January 28, 2025 · 13 min read

How to Streamline Mergers and Acquisitions with Meeting Management Solutions

Shaimaa Badawi

Mergers and acquisitions can either drive growth and efficiency or create costly complications. The difference often lies in how well teams communicate and execute integration plans. With multiple stakeholders handling financial evaluations and legal approvals, unstructured meetings can lead to delays and miscommunication.

This article explores how meeting management solutions help enterprises streamline M&A by improving collaboration, tracking key decisions, and ensuring accountability throughout the deal lifecycle.

Why is structured meeting management critical in mergers and acquisitions?

Mergers and acquisitions (M&A) are high-stakes, high-complexity processes that require careful planning, extensive coordination, and precise execution. Every deal involves multiple stakeholders, legal considerations, financial evaluations, and post-merger integration strategies. Without structured meeting management, critical discussions become fragmented, decisions get delayed, and the risk of misalignment increases.

A well-structured meeting management system ensures that deal negotiations, due diligence, and integration planning stay on track while minimizing miscommunication and inefficiencies. Here’s why structured meetings are essential for successful M&A execution:

1. Aligning stakeholders and maintaining clear communication

M&A deals involve executives, legal teams, financial analysts, risk assessors, and operational leaders: all of whom bring different perspectives and priorities. Without structured meetings, discussions can become unfocused, repetitive, or misaligned with the deal’s objectives.

A structured meeting process does the following:

- Sets clear agendas to ensure that key financial, legal, and operational issues are addressed in a logical order.

- Standardizes communication between merging entities to prevent conflicting interpretations of deal terms.

- Tracks key takeaways to ensure that discussions lead to decisive action rather than endless deliberation.

During due diligence, for example, structured meetings allow legal teams to align contract reviews with financial evaluations rather than working in silos, reducing the risk of compliance oversights. Strategic investment decision-making in M&A relies on structured meetings to assess financial risks, align stakeholders, and ensure due diligence is completed without delays.

2. Keeping due diligence on schedule and organized

Due diligence is one of the most time-sensitive aspects of M&A. It requires a systematic review of financial statements, contracts, liabilities, operational risks, and regulatory requirements. Without a structured meeting process, teams may overlook key areas, causing delays or exposing the deal to hidden risks.

With structured meeting management, M&A teams can do the following:

- Create a due diligence roadmap, ensuring that all financial, legal, and operational checks are completed in a timely manner.

- Assign action items to different teams and track progress to prevent bottlenecks.

- Centralize documentation, reducing the inefficiencies of scattered reports, emails, and spreadsheets.

In many failed M&A deals, poorly managed due diligence has led to unexpected liabilities post-acquisition. A structured meeting process ensures that no critical detail is missed.

3. Enhancing post-merger integration and synergy realization

Post-merger integration is where most M&A deals succeed or fail. Without structured meetings, companies struggle to align business processes, consolidate financial systems, and integrate corporate cultures.

A structured meeting system supports post-merger integration by the following:

- Providing a clear timeline for integrating financial operations, IT systems, and HR policies. Post-merger integration requires a unified approach to financial reporting for boards, ensuring leadership has visibility into consolidated performance metrics.

- Tracking synergy realization, ensuring that cost-saving measures and efficiency improvements are implemented as planned.

- Facilitating cross-functional collaboration, allowing finance, legal, and operational teams to work together on integration strategies. By streamlining M&A discussions, structured meetings contribute to improving customer experience in financial services, ensuring smooth post-merger transitions that maintain service continuity.

For example, if one company operates on SAP for financial reporting and the other on Oracle, structured meetings ensure that IT and finance teams create a migration plan rather than facing system conflicts post-merger.

4. Reducing deal risks and improving compliance

M&A transactions must comply with regulatory, tax, and financial reporting standards. A lack of structured meetings increases the risk of regulatory violations, leading to legal penalties or deal termination.

By implementing structured meeting management, here's what companies can do:

- Ensure compliance checklists are reviewed and updated throughout the M&A process.

- Document regulatory approvals and risk assessments, providing an auditable record for legal teams. Understanding the articles of incorporation is critical in M&A transactions to ensure compliance with shareholder agreements, voting rights, and structural governance.

- Identify red flags early, preventing last-minute deal complications. A strong compliance risk management framework ensures that M&A transactions adhere to evolving regulatory requirements, minimizing legal and financial exposure.

In highly regulated industries like banking, healthcare, and government contracting, structured meeting workflows are essential to securing regulatory approval and avoiding legal disputes.

How can meeting management solutions improve communication and collaboration in M&A?

M&A demand fast, clear, and secure communication between legal teams, financial analysts, executives, and operational leaders. Delays, misalignment, or lost discussions can jeopardize deals, making real-time collaboration and structured communication essential. Here's how meeting management solutions contribute to effective M&A meetings:

1. Centralized discussions eliminate fragmented communication

M&A teams work across multiple organizations, departments, and locations. Without a single platform for discussions, important updates get lost in long email chains, and critical insights are spread across different tools.

This is how meeting management solutions centralize all M&A discussions:

- Consolidating agendas, meeting minutes, and key documents in one place.

- Providing instant access to the latest updates and financial reports, ensuring all teams work with the same information.

- Eliminating duplicate conversations and conflicting decisions, improving coordination between legal and financial teams. Incorporating AI-driven solutions aids in reducing meeting fatigue with AI, keeping M&A discussions focused, productive, and action-oriented.

Instead of sifting through outdated reports or conflicting email threads, deal teams can access live updates and decisions instantly, keeping negotiations and approvals on track.

2. Real-time collaboration speeds up deal execution

M&A deals require fast decision-making, especially in time-sensitive negotiations and due diligence. Meeting management solutions provide real-time collaboration features that reduce delays and streamline approvals.

- Shared workspaces for financial modeling, contract reviews, and risk assessments keep all stakeholders engaged.

- Live annotation and commenting tools allow legal teams to review terms and make instant clarifications. Leveraging machine learning in meeting preparation enables M&A teams to surface relevant insights, anticipate risks, and enhance strategic discussions.

- Automated notifications and updates ensure that no one misses critical deadlines or decision points.

For example, if new regulatory requirements arise mid-deal, legal and compliance teams can update meeting notes, notify stakeholders, and approve necessary adjustments in real time rather than waiting for the next scheduled meeting.

3. Decision tracking prevents stalled negotiations

Deals move fast, and M&A teams must ensure that discussions translate into clear, trackable actions. Without structured tracking, key approvals get delayed, responsibilities become unclear, and execution slows down.

Meeting management solutions prevent decision bottlenecks by applying these steps:

- Assigning action items directly to teams or individuals, ensuring accountability.

- Tracking pending approvals, reducing the risk of deal-stalling delays.

- Providing a structured timeline for post-merger integration tasks, preventing oversight. Optimizing meeting duration leads to measurable benefits, as the ROI of reduced meeting time directly improves decision-making efficiency in M&A.

Instead of losing momentum due to unclear follow-ups, teams can see exactly what needs action, who is responsible, and when tasks are due.

4. Secure documentation ensures compliance and risk management

Regulatory scrutiny is high in M&A transactions, and compliance missteps can result in costly legal disputes. Proper documentation is essential for record-keeping, audits, and post-merger governance.

Meeting management solutions safeguard compliance by following these guidelines:

- Storing all meeting records, approvals, and compliance discussions in one location for easy retrieval.

- Maintaining an audit trail of key decisions, reducing legal risks.

- Providing controlled access to sensitive financial and legal documents, ensuring confidentiality.

For enterprises in finance, healthcare, and government contracting, having a secure and organized record of compliance-related discussions is critical to avoiding post-merger regulatory challenges.

What role does real-time content collaboration play in M&A deal execution?

M&A require teams to work with financial models, legal contracts, risk assessments, and operational plans, often across multiple organizations and locations. Real-time content collaboration ensures that all stakeholders work with the same up-to-date information, reducing errors, speeding up approvals, and keeping the deal on track.

1. Keeping financial and legal teams aligned

Financial analysts and legal advisors must stay synchronized throughout the deal. If valuation models and contract negotiations happen in silos, discrepancies in deal terms can cause unnecessary renegotiations or regulatory setbacks.

- Providing shared access to financial reports, due diligence findings, and legal documents, ensuring teams work from the same data.

- Allowing live document edits and annotations, reducing back-and-forth email exchanges.

- Instantly reflecting updates, so changes to financial projections or regulatory requirements are immediately visible to all decision-makers.

For example, if an acquiring company adjusts its valuation model based on new revenue projections, the legal team can simultaneously review how the changes affect deal terms, preventing last-minute contract revisions.

2. Accelerating deal approvals and compliance processes

M&A deals require multiple layers of approvals, from internal executives to external regulators. Waiting for scheduled meetings to review updates can cause delays, while missing key compliance requirements can derail the deal altogether.

- Allowing executives and board members to review and approve documents digitally, eliminating delays caused by scheduling conflicts.

- Providing instant access to updated regulatory and compliance reports, ensuring all stakeholders stay aligned.

- Enabling live contract negotiations, where parties can discuss terms and make revisions without waiting for follow-up meetings.

If a regulatory authority requests additional documentation before approving the merger, real-time collaboration allows legal teams to address the request immediately rather than delaying the process for days or weeks.

3. Improving post-merger integration planning

After the deal closes, integration planning begins. IT systems, HR policies, and operational workflows must be aligned between the merging companies. If teams rely on disconnected tools and outdated documents, integration tasks become disorganized, leading to inefficiencies and operational bottlenecks.

- Keeping transition plans, IT roadmaps, and HR policies accessible to both companies in a shared environment. Acquiring a wholly owned subsidiary requires structured meetings to align financial integration plans, operational workflows, and compliance measures.

- Providing live status updates on integration milestones, ensuring that deadlines are met.

- Facilitating direct collaboration between merging teams, reducing confusion about post-merger responsibilities.

For instance, if an IT team from one company is working on migrating financial systems to the acquiring company’s infrastructure, real-time updates ensure that finance and operations teams are aware of the timeline and any disruptions that may occur.

4. Ensuring transparency and minimizing risks

M&A transactions involve high financial stakes and regulatory scrutiny. When information is scattered, it increases the risk of miscommunication, compliance failures, and financial miscalculations.

- Creating a single source of truth where all documents, contracts, and compliance records are accessible.

- Maintaining version control to track edits and approvals, reducing the risk of unauthorized changes.

- Enhancing security with controlled access, ensuring that sensitive financial and legal information is only available to authorized stakeholders.

In industries like finance, healthcare, and government contracting, real-time collaboration plays a critical role in ensuring that regulatory filings, employee transfers, and operational changes are documented and reviewed properly.

How does action tracking ensure accountability in post-merger integration?

Closing a merger or acquisition is only the beginning, post-merger integration is where the real work begins. Companies must align financial operations, IT systems, HR policies, and corporate structures while ensuring that cost synergies and strategic goals are met. Without clear accountability, integration plans can stall, leading to operational inefficiencies, cultural clashes, and missed financial targets.

Action tracking provides a structured approach to monitor post-merger tasks, assign responsibilities, and ensure leadership oversight, including board-level decision tracking.

1. Ensuring leadership oversight and board alignment

The board of directors plays a critical role in overseeing post-merger execution to ensure that financial, operational, and strategic goals are met. Board members need visibility into the progress of key integration milestones, and without structured action tracking, oversight becomes fragmented.

- Providing a centralized dashboard where leadership can track integration progress. Effective board governance ensures M&A decisions align with long-term corporate strategy, mitigating risks and enhancing post-merger oversight.

- Documenting all post-merger resolutions made during board and executive meetings.

- Assigning ownership to specific teams and ensuring that accountability flows from top-level decision-makers to operational leaders.

For example, if the board approves a timeline for financial consolidation, action tracking ensures that the finance team has clear deadlines and reporting expectations, preventing unnecessary delays.

2. Assigning clear responsibilities to integration teams

Merging two companies requires coordination across finance, IT, HR, legal, and operations. Without structured action tracking, tasks fall through the cracks, and teams struggle with conflicting priorities or duplicated efforts.

- Assigning specific tasks to departments or individuals so that responsibilities are clear.

- Setting deadlines and priority levels to ensure timely execution.

- Providing a structured follow-up system, reducing the risk of unfinished tasks.

For instance, if HR is responsible for standardizing employee benefits, action tracking ensures that deadlines are met, policy updates are documented, and leadership remains informed of progress.

3. Preventing operational bottlenecks and delays

Post-merger integration requires teams to align financial systems, IT infrastructure, supply chains, and compliance processes. If key integration tasks are not properly tracked, enterprises face cost overruns, system disruptions, and legal risks.

- Identify bottlenecks early, allowing teams to adjust priorities before delays escalate.

- Ensure cross-departmental coordination, reducing misalignment between finance, legal, and IT teams.

- Streamline approval workflows, so that integration-related decisions do not stall at executive or board levels.

For example, if the acquiring company needs to transition the target company’s accounting system, action tracking ensures that finance, IT, and compliance teams align their efforts, avoiding disruptions to financial reporting.

4. Tracking synergy realization and cost-saving measures

M&A deals often come with cost-saving goals, such as eliminating redundant systems, consolidating office spaces, or streamlining supply chains. Without proper tracking, these synergies can be overlooked, reducing the expected return on investment.

- Monitor synergy realization metrics, ensuring that financial and operational goals are met.

- Track cost-saving initiatives, preventing inefficiencies in resource allocation.

- Maintain an integration timeline, ensuring that synergy targets align with board-approved objectives.

For instance, if an M&A deal promises $50 million in annual savings from IT consolidation, action tracking ensures that project milestones are followed, systems are integrated, and financial reporting reflects actual cost reductions.

5. Providing transparency for stakeholders and regulators

Regulatory bodies and key stakeholders, such as investors, shareholders, and board members, require transparency on post-merger execution. If integration actions are not properly documented, enterprises face compliance risks and loss of investor confidence.

- All integration steps are recorded and auditable, reducing regulatory risks.

- Stakeholders receive regular progress updates, improving trust and accountability.

- The board has visibility into compliance milestones, ensuring that all regulatory approvals and risk assessments are completed on time.

For example, in heavily regulated industries like banking or healthcare, failing to track compliance-related tasks could result in delays in licensing, operational penalties, or even deal reversal.

How does adam.ai streamline M&A meetings for enterprises?

M&A require structured discussions, real-time collaboration, and clear follow-through to ensure successful deal execution. With multiple teams handling legal, financial, and operational aspects of the transaction, disorganized meetings can lead to misalignment, delays, and compliance risks.

Here’s how adam.ai optimizes M&A meetings:

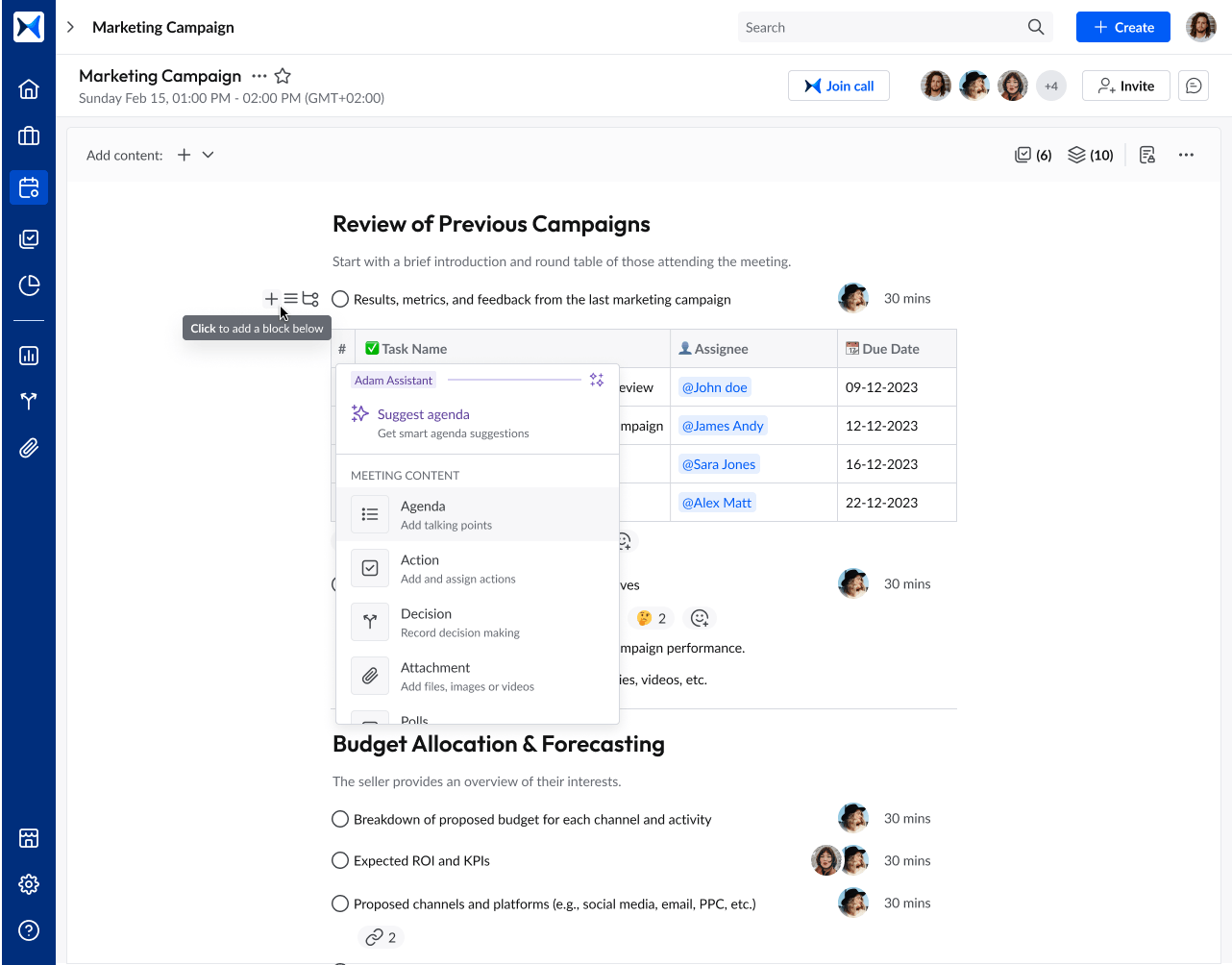

- Agenda management: Keeps M&A discussions structured by setting clear objectives, assigning topics, and ensuring that critical financial, legal, and operational issues are addressed in the right order.

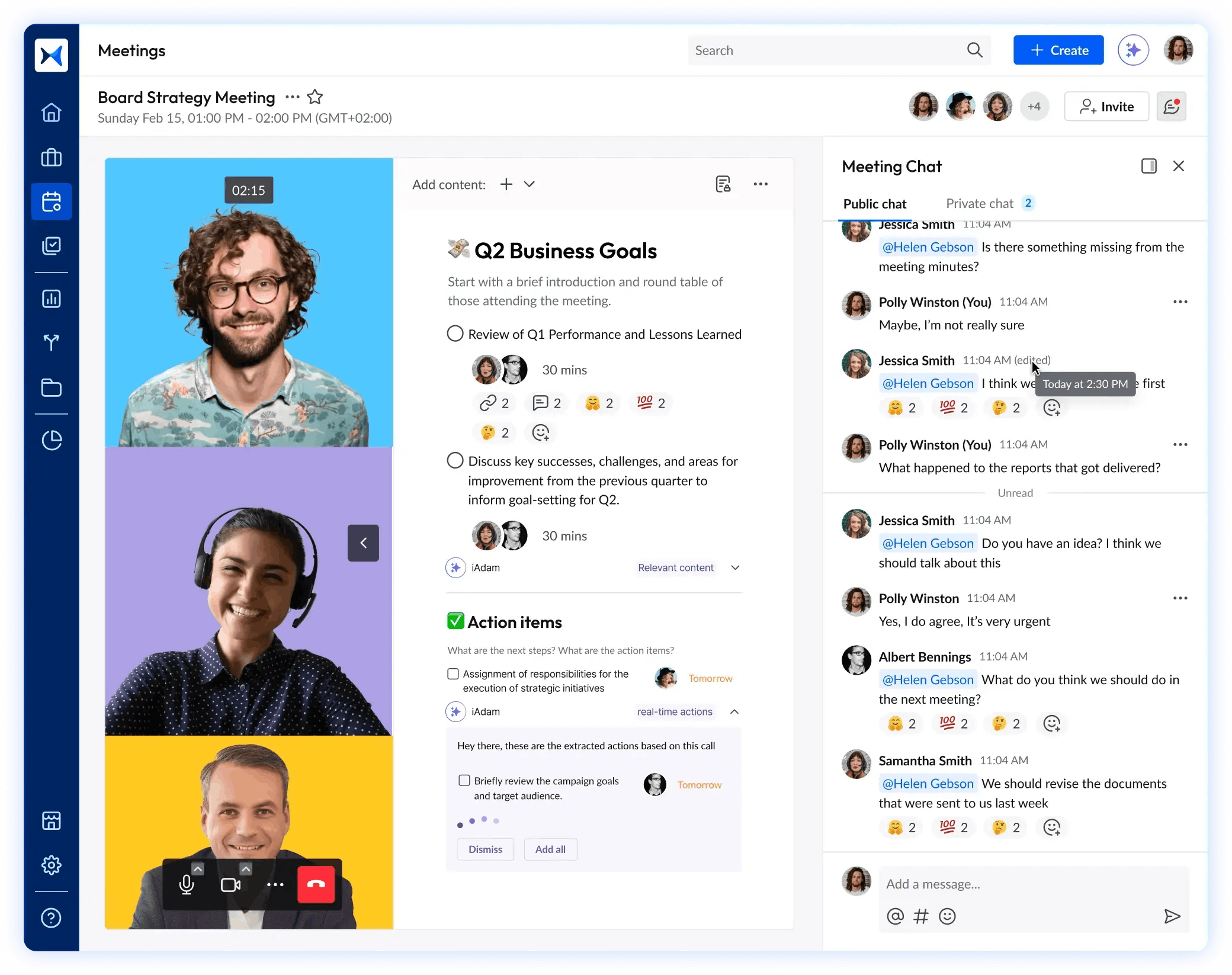

- Real-time content collaboration: Enables legal teams, financial analysts, and executives to work on documents simultaneously, ensuring that contract revisions, valuation adjustments, and regulatory updates are reflected instantly.

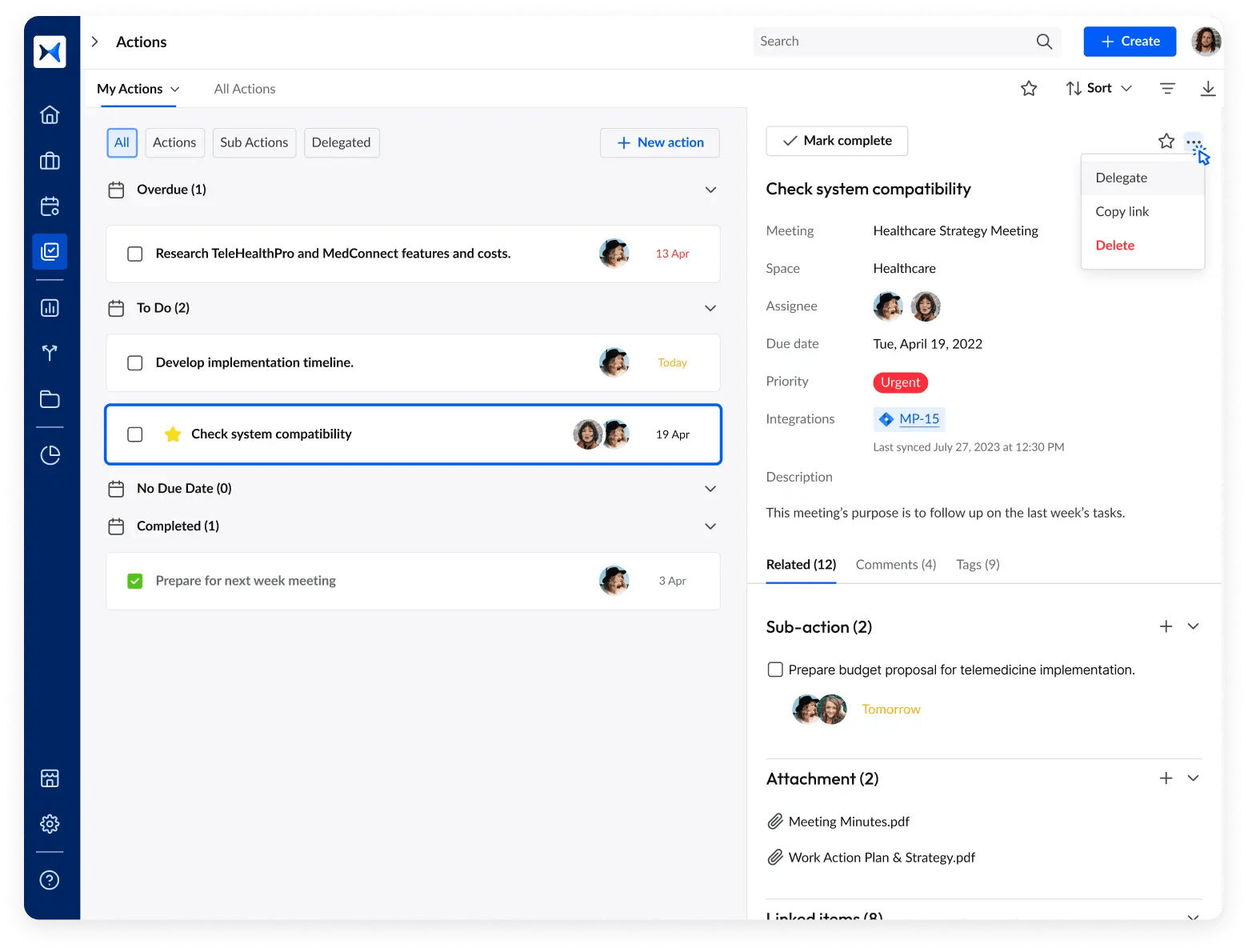

- Action tracking: Assigns clear responsibilities for post-merger tasks, ensuring that due diligence, integration plans, and compliance steps are executed on time. Teams receive notifications and status updates, preventing delays caused by unclear ownership of tasks.

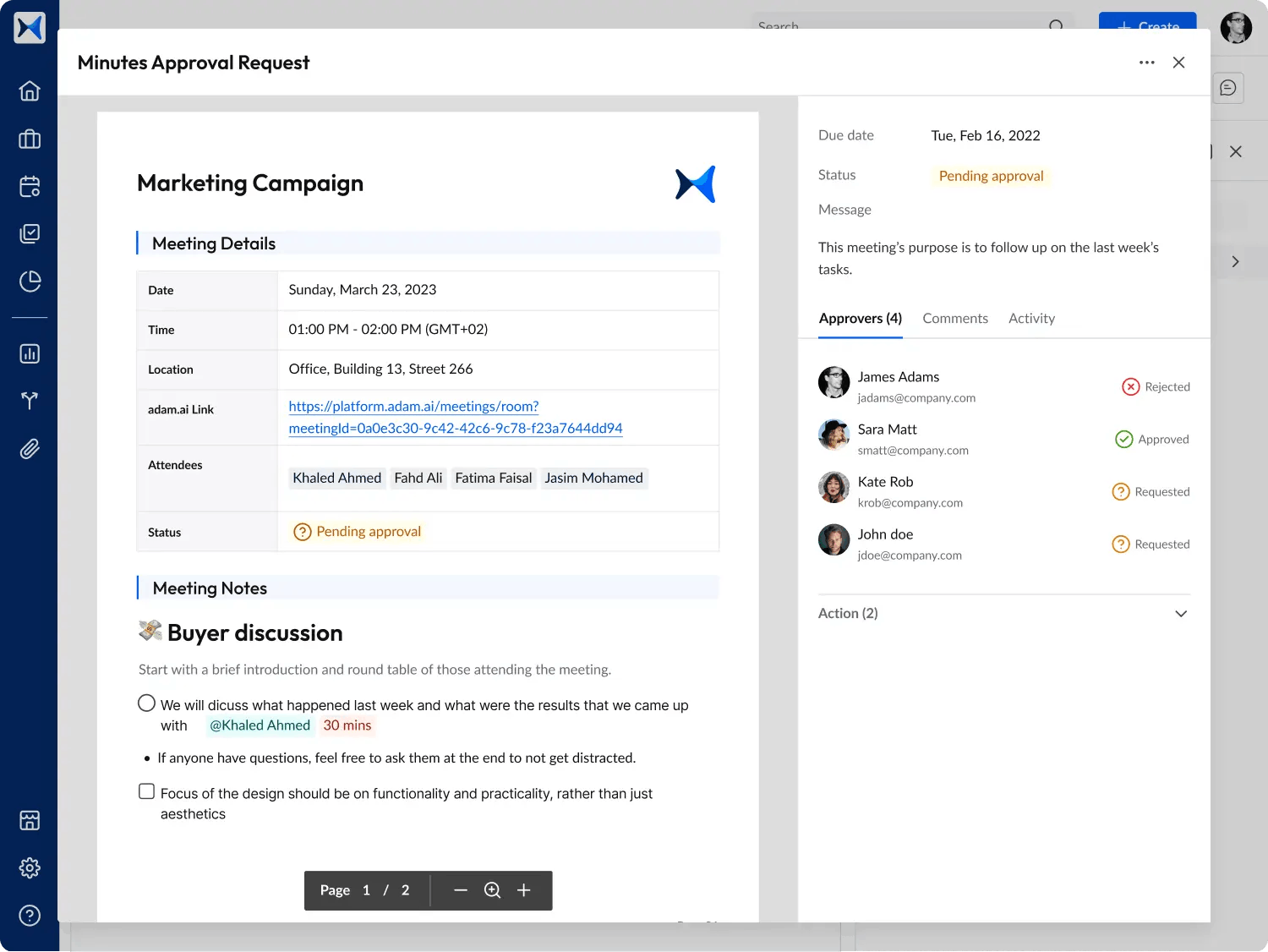

- Meeting minutes: Captures all key M&A discussions, including deal negotiations, risk assessments, and strategic approvals, providing an auditable record of decisions.

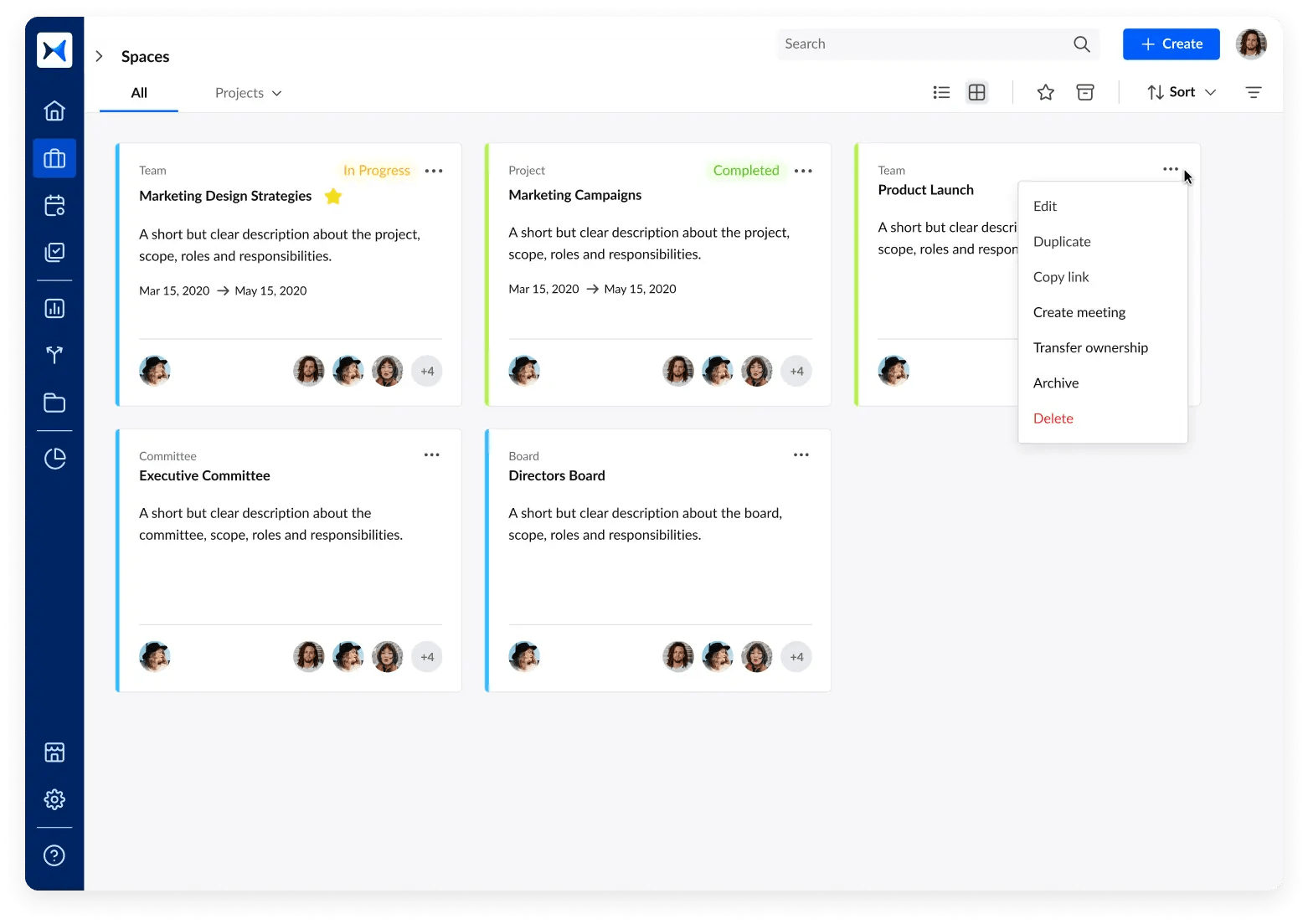

- Multi-space management: Organizes meetings across different phases of the M&A lifecycle, from initial negotiations to post-merger integration. Teams can manage due diligence separately from financial planning while keeping everything accessible in one platform.

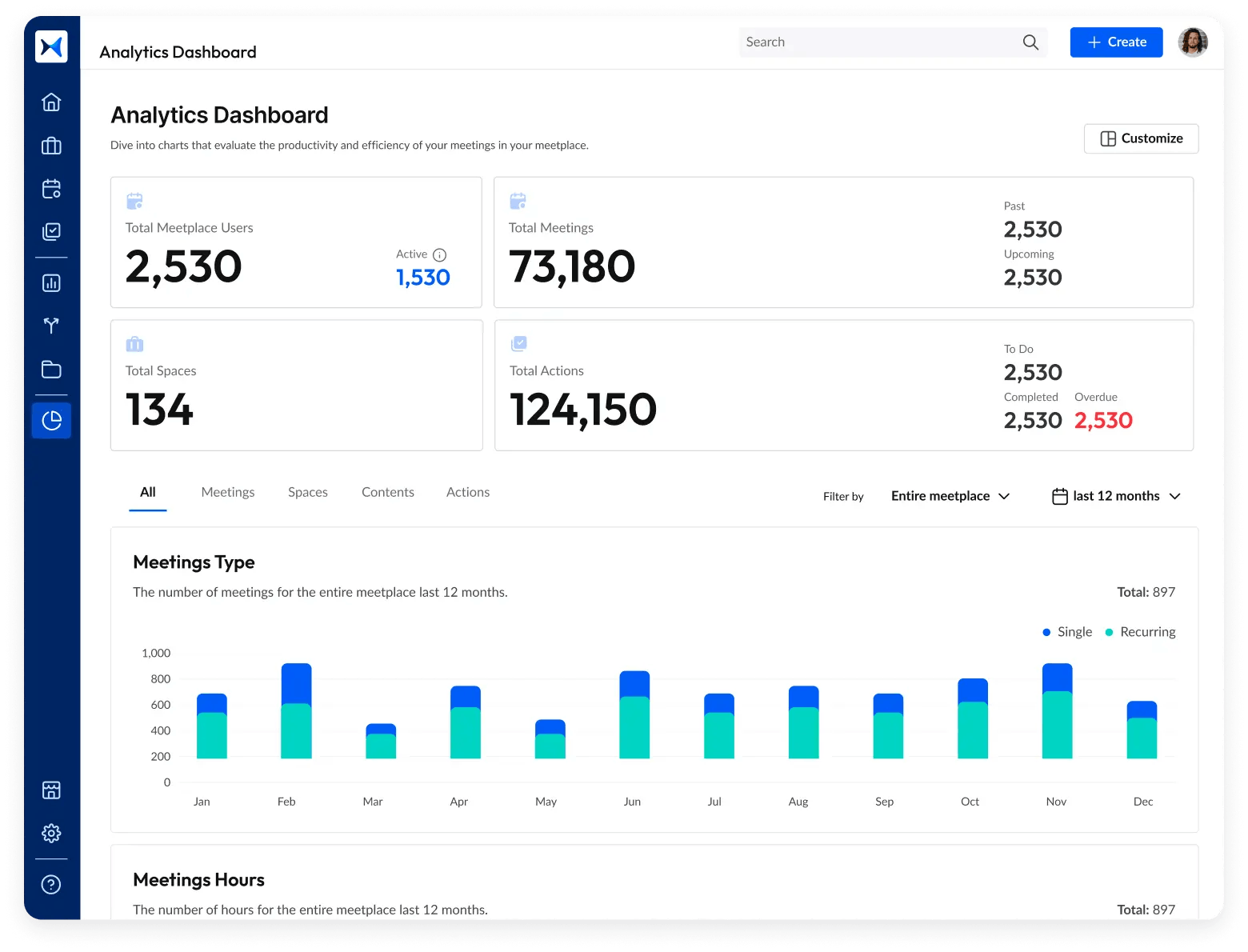

- Analytical dashboards: Provides leadership and board members with real-time insights into deal progress, outstanding approvals, and integration milestones.

The bottom line

Mergers and acquisitions' success depends on structured discussions and seamless coordination. Meeting management solutions eliminate inefficiencies by ensuring that stakeholders stay aligned from initial negotiations to post-merger integration. Enterprises that adopt these tools can reduce deal complexity, accelerate execution, and maximize long-term value.

And while there may be multiple solutions available, here is why adam.ai is the meeting management software platform you can trust:

- adam.ai is one of Atlassian Ventures' portfolio companies.

- In the meeting management software category on G2, adam.ai has been ranked a leader and a high performer for successive quarters in the past years.

- adam.ai has been included in the Forrester Report in the AI-enabled meeting technology landscape.

- adam.ai is trusted and used by powerful teams and organizations worldwide for all types of critical meetings, like board, committee, project management, and business development meetings.

- And most importantly, adam.ai integrates with your existing workflow, is SOC2 compliant, provides dedicated support and success, and has a free trial option.

Subscribe to adam.ai blog

Stay ahead with the latest insights—get our newest blog posts, tips, and updates sent straight to your inbox.