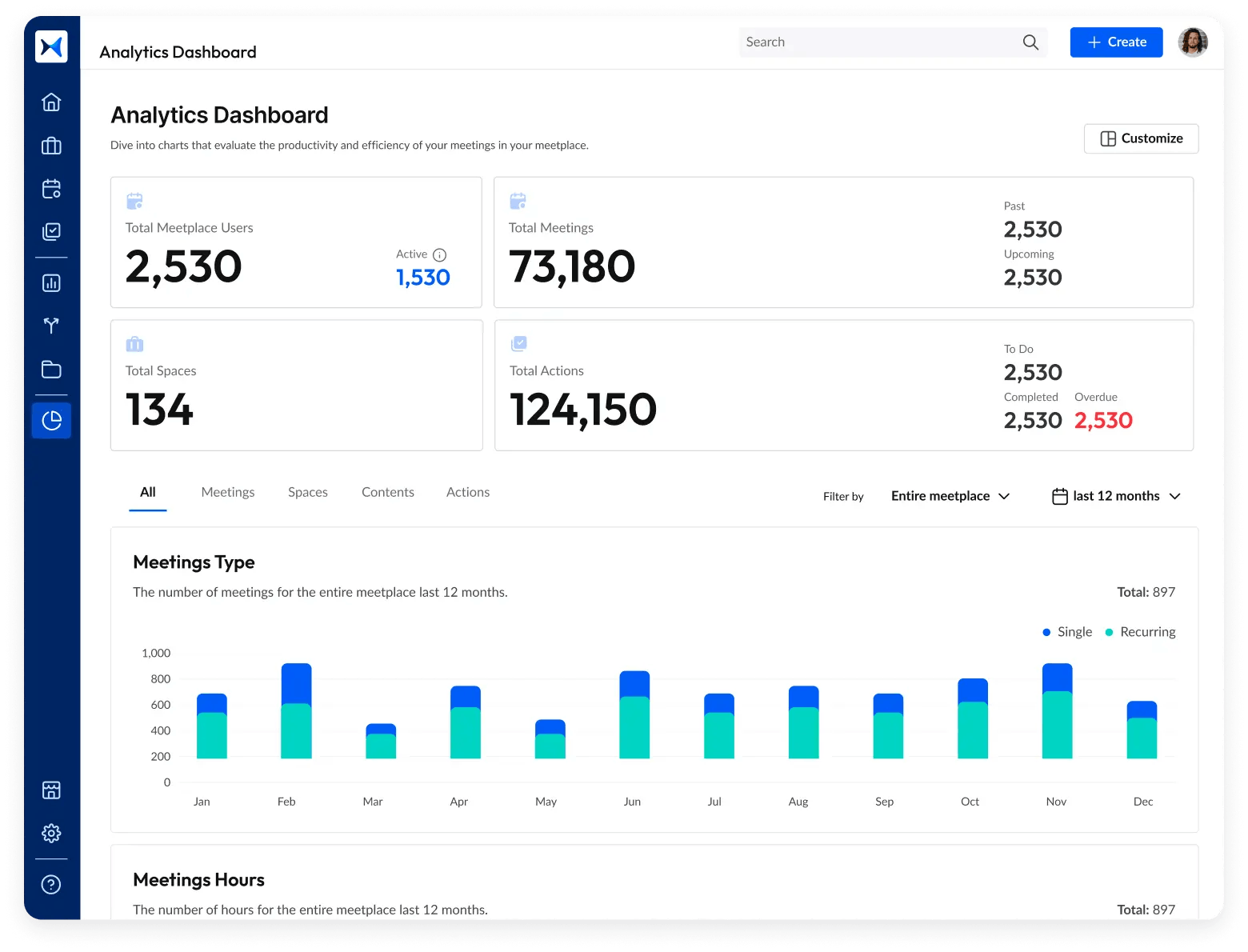

6. Analytics dashboard: Assess participation rates, compliance status, decision outcomes, and the progress of action items. This feature facilitates smooth and effective meetings, helping your team stay informed and proactive.

Transform how you conduct critical meetings—From meticulous preparation to effective execution and insightful follow-up, adam.ai integrates comprehensive analytics, full customization, and intuitive interfaces with powerful meeting management tools.

Easy onboarding. Enterprise-grade security. 24/7 dedicated support.

The bottom line

Effective compliance risk management is the backbone of a resilient financial institution. By systematically assessing risks, fostering a culture of compliance, and staying abreast of regulatory changes, your institution can not only avoid costly penalties but also build a strong foundation for sustainable growth. Leveraging advanced tools and technologies like meeting management tools can further enhance these efforts.

And while there may be multiple meeting management solutions available, here is why adam.ai is the meeting management software you can trust:

- adam.ai is one of Atlassian Ventures' portfolio companies.

- In the meeting management software category on G2, adam.ai has been ranked a leader and a high performer for successive quarters in the past years.

- adam.ai has been included in the Forrester Report in the AI-enabled meeting technology landscape.

- adam.ai is trusted and used by powerful teams and organizations worldwide for all types of critical meetings, like board, committee, project management, and business development meetings.

- And most importantly, adam.ai integrates with your existing workflow, is SOC2 compliant, provides dedicated support and success, and has a free trial option.

Subscribe to adam.ai blog

Stay ahead with the latest insights—get our newest blog posts, tips, and updates sent straight to your inbox.