May 29, 2024 · 11 min read

Board Management Best Practices for a Wholly Owned Subsidiary

Shaimaa Badawi

A wholly owned subsidiary is a strategic asset that allows companies to expand their operations, manage risks, and maintain control over diverse markets. This business structure provides parent companies with the flexibility to operate independently through separate legal entities, while still retaining full ownership and oversight. In this article, you'll discover the essentials of wholly owned subsidiaries and learn best practices for effective management.

What is a wholly owned subsidiary?

A wholly owned subsidiary is a company whose entire stock is owned by another company, known as the parent company. This complete ownership allows the parent company to exercise full control over the subsidiary’s operations, decisions, and strategic direction. Wholly owned subsidiaries can be formed through acquisitions, where the parent company buys all the shares of an existing company, or through greenfield investments, where a new company is established and fully owned by the parent company.

These subsidiaries operate as separate legal entities, which means they have their own management teams and boards of directors. However, the parent company oversees and guides their strategic decisions and policies. Wholly owned subsidiaries enable parent companies to diversify their operations, manage risks across different markets, and maintain control over their international or domestic business expansions.

How does a wholly owned subsidiary work?

A wholly owned subsidiary is a company entirely owned by another company, known as the parent company. This ownership structure gives the parent company complete control over the subsidiary’s operations and strategic direction. Here’s an overview of how a wholly owned subsidiary functions:

Ownership and control

- Total ownership: The parent company holds 100% of the subsidiary’s shares, making it the sole shareholder. This means there are no minority shareholders, and the parent company has full control over the subsidiary.

- Board of directors: The parent company has the authority to appoint the subsidiary’s board of directors. This board oversees the subsidiary’s operations and ensures alignment with the parent company’s strategic goals.

Operational independence

- Legal entity: Despite being fully owned by the parent company, the subsidiary operates as a separate legal entity. This means it can enter into contracts, own property, and be liable for its own debts and obligations.

- Day-to-day operations: The subsidiary may have its own management team to handle daily operations. However, significant decisions and strategic directions are typically influenced or directly managed by the parent company.

Strategic alignment

- Decision-making: The parent company’s influence extends to major business decisions, including strategic initiatives, financial planning, and operational policies. The subsidiary works under the parent company’s approval for these activities.

- Market and geographic expansion: Wholly owned subsidiaries allow parent companies to diversify and expand their operations into new markets or geographic regions. This can help manage risks and capitalize on opportunities in different areas.

Why do businesses set up wholly owned subsidiaries?

Businesses establish wholly owned subsidiaries for several strategic reasons, each contributing to the parent company’s overall growth, diversification, and risk management.

1. Market expansion

- Geographic reach: Wholly owned subsidiaries allow parent companies to extend their operations into new geographic regions. This is particularly beneficial for tapping into international markets, which can help mitigate risks associated with market saturation in the parent company’s home country.

- Global mobility: By establishing subsidiaries in different countries, parent companies can navigate various geopolitical and trade environments more effectively. This diversification helps buffer against regional economic downturns or political instability.

2. Control and integration

- Total control: A wholly owned subsidiary structure provides the parent company with complete control over the subsidiary’s operations. This includes decision-making processes, strategic direction, and management practices, ensuring alignment with the parent company’s overall goals.

- Vertical integration: Establishing wholly owned subsidiaries can facilitate vertical integration, allowing the parent company to control multiple stages of its supply chain. This can enhance efficiency, reduce costs, and improve product quality.

3. Risk management and legal separation

- Limited liability: Operating as separate legal entities, wholly owned subsidiaries help parent companies manage and contain risks. Legal liabilities remain with the subsidiary, protecting the parent company’s assets.

- Regulatory compliance: Subsidiaries can be tailored to comply with local regulations in different markets, reducing the parent company’s exposure to legal risks and ensuring smooth operations in diverse jurisdictions.

4. Strategic and operational flexibility

- Specialized operations: Wholly owned subsidiaries can focus on specialized operations, product lines, or services that require dedicated management and resources. This specialization allows for more efficient and effective business practices.

- Dedicated target audience: By establishing subsidiaries, parent companies can better cater to specific customer segments or market niches, enhancing customer satisfaction and loyalty.

5. Financial and profit benefits

- Profit diversification: Subsidiaries can generate additional revenue streams, contributing to the parent company’s overall profitability. Profits from these subsidiaries can be reinvested into new ventures, assets, or further expansion.

- Cost efficiency: Operating subsidiaries can sometimes lead to reduced operational costs, especially when taking advantage of local market conditions, such as lower labor costs or favorable tax environments.

What are the advantages of a wholly owned subsidiary?

1. Complete control and operational efficiency

- Full decision-making authority: The parent company has complete control over the subsidiary’s operations, allowing for swift and decisive action without the need to consult minority shareholders. This streamlined decision-making process enhances operational efficiency and agility.

- Standardized practices: With full control, the parent company can implement standardized quality control measures and customer experience protocols across all subsidiaries, ensuring consistency and reliability.

- Synergy and efficiency: Wholly owned subsidiaries benefit from shared policies, processes, and administrative services with the parent company. This integration reduces costs and enhances operational efficiency, leveraging economies of scale and streamlining resource allocation.

2. Strategic and financial advantages

- Legal and financial separation: Subsidiaries operate as separate legal entities, which helps to isolate financial risks and liabilities from the parent company. This separation protects the parent company’s assets and minimizes overall risk exposure.

- Tax benefits: Many countries offer tax incentives for foreign direct investments through subsidiaries, such as tax breaks and exemptions. Additionally, losses incurred by one subsidiary can be used to offset profits from another, optimizing the parent company’s overall tax liability.

- Geographic and market expansion: Wholly owned subsidiaries allow parent companies to enter new markets and geographic regions, spreading risk and capturing opportunities in diverse environments. This expansion helps stabilize revenue streams and reduce dependence on any single market.

- Customer base inheritance: Acquiring a wholly owned subsidiary enables the parent company to inherit an established customer base, reducing the time and effort needed to build new client relationships from scratch.

3. Enhanced brand and market presence

- Increased valuation: Subsidiaries gain prestige and market value from being associated with a larger, well-known parent company. This association can enhance the subsidiary’s reputation and attract more customers and investors.

- Consistent branding: The parent company can maintain a consistent brand image and strategic vision across all subsidiaries, reinforcing brand recognition and customer loyalty.

- Tailored offerings: Wholly owned subsidiaries can adapt products, services, and marketing strategies to local markets, increasing customer satisfaction and sales. This localization helps the parent company connect with regional audiences more effectively.

- Direct market insights: Operating subsidiaries in different regions provides valuable market insights and customer data, which can be used to refine products and strategies for better market fit.

4. Innovation and confidentiality

- Accelerated development: The close integration of parent and subsidiary operations fosters innovation and accelerates research and development efforts. This collaboration can lead to the rapid introduction of new products and technologies.

- Shared expertise: Subsidiaries can benefit from the parent company’s technical know-how, industry expertise, and proprietary technologies, enhancing their competitive edge.

- Protected intellectual property: Wholly owned subsidiaries allow parent companies to manage and protect sensitive information, trade secrets, and proprietary technologies without the risk of external exposure.

What are the disadvantages of wholly owned subsidiaries?

1. High costs of setup and operational expenses

- Initial investment: Establishing a wholly owned subsidiary requires a significant financial investment. This includes costs related to researching the market, regulatory compliance, setting up operations, and managing supply chains.

- Ongoing expenses: Operational costs, such as staffing, branding, and maintaining infrastructure, can be high. Additionally, managing separate legal entities involves costs related to tax filings, legal compliance, and administrative overhead.

- Overvaluation risk: If multiple companies are bidding for the same subsidiary, the parent company might have to pay a premium, leading to the overvaluation of assets.

2. Regulatory and compliance challenges

- Diverse regulations: Operating in different countries requires navigating a complex web of local laws and regulations concerning investments, corporate governance, taxation, labor, and infrastructure. Compliance failures can result in substantial fines or even the closure of the subsidiary.

- Additional legal costs: Legal expertise is often necessary to manage these regulatory requirements, adding to operational costs.

- Political opposition: Some countries may have political environments that are hostile to foreign-owned subsidiaries, increasing the risk of regulatory and operational hurdles.

- Cultural misalignment: A lack of understanding of local cultural nuances can lead to ineffective customer engagement and difficulties in building relationships with local business leaders, government officials, and suppliers.

3. Management and operational complexities

- Complex management structure: Managing multiple subsidiaries can complicate the consolidation and organization of finances. The parent company must ensure that all subsidiaries are aligned with its strategic objectives, which can be challenging.

- Dependency on parent company: Subsidiaries often rely heavily on the parent company for capital, operational guidance, and business plans. This dependency can limit the subsidiary’s ability to adapt to local market conditions and consumer preferences.

- Cultural differences: Differences in management styles and business cultures between the parent company and the subsidiary can hinder operational efficiency. Establishing effective workflows and relationships with local staff can take considerable time and effort.

4. Financial and operational risks

- Financial risks: The parent company bears the full financial risks associated with the subsidiary’s operations. Any losses incurred by the subsidiary directly impact the parent company’s financial health.

- Taxation: Additional taxation on the parent company may arise from the subsidiary’s operations, potentially increasing the overall tax burden.

- Transition challenges: Integrating a new subsidiary can disrupt existing operations. Building rapport with local vendors, clients, and staff requires time, which can lead to temporary operational inefficiencies.

Key best practices for managing wholly owned subsidiaries

1. Establish robust governance structures

a. Develop a subsidiary governance framework

- Secure buy-in from the boards of the parent and subsidiary companies.

- Perform audits and due diligence on all subsidiaries.

- Establish a governance team with clear priorities and goals.

b. Adapt to local needs

- Customize governance frameworks to accommodate local laws, regulations, and customs.

- Involve local subsidiary boards and management in developing governance practices.

c. Conduct regular audits and reviews

- Assess the composition and effectiveness of subsidiary boards regularly.

- Ensure appropriate policies, protections, and remuneration practices are in place.

2. Align strategic and operational goals

a. Align subsidiary goals with corporate strategy

- Regularly review subsidiary goals to ensure alignment with the parent company’s objectives.

- Maintain open communication channels to keep subsidiary leaders updated on strategic changes.

b. Optimize financial performance

- Implement standard financial practices and conduct regular audits.

- Ensure subsidiaries comply with relevant accounting standards.

c. Enhance operational efficiency

- Encourage collaboration and information sharing across subsidiaries.

- Develop standard operating procedures and set key performance indicators (KPIs).

3. Foster effective communication and training

a. Maintain clear communication channels

- Establish regular reporting cadences between the parent and subsidiaries.

- Hold regular board meetings and communicate any changes or concerns promptly.

b. Provide ongoing training

- Train subsidiary managers and staff on governance, compliance, and operational practices.

- Develop a communications guide or strategy and appoint corporate governance champions.

4. Implement strong risk management and compliance practices

a. Identify and mitigate risks

- Conduct unique risk assessments for each subsidiary and develop mitigation plans.

- Train subsidiary managers on risk management practices.

b. Ensure compliance with local laws and regulations

- Establish teams to monitor regulatory changes affecting subsidiaries.

- Conduct regular compliance audits and provide training on key legal issues.

5. Leverage technology for efficient management

a. Centralize data and automate processes

- Utilize technology to centralize subsidiary data and ensure consistent governance practices.

- Implement platforms that enhance collaboration, automate document management, and streamline reporting.

b. Invest in tech solutions

- Use cloud-based legal management systems to plan, maintain, and document subsidiary records seamlessly.

- Leverage technology to minimize non-compliance risks and increase productivity.

6. Integrate subsidiaries into the parent company’s culture and values

a. Align corporate values and brand reputation

- Ensure subsidiaries reflect the parent company’s values and maintain brand consistency.

- Align subsidiary policies and practices with those of the parent company to foster a cohesive corporate culture.

b. Build strong local relationships

- Respect local customs and practices to build trust and effective relationships with local stakeholders.

- Encourage subsidiaries to leverage their local knowledge and expertise while aligning with the parent company’s strategic goals.

Empower your subsidiary management strategy with adam.ai

Effective management of wholly owned subsidiaries requires robust tools and seamless coordination across various levels of governance and operations.

adam.ai is a comprehensive meeting management software platform designed for boards, committees, and projects to enhance governance and streamline operations.

Here's what you can do with adam.ai:

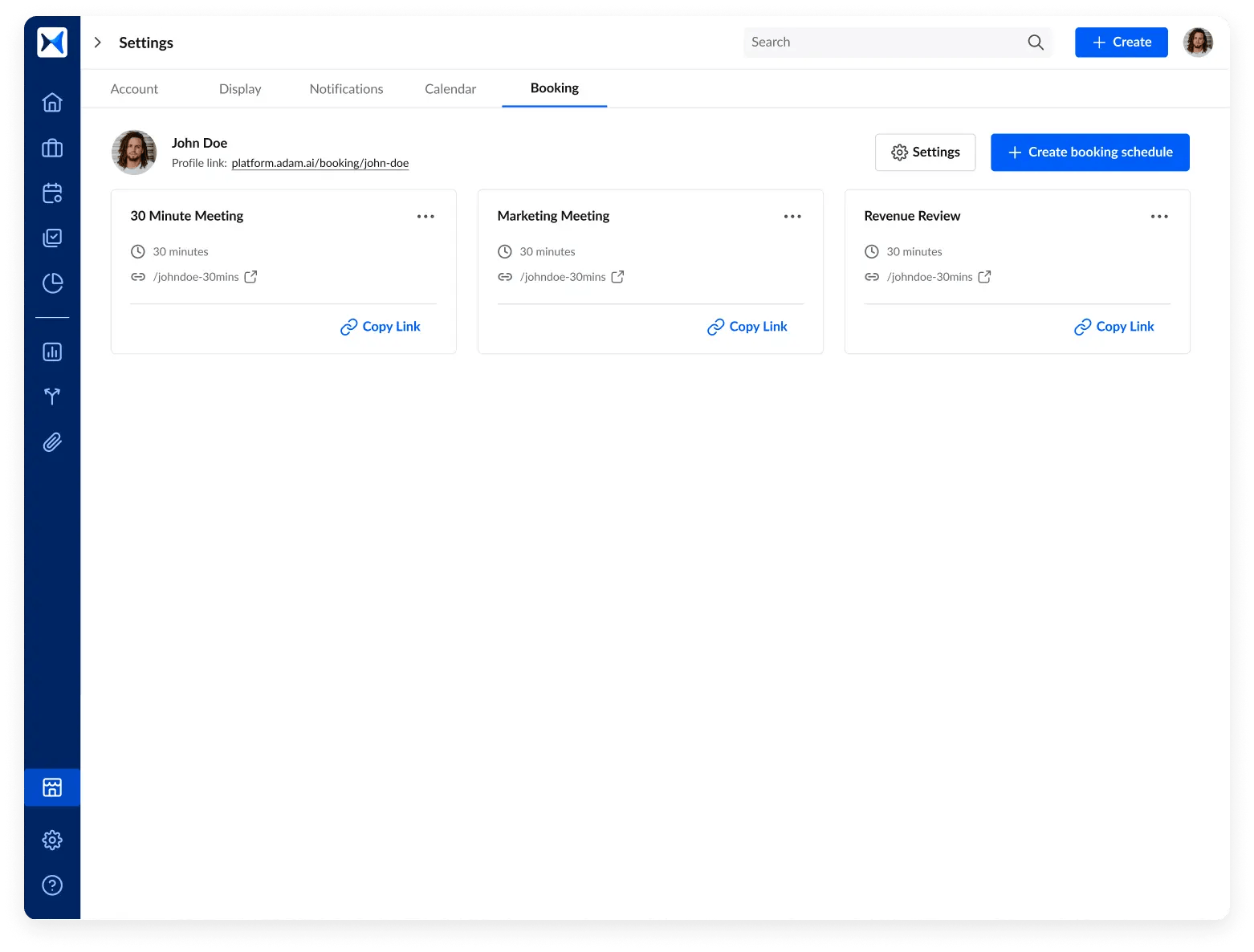

1. Unlimited booking pages: Easily schedule and organize meetings across different subsidiaries, committees, and stakeholders.

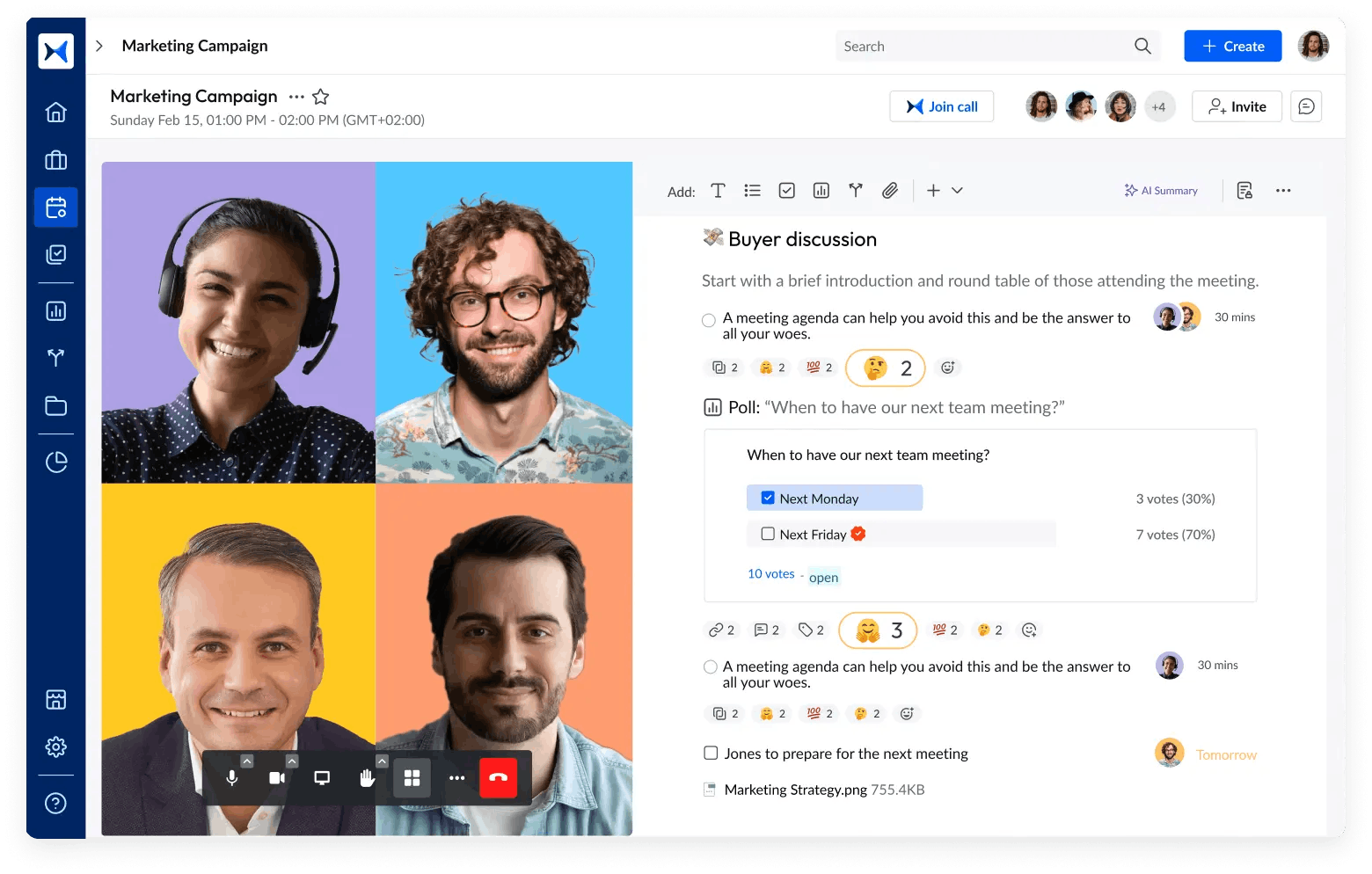

2. Smart note-taking system: Capture agenda items, decisions, and action points seamlessly during meetings. Integrated with built-in video conferencing, this feature allows for real-time collaboration and decision-making.

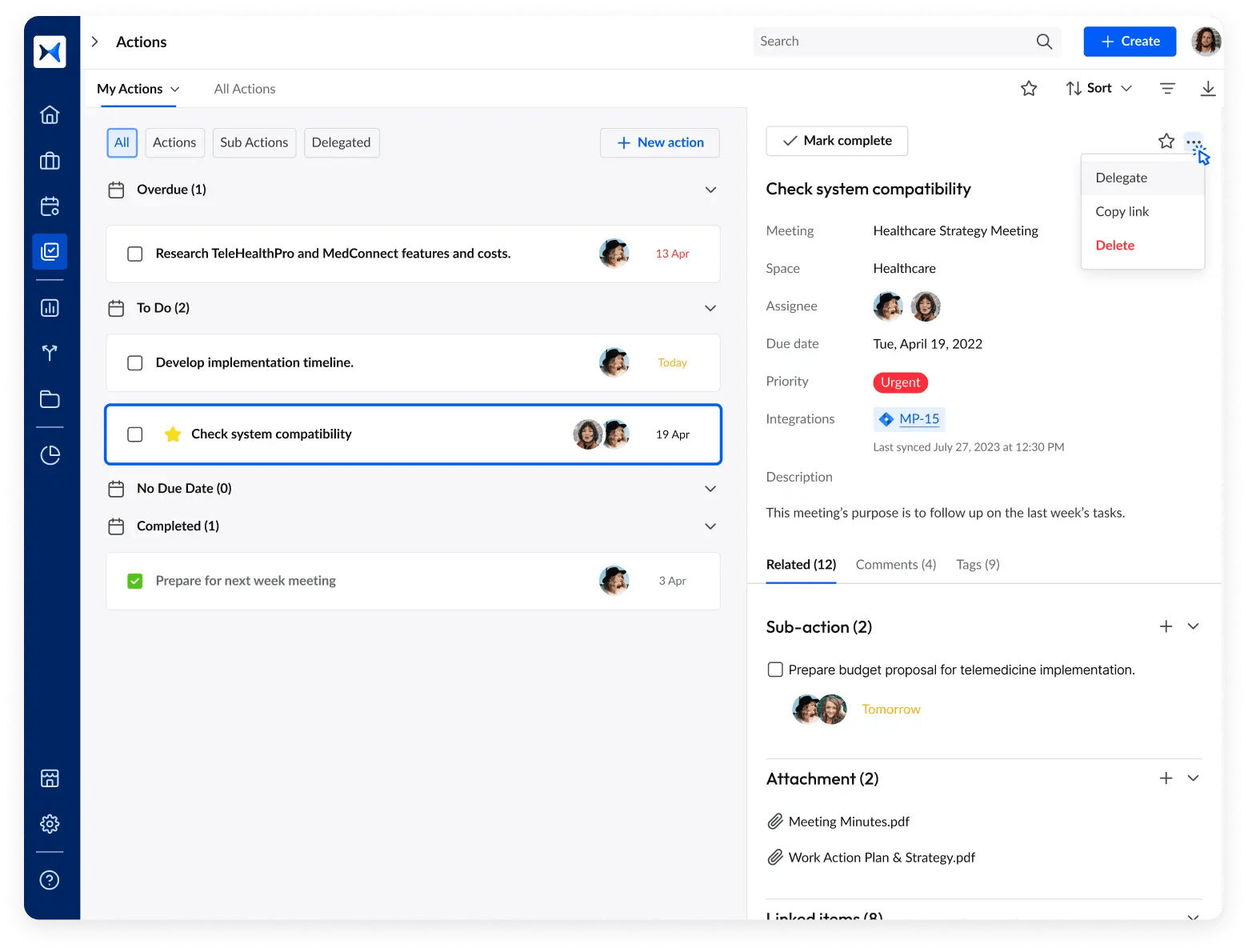

3. Action and decision tracking: Keep track of decisions made and actions assigned during board meetings to ensure follow-through and accountability and monitor progress and outcomes across different subsidiaries.

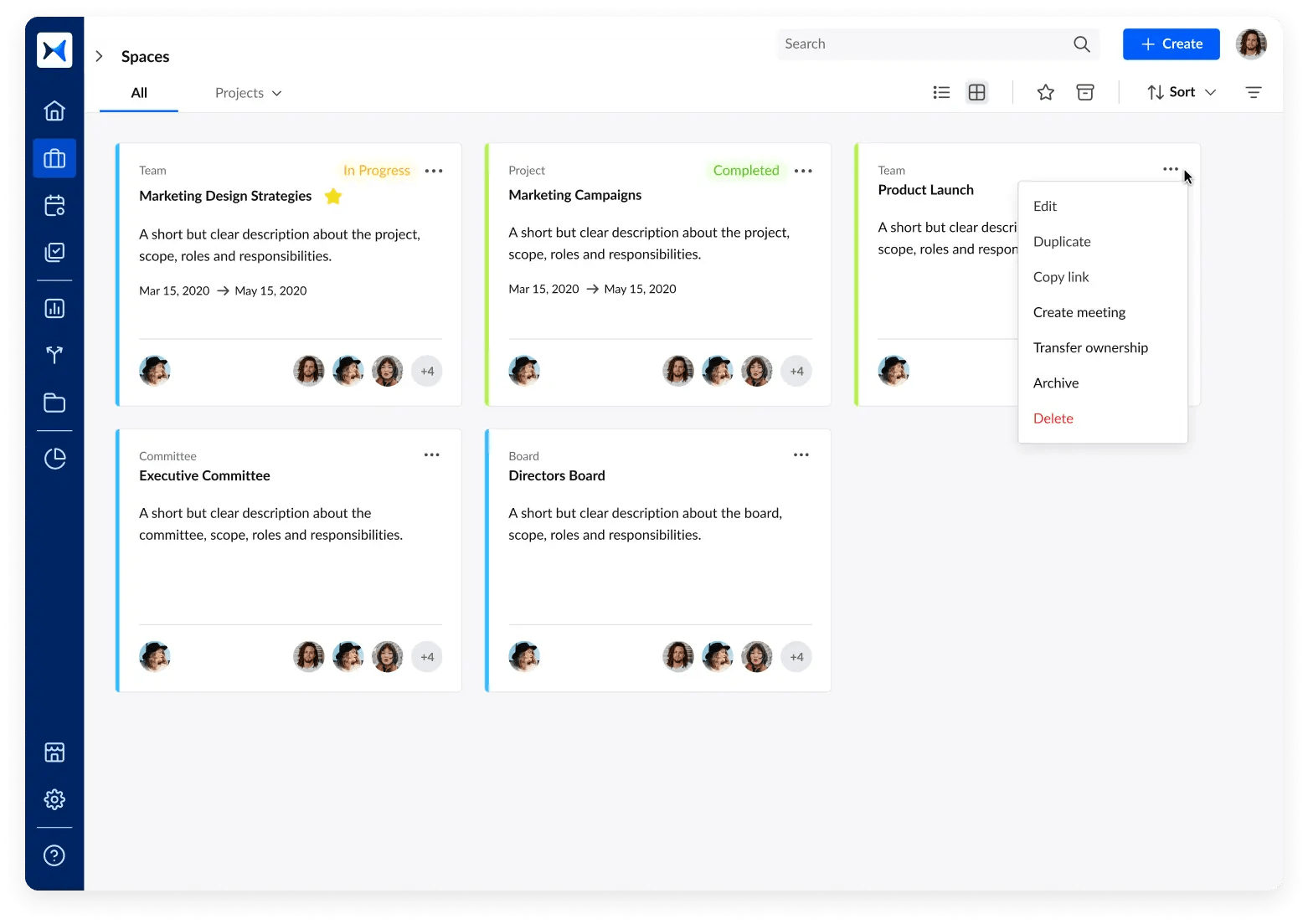

4. Meeting spaces: Organize meetings into specific spaces for various subsidiaries, committees, teams, and projects. This categorization helps maintain clear records to easily manage multiple entities within the corporate structure.

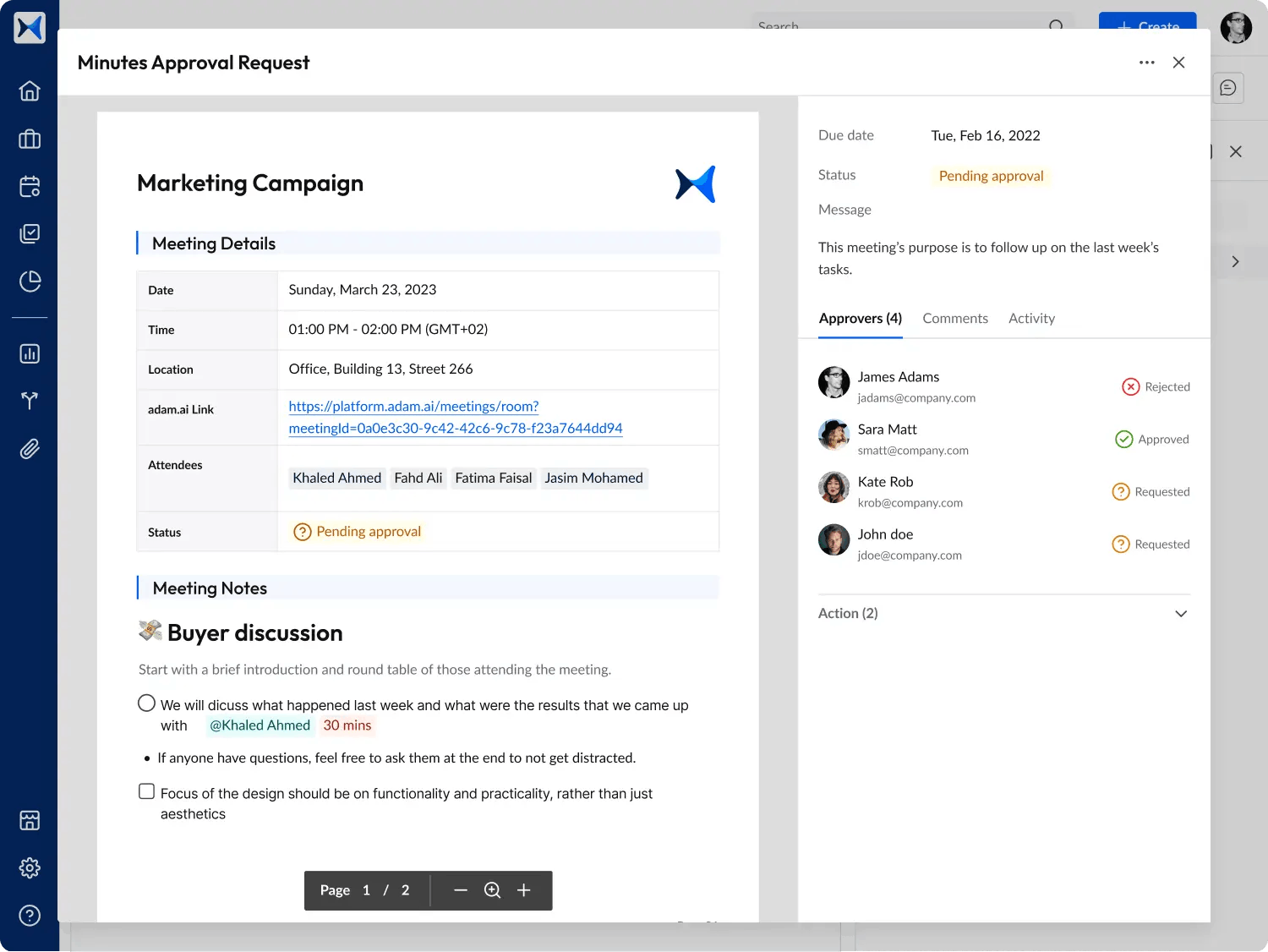

5. Meeting minutes and approval cycle: Automatically generate and share meeting minutes to maintain comprehensive records for future reference and stay aligned with governance requirements.

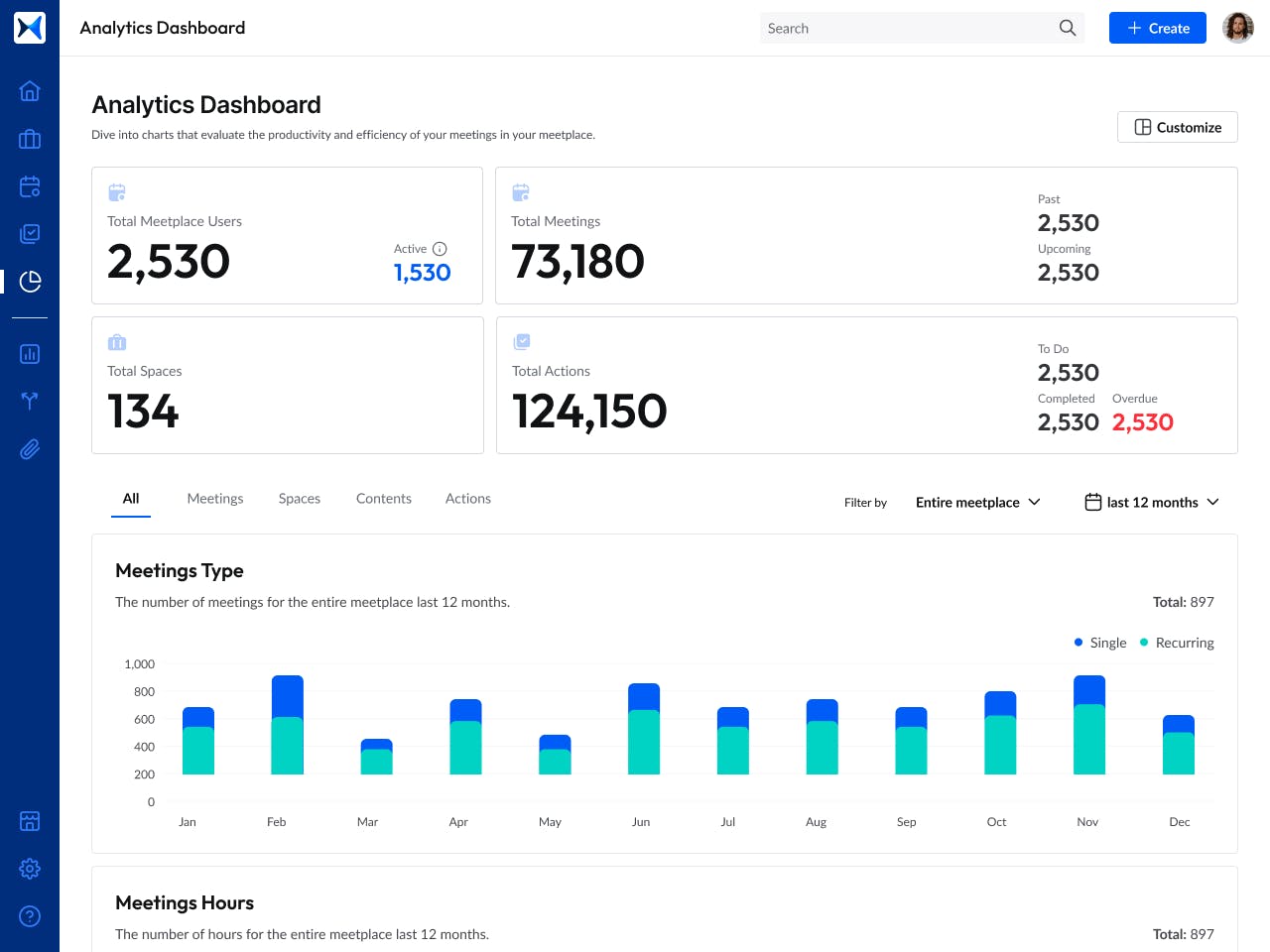

6. Analytics dashboard: Utilize analytics to assess participation rates, decision outcomes, and the progress of action items to make data-driven decisions and improve governance practices.

Transform how you conduct critical meetings—From meticulous preparation to effective execution and insightful follow-up, adam.ai integrates comprehensive analytics, full customization, and intuitive interfaces with powerful meeting management tools.

Easy onboarding. Enterprise-grade security. 24/7 dedicated support.

The bottom line

Managing a wholly owned subsidiary effectively requires a strategic approach that encompasses robust governance structures, clear communication, risk management, and leveraging technology. By aligning the subsidiary’s goals with the parent company’s strategic vision, optimizing financial and operational practices, and fostering a cohesive corporate culture, businesses can ensure their subsidiaries contribute positively to overall success.

Leveraging tools or technology to manage subsidiaries is crucial for maintaining consistent governance, enhancing operational efficiency, and mitigating risks.

And while there may be multiple solutions available, here is why adam.ai is the meeting management software platform you can trust:

- adam.ai is one of Atlassian Ventures' portfolio companies.

- In the meeting management software category on G2, adam.ai has been ranked a leader and a high performer for successive quarters in the past years.

- adam.ai has been included in the Forrester Report in the AI-enabled meeting technology landscape.

- adam.ai is trusted and used by powerful teams and organizations worldwide for all types of critical meetings, like board, committee, project management, and business development meetings.

- And most importantly, adam.ai integrates with your existing workflow, is SOC2 compliant, provides dedicated support and success, and has a free trial option.

Subscribe to adam.ai blog

Stay ahead with the latest insights—get our newest blog posts, tips, and updates sent straight to your inbox.