June 17, 2024 · 10 min read

What Is a Parent Company? Must-Know Facts for Business Leadership

Shaimaa Badawi

Understanding what is a parent company is essential for grasping how large corporations operate and manage multiple business entities. In this article, we will explore the fundamental aspects of a parent company, including its definition, the reasons for its existence, and the benefits it provides. You'll discover how parent companies manage their subsidiaries, the strategic advantages they offer, and the role they play in optimizing corporate efficiency and governance.

What is the meaning of parent company?

A parent company is a firm that holds at least 50% plus one of the voting shares in another business, granting it the power to oversee and direct its activities. This controlling interest allows the parent company to either manage the subsidiary's operations closely or provide overarching guidance and resources while letting the subsidiary handle its daily functions independently.

Such companies often emerge from business combinations, expansions, or restructuring processes, with the primary aim of steering their subsidiaries toward aligned objectives and regulatory compliance.

Is a parent company an owner?

Yes, a parent company is an owner. It holds a majority of the voting shares, typically more than 50%, in another company, known as a subsidiary. This ownership allows the parent company to control and influence the subsidiary’s operations and strategic decisions.

In cases where the parent company owns 100% of the subsidiary's common stock, the subsidiary is referred to as a wholly owned subsidiary. This significant ownership makes the parent company the dominant entity, guiding and supporting the subsidiary while maintaining the option to manage its operations directly or adopt a more hands-off approach.

Why do parent companies exist?

Parent companies exist to streamline operations, ensuring that subsidiaries can focus on their core activities without being burdened by corporate governance tasks. This structure allows the parent company to handle critical functions like legal compliance, financial oversight, and strategic direction. Additionally, parent companies diversify risk by owning multiple subsidiaries across different industries, optimizing tax strategies, and providing legal protection. This approach leads to better resource allocation, enhanced efficiency, and improved overall performance of the corporate group.

What is the role of a parent company?

The role of a parent company encompasses a broad range of responsibilities that ensure the effective management and success of its subsidiaries.

Management and oversight

The primary role of a parent company is to manage and oversee its subsidiaries. This includes setting strategic directions, providing guidance, and ensuring that subsidiaries align with the overall objectives of the parent company. Parent companies can influence or control the operations of their subsidiaries to ensure efficient and effective performance.

Financial support

Parent companies often provide financial resources to their subsidiaries. This support can include capital investments, loans, and other financial aid necessary for the subsidiaries to operate and grow. Having access to the parent company’s resources allows subsidiaries to undertake projects and investments they might not otherwise be able to afford.

Strategic integration

Parent companies can integrate their subsidiaries either horizontally or vertically. Horizontal integration involves owning subsidiaries that operate at the same level in an industry, while vertical integration involves owning companies at different stages of production or supply chain processes. This integration helps streamline operations, reduce costs, and improve overall efficiency.

Compliance and regulation

Ensuring that subsidiaries comply with relevant laws and regulations is another crucial role of a parent company. The parent company sets the standards and practices that subsidiaries must follow to maintain compliance. This oversight helps protect the parent company from legal risks and ensures smooth operations across its subsidiaries.

Risk management

By having a diverse portfolio of subsidiaries, a parent company can spread risk across different markets and industries. This diversification helps mitigate the impact of potential losses in any one area. Additionally, subsidiaries often benefit from the financial stability and backing of the parent company, making them less risky investments.

Operational influence

Parent companies have the authority to make significant decisions regarding the operations of their subsidiaries. This can include changes in business strategies, leadership, and other critical aspects of the subsidiary’s operations. Depending on the approach, parent companies can be hands-on, directly managing the day-to-day activities, or hands-off, allowing subsidiaries a degree of autonomy while still providing oversight.

What is another name for a parent company?

Another name for a parent company is a holding entity. This type of company earns income through the ownership and control of other businesses, often benefiting from the financial returns generated by these owned businesses. Holding entities can also gain revenue from various activities such as managing assets, receiving fees for services, or earning interest from loans provided to their subsidiaries. Additionally, holding entities can strategically influence their subsidiaries to align with broader business goals and optimize overall profitability.

What is an example of a parent company?

Several well-known companies today function as parent companies, overseeing a range of subsidiaries across different industries. Here are some notable examples:

1. Alphabet Inc.:

- Subsidiaries: Google, YouTube, Waymo, Fitbit, Nest, and many others.

- Overview: Alphabet, the parent company of Google, operates in diverse sectors including technology, smart home devices, and autonomous vehicles. Alphabet frequently acquires smaller companies to enhance its portfolio and maintain its competitive edge.

2. Berkshire Hathaway Inc.:

- Subsidiaries: Geico, Dairy Queen, Duracell, and numerous others.

- Overview: This conglomerate, led by Warren Buffett, owns a variety of companies spanning insurance, retail, manufacturing, and more. Berkshire Hathaway is known for its strategic acquisitions and investments.

3. Procter & Gamble (P&G):

- Subsidiaries: Pampers, Gillette, and Tide, among others.

- Overview: P&G is a major player in the consumer goods industry, managing a vast array of brands that are household names globally. The company focuses on maintaining a strong market presence through its diverse product lines.

4. Johnson & Johnson:

- Subsidiaries: Ethicon, Janssen Pharmaceutica, Neutrogena, and more.

- Overview: A leader in the pharmaceutical, medical devices, and consumer health sectors, Johnson & Johnson operates numerous subsidiaries that contribute to its innovation and market dominance.

5. The Walt Disney Company:

- Subsidiaries: ABC, Marvel, Pixar, and others.

- Overview: Disney is a giant in the entertainment industry, owning a wide range of subsidiaries in film, television, and theme parks. The company is renowned for its strategic acquisitions to enhance its content and reach.

6. General Electric (GE):

- Subsidiaries: GE Aviation, GE Healthcare, and GE Power, among others.

- Overview: GE is a diversified conglomerate with interests in aviation, healthcare, and energy. The company’s broad portfolio allows it to leverage synergies across different industries.

How do parent companies make money?

Parent companies generate revenue through several key mechanisms:

1. Dividends and interest

- Parent companies earn dividends from the shares they own in their subsidiaries.

- They may also receive interest from bonds or loans extended to their subsidiaries.

2. Profit sharing

- Subsidiaries may remit a portion of their profits to the parent company as part of profit-sharing arrangements.

3. Asset management

- Parent companies can lease or rent assets to their subsidiaries or third parties, earning income from these transactions.

- They might also generate revenue from royalties on intellectual property or other assets.

4. Strategic services

- Providing management, administrative, or financial services to subsidiaries can be another revenue stream.

- These services are often billed to the subsidiaries, resulting in additional income for the parent company.

5. Capital gains

- Parent companies can profit from selling shares or assets of their subsidiaries at a higher price than the purchase cost.

- Mergers, acquisitions, or divestitures of subsidiaries can also yield significant capital gains.

6. Operational synergies

- By integrating operations across subsidiaries, parent companies can reduce costs and improve efficiency, indirectly boosting profitability.

How to make a parent company

1. Select a location

- Choose the state or jurisdiction for incorporating the parent company, considering favorable corporate laws.

2. Create articles of incorporation documents

- Prepare the articles of incorporation, including details of directors, shareholders, and the registered agent. Optionally, state the purpose as "any lawful purpose" for flexibility.

- Submit the incorporation documents to the state’s relevant office with the necessary fee.

3. Develop company bylaws

- Draft the bylaws to outline the company’s operating procedures, including the roles and powers of directors and shareholders.

4. Establish subsidiary companies

- Follow the incorporation steps for each subsidiary, listing the parent company as the main shareholder.

5. Appoint subsidiary directors

- Assign directors to manage each subsidiary, ensuring the parent company retains control.

6. Issue share certificates

- Create share certificates for the subsidiaries, designating ownership to the parent company.

7. Consider forming an LLC

- If preferred, establish a parent company as an LLC in the chosen jurisdiction, adhering to local requirements.

8. Obtain tax identification numbers

- Secure a federal Employer Identification Number (EIN) and a state tax ID number.

9. Register trade names

- File "Doing Business As" (DBA) names for subsidiaries under the parent LLC, ensuring unique names.

10. Publish trade names

- Announce the registered trade names in local publications if required by law.

11. Form or acquire subsidiaries

- Set up or purchase subsidiary businesses, each with its own EIN and unique name. Update ownership records to reflect the parent company's status.

How can a business become a parent company?

Becoming a parent company involves several strategic actions. Here are the primary methods:

1. Acquisition of other companies

- Purchase controlling shares: Acquire a majority share (more than 50%) in a smaller company to gain control over its operations. This can help reduce competition, expand market presence, and integrate new expertise.

- Subsidiary merger: A subsidiary can acquire another company on behalf of the parent, making the parent the ultimate owner and avoiding the liabilities of the acquired firm.

2. Spin-offs

- Create a separate business: Detach a unit or division of your company to form a new subsidiary. This is often done to focus on high-growth potential areas or streamline operations by separating less productive segments.

- Unlock value: Spin-offs can unlock value in parts of the business that may perform better independently, sometimes with the intention of selling the subsidiary later for profit.

3. Special considerations

- Consolidated financial statements: As a parent company, you will need to produce combined financial statements that reflect the overall health of both the parent and its subsidiaries, eliminating any overlaps such as inter-company transactions.

- Minority interests: If the parent company does not own 100% of the subsidiary, a minority interest will be recorded on the balance sheet to reflect the portion not owned by the parent.

Streamline your parent company’s strategy with adam.ai

Managing a parent company involves navigating complex responsibilities and ensuring seamless coordination across various subsidiaries. adam.ai, an intelligent meeting management platform for boards, committees, and projects, offers tailored features that can significantly enhance the operational efficiency and strategic oversight of parent companies.

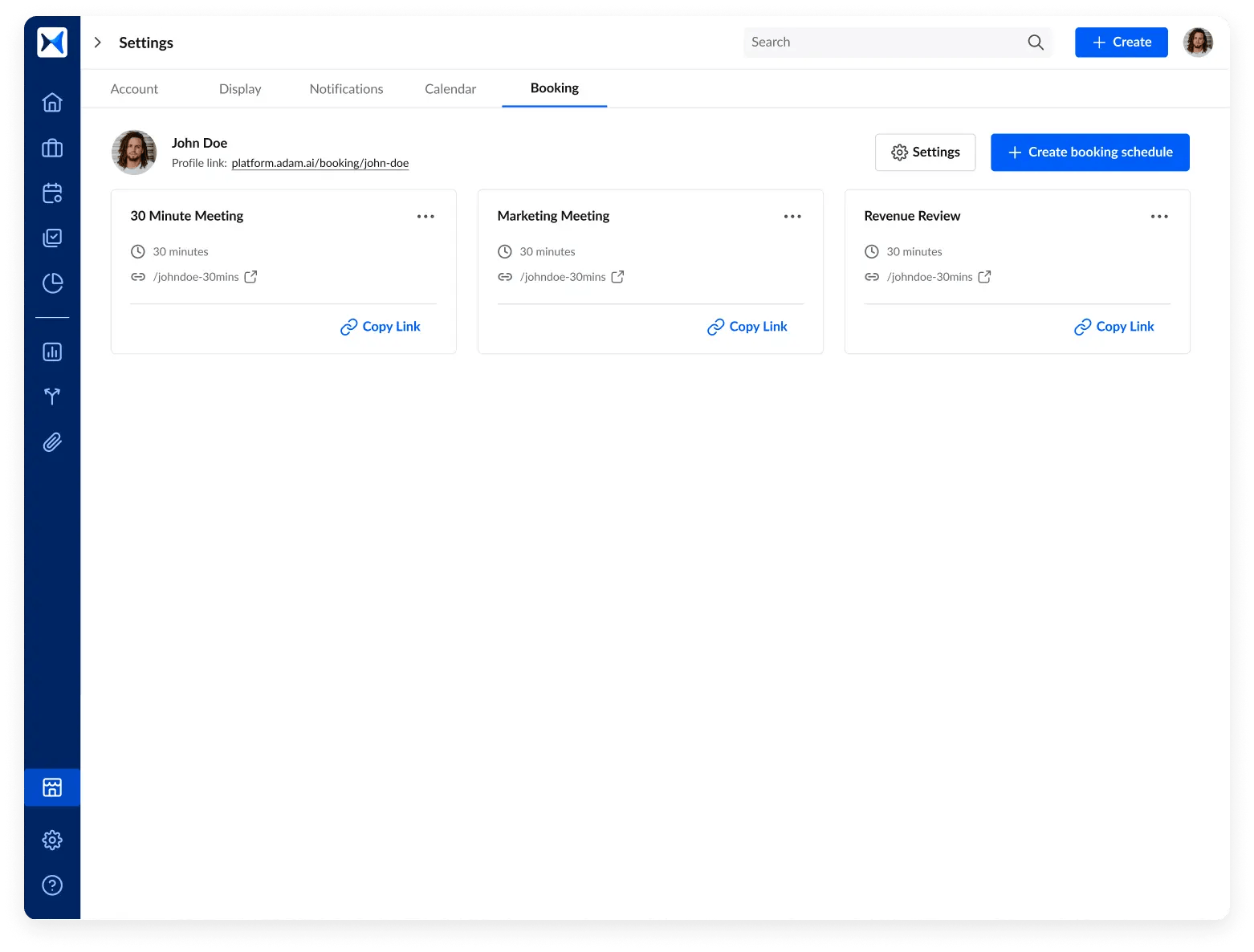

Streamlined meeting scheduling

adam.ai facilitates the organization of meetings between parent company executives and subsidiary leaders through unlimited booking pages. This ensures timely and consistent interactions, crucial for overseeing subsidiary performance and strategic alignment.

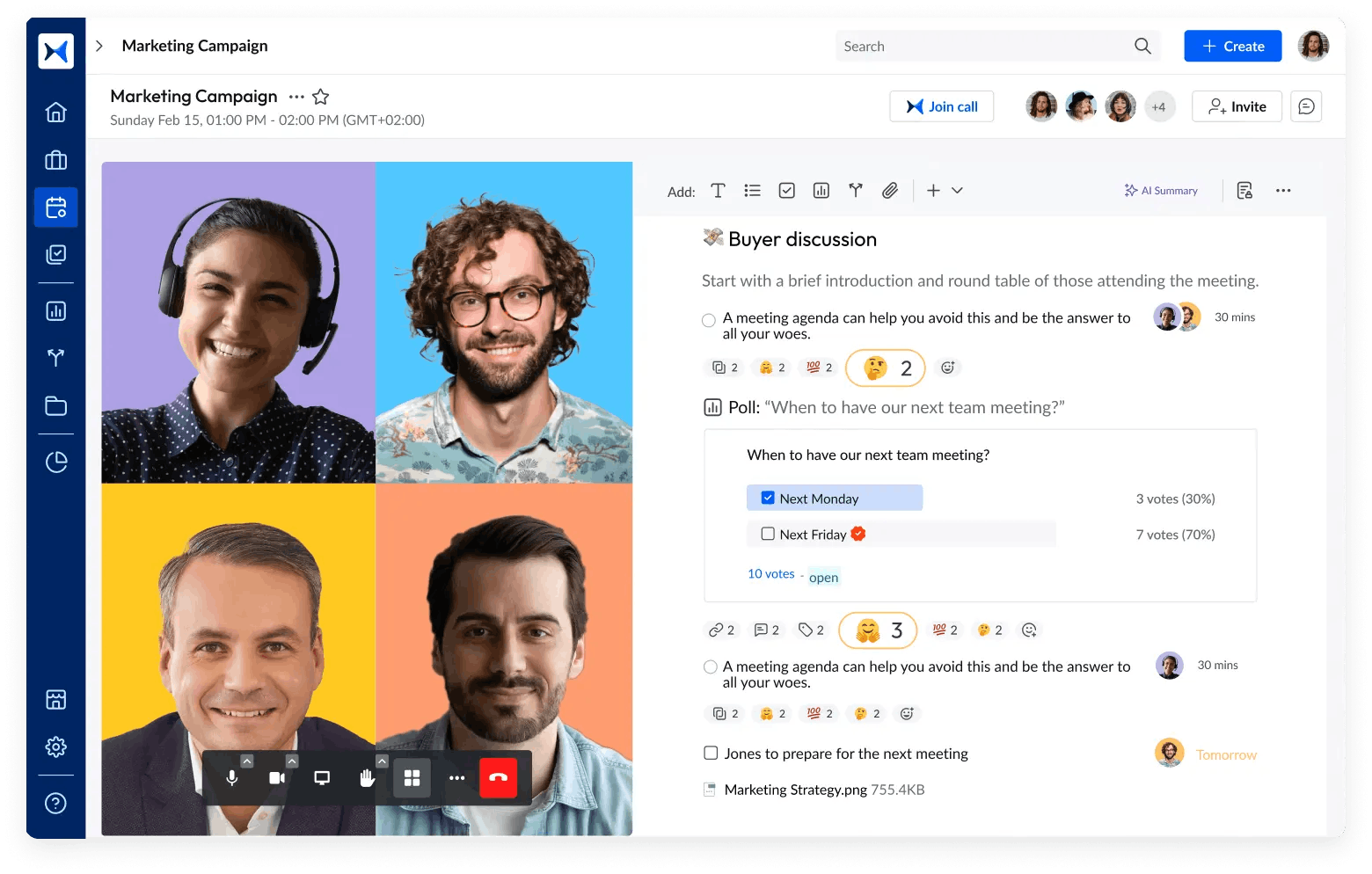

Smart note-taking and documentation

The platform’s intelligent note-taking system records decisions, actions, and key discussions in a user-friendly interface. With built-in video conferencing, adam.ai enables smooth and efficient communication between the parent company and its subsidiaries, ensuring no detail is missed.

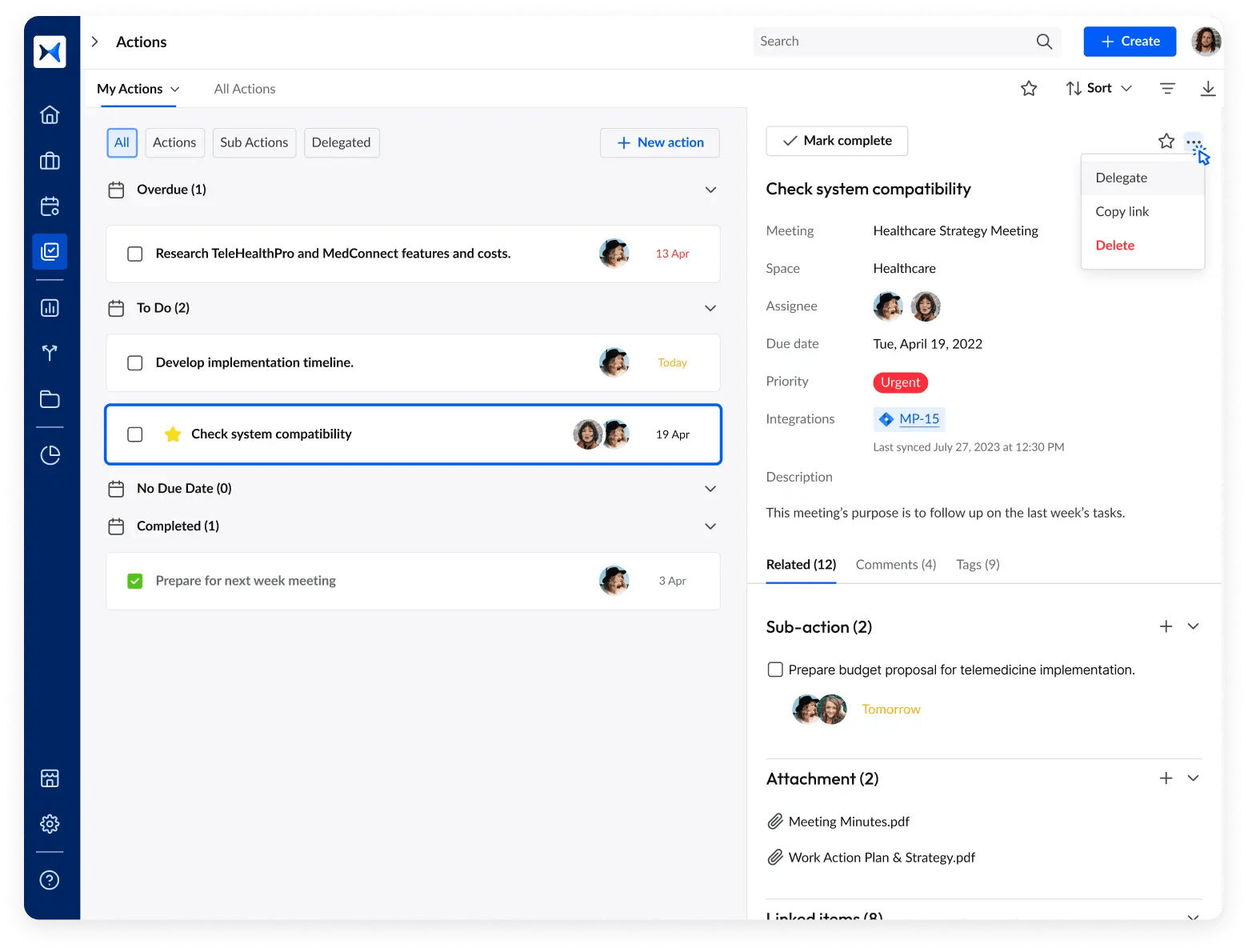

Action and decision tracking

adam.ai’s action and decision tracking feature helps follow up on directives and resolutions made during meetings. This ensures accountability and progress, keeping the parent company informed about the implementation of strategic decisions across its subsidiaries.

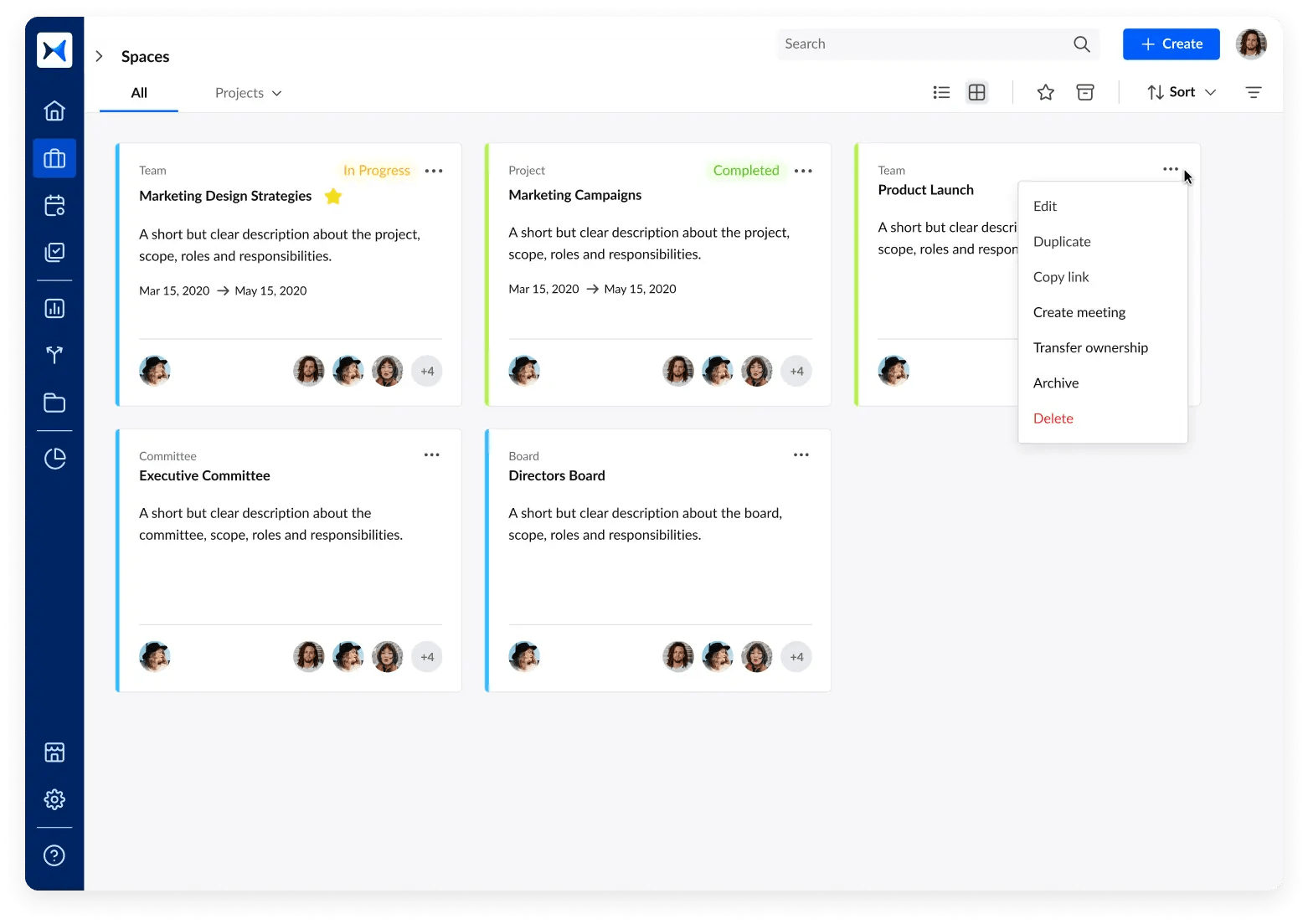

Organized meeting spaces

Create dedicated meeting spaces for different subsidiaries, teams, and projects. This organization helps maintain clear records and focus on specific operational areas, enhancing the parent company’s ability to manage and support its diverse portfolio efficiently.

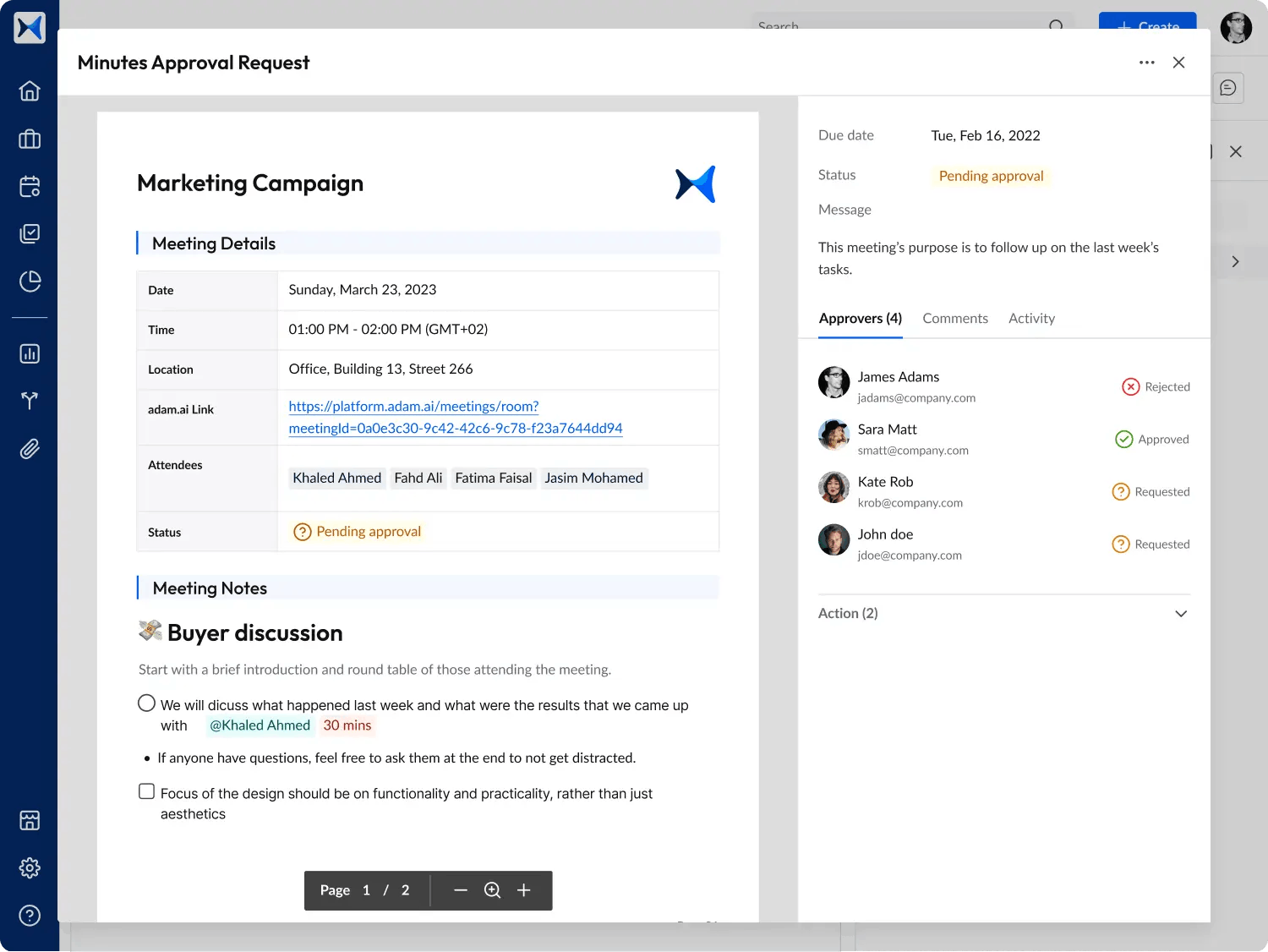

Automated meeting minutes

Automatically generate and share meeting minutes to ensure transparency and maintain comprehensive records. This feature supports the documentation of key decisions and actions, making it easier for parent company executives to track and review subsidiary performance.

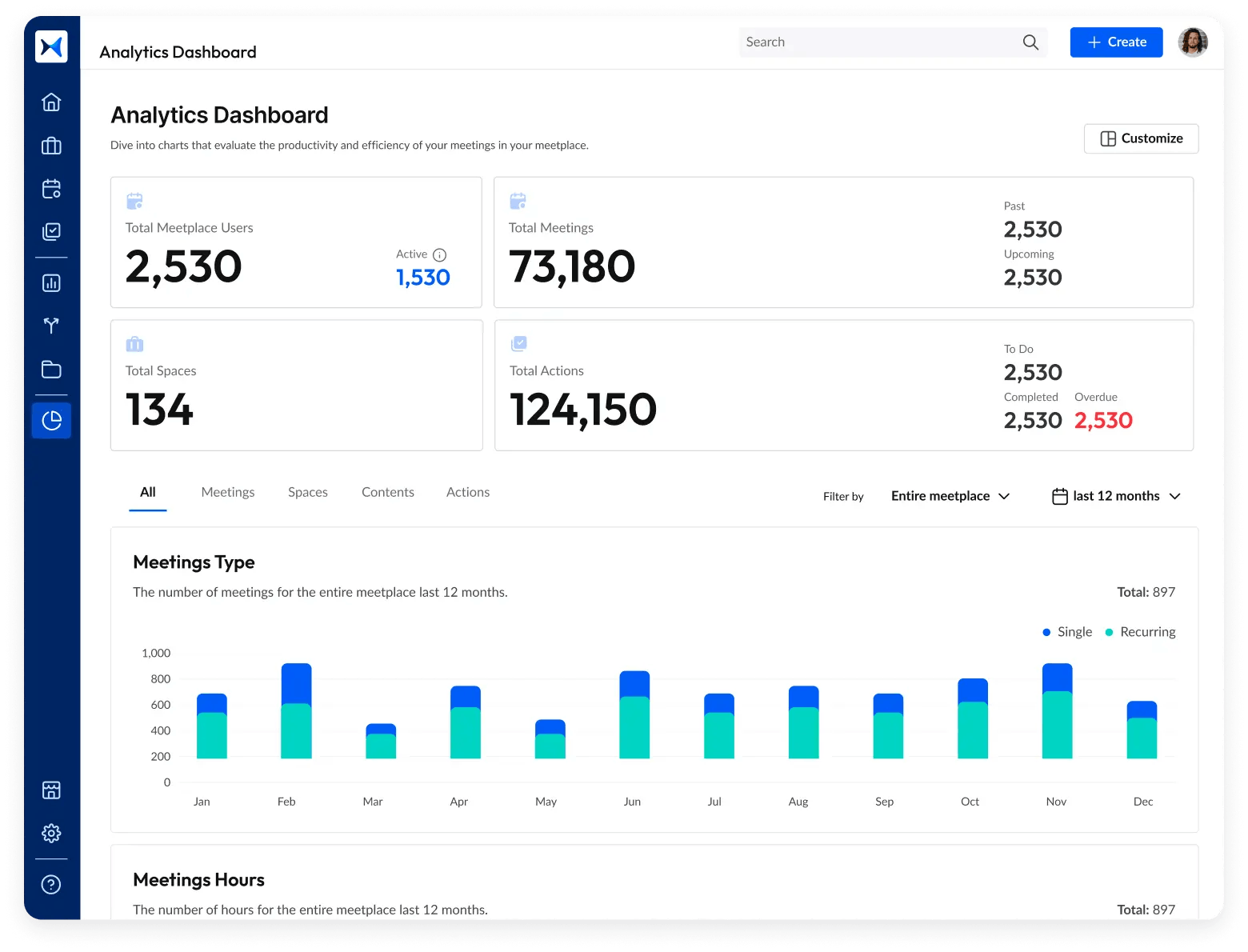

Analytics dashboard

adam.ai’s analytics dashboard allows parent company leaders to assess participation rates, decision outcomes, and the progress of action items across subsidiaries. This feature provides valuable insights, helping the parent company stay informed and proactive in its strategic oversight.

Transform how you conduct critical meetings—From meticulous preparation to effective execution and insightful follow-up, adam.ai integrates comprehensive analytics, full customization, and intuitive interfaces with powerful meeting management tools.

Easy onboarding. Enterprise-grade security. 24/7 dedicated support.

The bottom line

In conclusion, knowing what is a parent company and the strategic benefits it offers can provide a significant competitive edge. Leveraging modern tools can greatly enhance the management and efficiency of parent companies, ensuring sustained growth and success.

And while there may be multiple solutions available, here is why adam.ai is the meeting management software platform you can trust:

- adam.ai is one of Atlassian Ventures' portfolio companies.

- In the meeting management software category on G2, adam.ai has been ranked a leader and a high performer for successive quarters in the past years.

- adam.ai has been included in the Forrester Report in the AI-enabled meeting technology landscape.

- adam.ai is trusted and used by powerful teams and organizations worldwide for all types of critical meetings, like board, committee, project management, and business development meetings.

- And most importantly, adam.ai integrates with your existing workflow, is SOC2 compliant, provides dedicated support and success, and has a free trial option.

Subscribe to adam.ai blog

Stay ahead with the latest insights—get our newest blog posts, tips, and updates sent straight to your inbox.