June 20, 2024 · 10 min read

Winning the Battle: How a Proxy Fight Can Reshape Corporate Governance

Shaimaa Badawi

The high-stakes battle of a proxy fight occurs when shareholders unite to challenge a company's management, often leading to significant changes in leadership and strategy. In this article, you'll discover what a proxy fight entails, its role in mergers and acquisitions, and examine real-world examples of both successful and failed proxy fights. You'll also get to explore a strategic guide on how to win a proxy fight, ensuring you're well-prepared for this corporate showdown.

What do you mean by proxy fight?

A proxy fight, also known as a proxy contest or proxy battle, occurs when a group of shareholders unites to gather enough proxy votes to oppose and replace the current management or board of directors of a corporation. This tactic is often employed in hostile takeovers, where the dissident shareholders believe that the existing leadership is not acting in the best interests of the company. Through a proxy fight, shareholders aim to gain control by convincing others to vote in favor of their proposed changes, typically during annual meetings or special voting sessions.

What is a proxy fight in M&A?

A proxy fight in mergers and acquisitions (M&A) occurs when shareholders use their voting power to influence the outcome of a corporate transaction. Here’s an overview:

- Trigger by M&A activity: Shareholders dissatisfied with an M&A deal or company management may initiate a proxy fight to block or alter the transaction.

- Retaining or appointing board members: Both acquiring and target companies might seek to influence shareholders to retain or appoint preferred board members, often against the wishes of the current board.

- Use of proxy solicitors: Companies may hire third-party proxy solicitors to gather support and sway shareholder votes.

- Strategic influence: Proxy fights can significantly impact the M&A process, ensuring shareholder interests are represented and potentially leading to changes in company leadership.

- Gathering proxies: Activist shareholders campaign to collect proxy votes from other shareholders to support their position at the shareholder meeting.

- Voting outcome: The collected proxies are used to vote on the M&A proposal, with the potential to alter deal terms or replace board members to align with activist goals.

How do proxy battles work?

A proxy fight is a mechanism used by dissatisfied shareholders to force changes in a company’s governance or management. Here's how it typically unfolds:

- Initiation by shareholders: Dissatisfied shareholders, often unhappy with management decisions or strategic direction, begin by rallying other shareholders to support their cause.

- Gathering support: Activist shareholders campaign to gather proxy votes from fellow shareholders. This involves persuading others to allow them to vote on their behalf during the annual general meeting (AGM) or a specially convened meeting.

- Proxy statement: The activist group sends out a proxy statement detailing their grievances and proposed changes. This document is crucial as it includes financial data and other relevant information about the company.

- Voting process: Shareholders, through their proxies, vote on various issues such as board member elections, mergers, or changes in corporate policies. The side with the majority of proxy votes wins.

- Corporate response: Companies often use tactics like staggered boards and restrictive bylaws to defend against proxy fights. They may also engage in negotiations to settle disputes without a vote.

- Outcome: If the activists win, they can implement their proposed changes, which may include replacing board members. If the company wins, the current management remains in control.

Are proxy fights successful?

Proxy fights and hostile takeovers are often viewed as aggressive measures by investors to shift a company’s direction or gain control when other methods have failed. These tactics can sometimes lead to substantial changes in a company's leadership or strategic approach, particularly when shareholders believe that current management is not maximizing the company's potential.

However, the success of such efforts is not guaranteed. While some proxy fights and hostile takeovers have resulted in significant positive changes and increased stock prices, many others have failed, leading to considerable financial losses for the investors involved. The complexity of corporate governance and the defensive measures that companies can employ, such as staggered boards and restrictive bylaws, often make these battles difficult to win.

How long does a proxy fight last?

The length of a proxy fight can vary significantly, typically ranging from a few weeks to over a year. Several factors influence this duration:

Short-term proxy fights

1. Negotiated settlements: Proxy fights can be resolved quickly, often within weeks, if both parties reach a negotiated settlement early in the process.

2. Activist objectives: Activist investors usually prefer shorter proxy fights due to the following reasons:

(a) They bear the costs directly, making shorter battles less expensive.

(b) They are often better prepared than the target company.

(c) They usually launch the fight at a strategically advantageous time.

Prolonged proxy fights

1. Company's defensive tactics: Target companies often aim to extend the duration of a proxy fight to

(a) deplete the financial resources of the activist investors

(b) allow themselves ample time to prepare a defense

(c) implement strategic changes that could counter the activists' arguments.

2. Meeting delays: There is generally no fixed deadline for holding a requisitioned shareholder meeting. Activists push for prompt meetings, while target companies seek delays, citing the need for sufficient time to respond adequately.

Legal and strategic considerations

Meeting scheduling: If a company fails to call a meeting within 21 days of a requisition, any requisitioning shareholder can do so. This provides strategic advantages, such as choosing the meeting location and timing and the ability to adjourn the meeting if necessary.

Who can start a proxy fight?

A proxy fight is typically initiated by shareholders who are dissatisfied with a company's direction or specific management decisions. These shareholders believe that the current board of directors is not acting in their best interests. Here are the primary initiators of proxy fights:

- Dissatisfied shareholders: Any shareholder or group of shareholders unhappy with corporate governance or strategic decisions can start a proxy fight. Their dissatisfaction often stems from changes in strategic direction, mergers, acquisitions, or general business conflicts.

- Activist shareholders: These are shareholders who actively push for changes in the company's management or strategy. They often have a significant stake in the company and seek to influence corporate policies to align with their views on improving performance and value.

- Acquiring companies: In hostile takeover scenarios, the acquiring company may initiate a proxy fight to replace the target company's board members with individuals who are more likely to approve the takeover.

How to win a proxy fight

Winning a proxy fight requires strategic planning, effective communication, and proactive measures. Here’s a step-by-step guide:

1. Preparation and surveillance

- Monitor shareholder activities: Track shareholder movements to detect potential activist investors early.

- Understand activists: Create detailed profiles of known activists, including their historical campaigns and strategies.

2. Build a defense team

- Assemble advisors: Form a team of internal leaders and external advisors skilled in managing proxy fights, including legal counsel, financial advisors, and public relations experts.

- Define roles: Clearly outline responsibilities for each team member to ensure a coordinated response.

3. Develop a communication strategy

- Unified messaging: Ensure all company communications are consistent and transparent, clearly articulating the company’s strategy and future plans.

- Engage with shareholders: Maintain regular communication with shareholders to build relationships and understand their concerns, addressing them proactively.

4. Strategic planning

- Create a response plan: Develop a detailed response plan for when an activist investor is identified, including engagement protocols and strategies for addressing shareholder concerns.

- Evaluate proposals: Be open to evaluating activist proposals to find a balanced solution that addresses shareholder concerns without compromising company values.

5. Legal and tactical considerations

- Advance notice provisions: Implement advance notice bylaws requiring shareholders to give timely and detailed notice of proposals or board nominations.

- Supermajority voting: Consider supermajority voting provisions for key decisions to make it harder for activists to gain control.

- Proxy solicitors: Use proxy solicitors to compile shareholder lists and influence voting decisions.

6. Public relations and media

- Shape public perception: Manage media relations effectively to ensure favorable coverage. Highlight the company's strengths and future plans to build confidence among shareholders.

- Utilize media: Use online publications and electronic dissemination to minimize costs and maximize reach.

7. Engage with stockholders

- Regular communication: Regularly communicate with significant stockholders, ensuring their views are heard and considered. Arrange formal meetings and involve independent directors if necessary.

- Transparency: Ensure your strategic plan is clearly communicated and has the support of significant stockholders.

8. Establish a working group and early warning system

- Form a working group: Establish a team responsible for planning and responding to activist activities, including senior officers, financial advisors, and legal counsel.

- Early warning system: Implement a stock watch program to monitor trading activity and receive real-time alerts on significant developments.

9. Conduct self-assessment

- Board assessment: Regularly assess the strengths and weaknesses of the board to anticipate potential criticisms from activists.

- Review indemnification agreements: Ensure directors and senior management are protected against personal financial harm in case of litigation following a proxy contest.

Famous proxy fight examples

Procter & Gamble (2017)

In 2017, activist investor Nelson Peltz launched a proxy fight against Procter & Gamble (P&G). Peltz, through his hedge fund Trian Fund Management, argued that P&G needed significant changes in its management and strategy. After a fierce battle, Peltz won a seat on the board. His involvement led to cost-cutting measures and a renewed focus on core brands, resulting in a substantial increase in P&G’s stock price over the following years.

DuPont (2015)

Nelson Peltz also waged a successful proxy fight against DuPont in 2015. Trian Fund Management, holding a significant stake in DuPont, pushed for changes due to dissatisfaction with the company's performance. The proxy fight resulted in Peltz winning four board seats, facilitating the spinoff of DuPont’s performance chemicals business. This restructuring contributed to a significant rise in DuPont’s stock price.

Yahoo (2008)

In 2008, billionaire Carl Icahn led a notable proxy fight against Yahoo. Icahn aimed to replace Yahoo’s board of directors following the company's rejection of Microsoft’s acquisition offer. Despite significant media coverage and shareholder support, Icahn's efforts initially faced resistance. However, the pressure eventually led to changes in Yahoo’s board and management, illustrating the power of persistent activist efforts in reshaping corporate governance.

Leverage adam.ai during a proxy fight

In the high-stakes environment of a proxy fight, effective communication and coordination are critical for success. Shareholders and board members need a streamlined, secure, and efficient solution to manage their complex responsibilities and strategize effectively. This is where adam.ai, an intuitive meeting management platform for boards, projects, and committees, becomes invaluable.

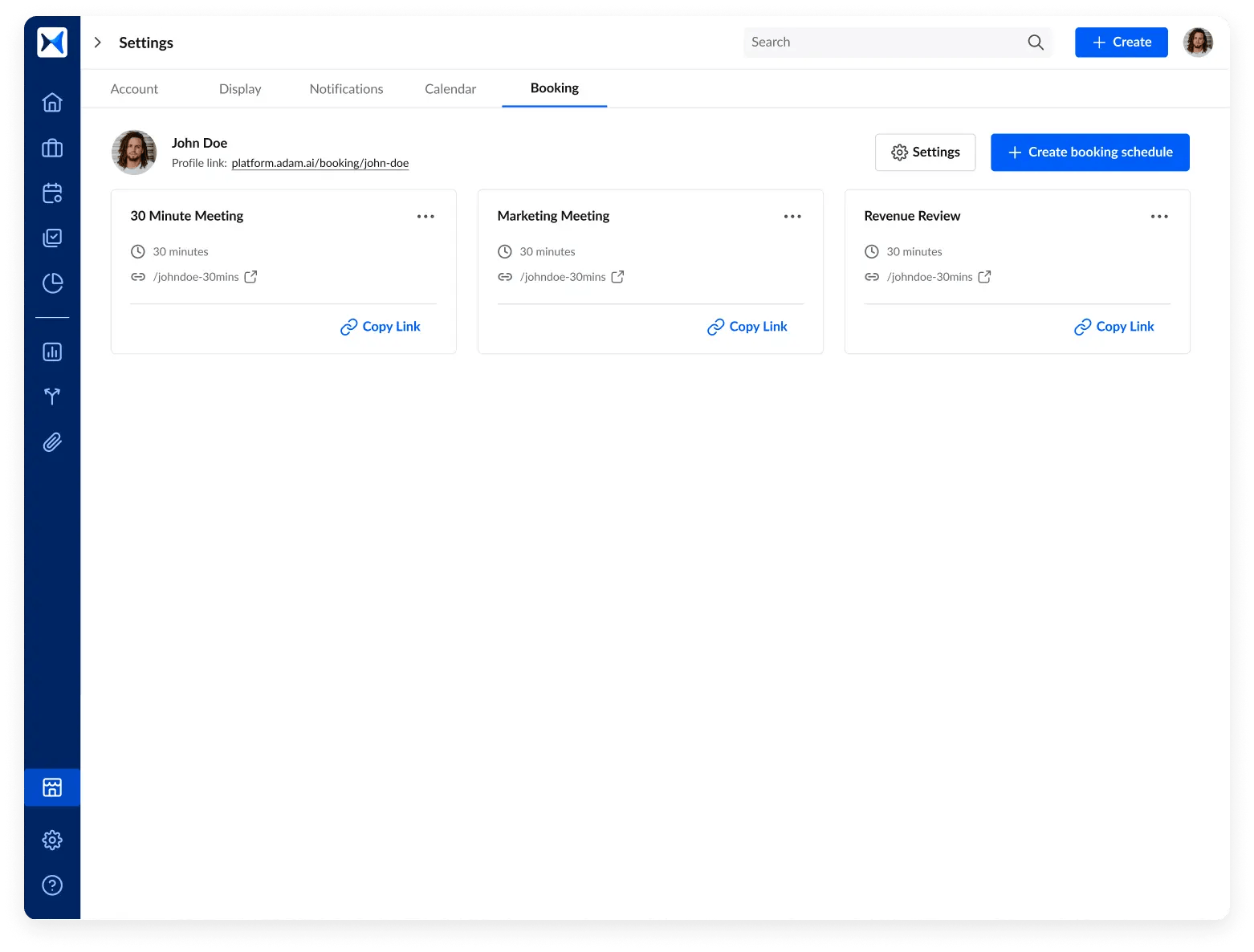

- Streamlined meeting scheduling: adam.ai simplifies the organization of strategic meetings between shareholders, board members, and stakeholders with unlimited booking pages. This ensures timely and regular interactions, crucial for planning and executing proxy fight strategies.

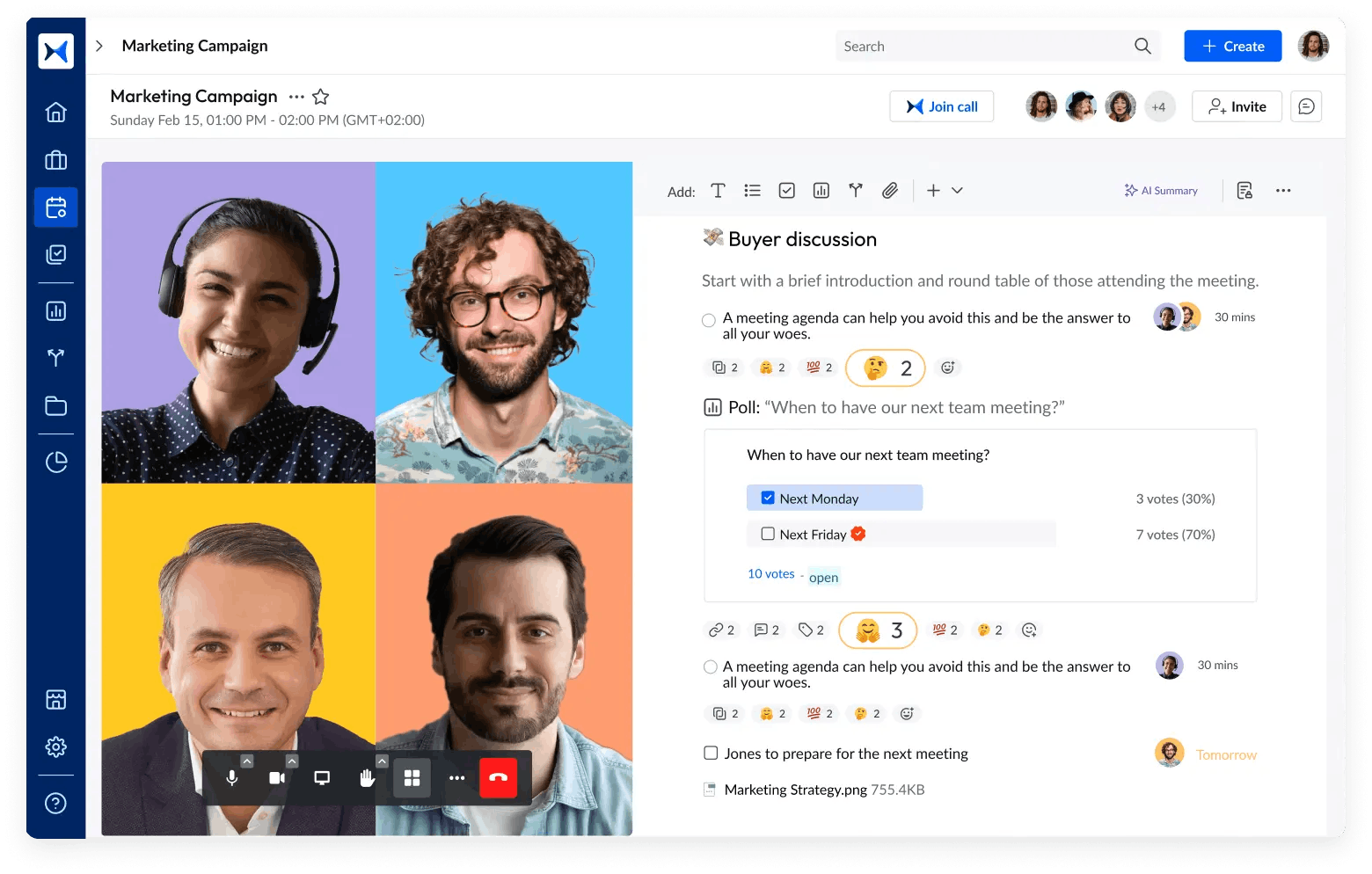

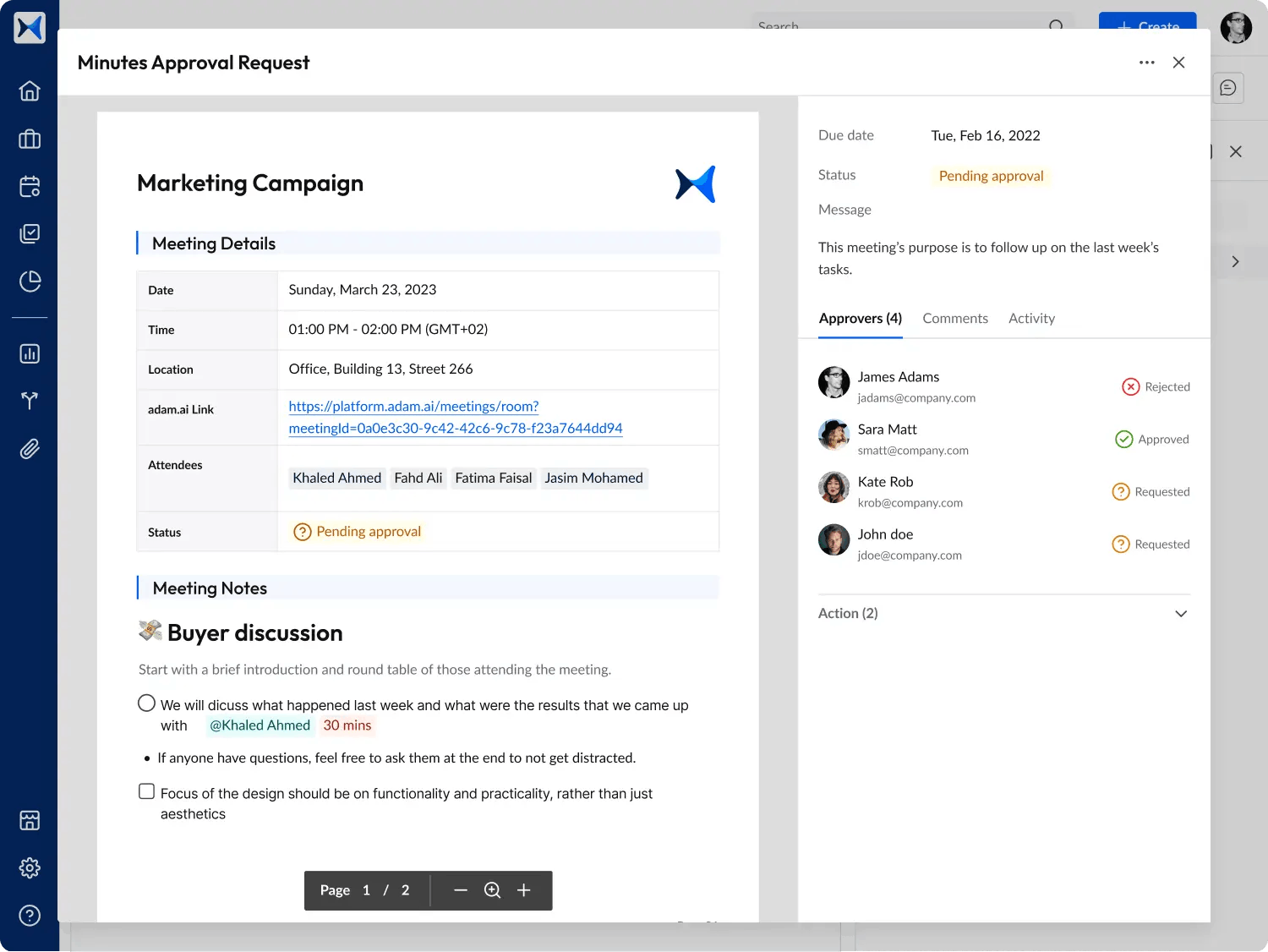

- Smart note-taking and documentation: The platform’s smart note-taking system allows for precise recording of actions, decisions, and notes. Integrated with built-in video conferencing, it enables seamless discussions and decision-making without delays, specifically catering to the needs of shareholders during a proxy fight.

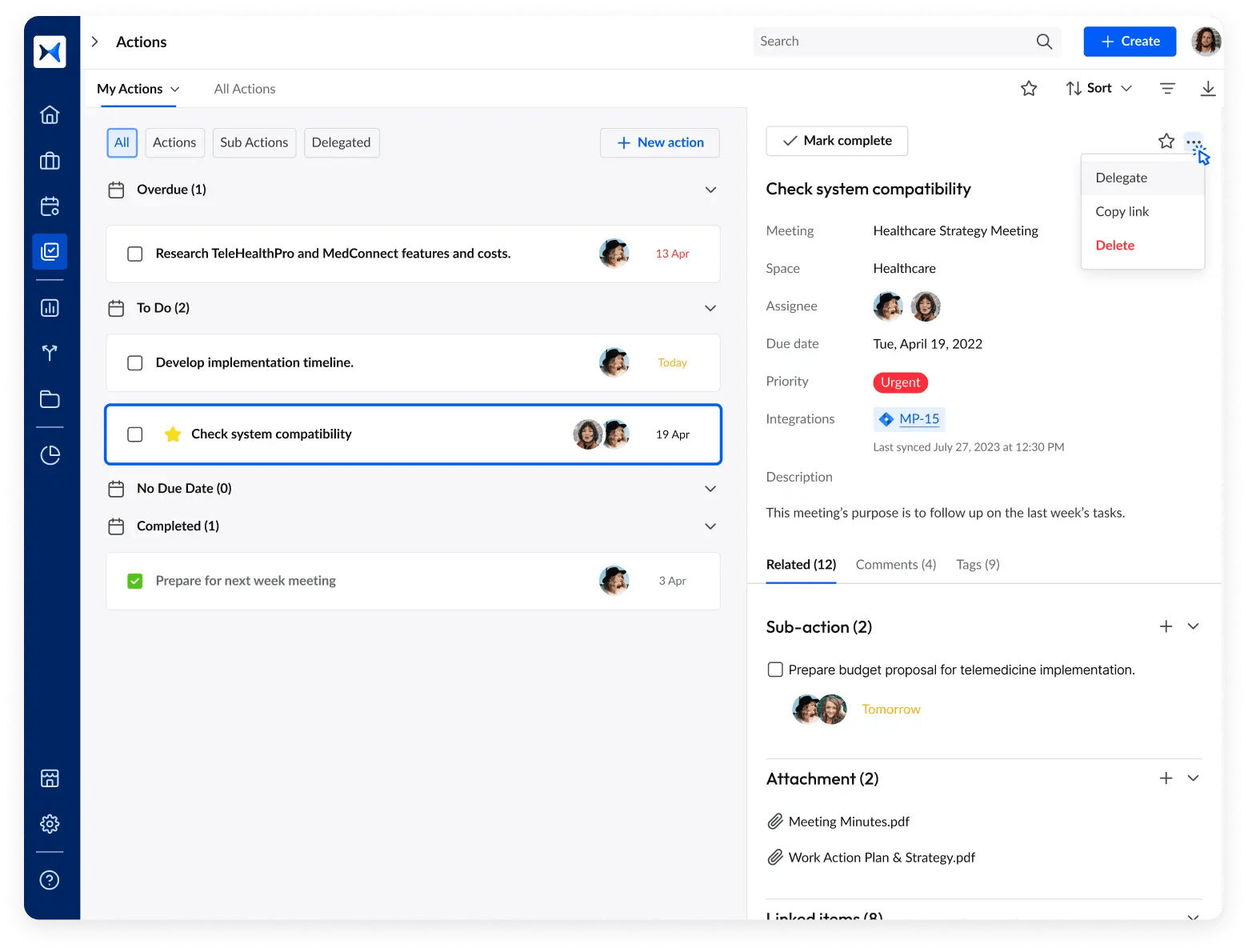

- Action and decision tracking: Follow up on actions and decisions made during strategy meetings to ensure accountability and progress. This feature keeps all involved parties updated on outcomes and follow-through, enhancing overall effectiveness in a proxy fight.

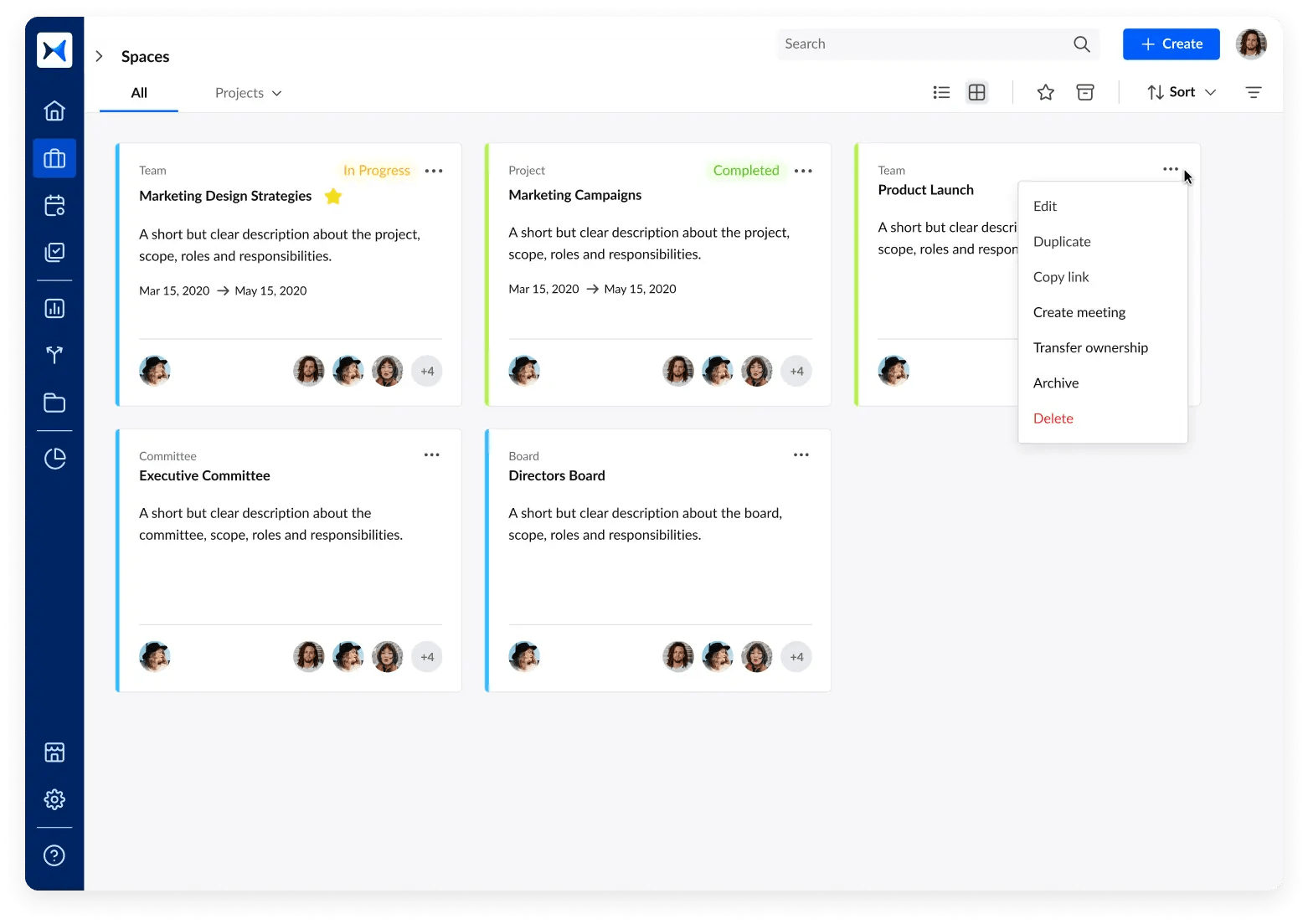

- Organized meeting spaces: Categorize meetings into specific spaces for various committees, teams, and projects. This organization helps maintain clear records and focus on specific areas of the proxy fight, making strategy management more efficient.

- Automated meeting minutes: Automatically generate and share meeting minutes to ensure transparency and maintain comprehensive records. This feature supports the documentation of all decisions and strategies, making it easier for shareholders to track and review past actions.

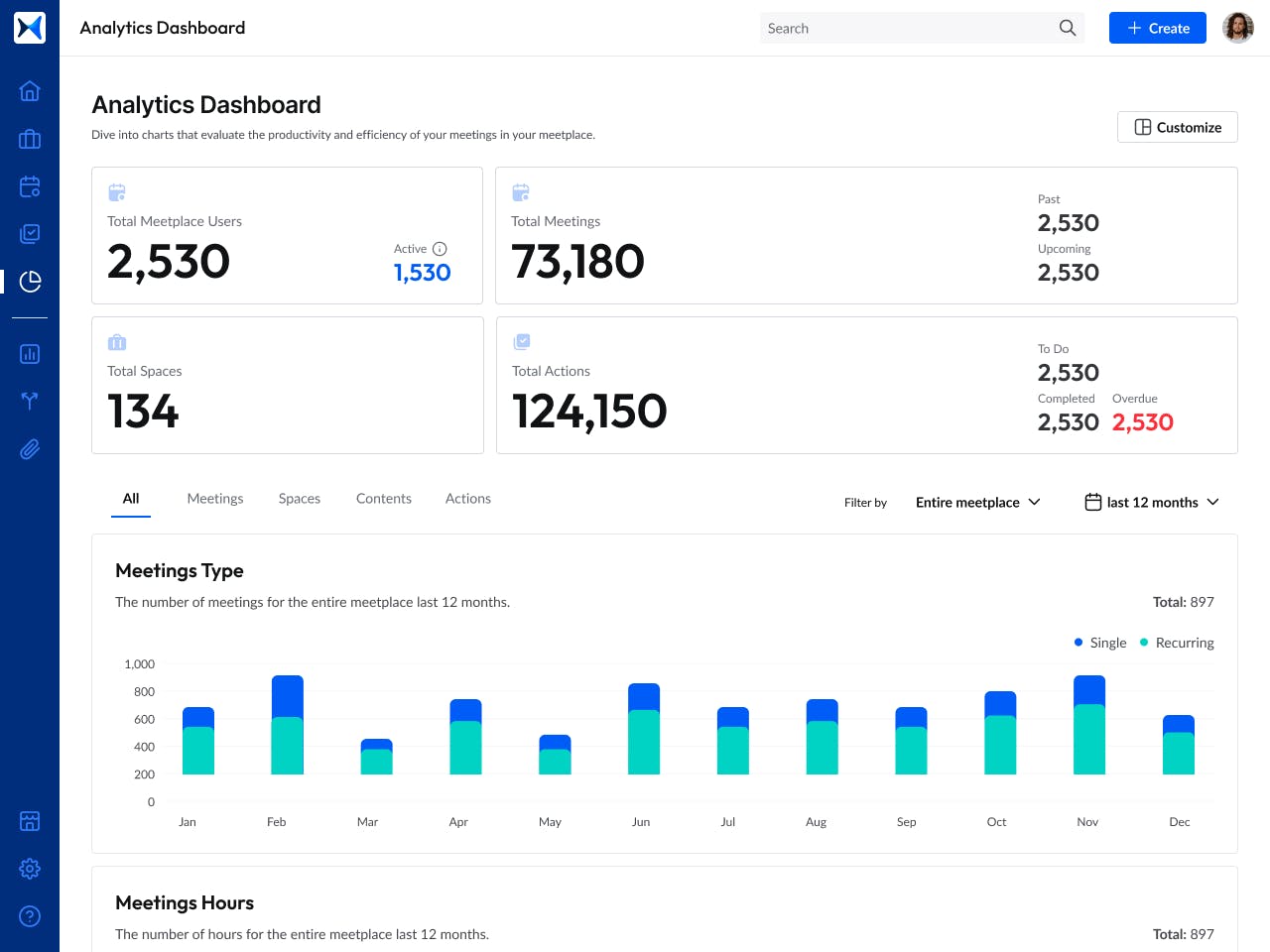

- Analytics dashboard: Assess participation rates, decision outcomes, and the progress of action items. This feature facilitates smooth and effective meetings, helping shareholders stay informed and proactive during a proxy fight.

Transform how you conduct critical meetings—From meticulous preparation to effective execution and insightful follow-up, adam.ai integrates comprehensive analytics, full customization, and intuitive interfaces with powerful meeting management tools.

Easy onboarding. Enterprise-grade security. 24/7 dedicated support.

The bottom line

A proxy fight is a potent mechanism for shareholders to influence corporate governance and steer company strategy. By understanding how proxy fights work, recognizing their impact in M&A scenarios, and learning from real-world examples, stakeholders can effectively leverage this tool. Boards can benefit from modern-day meeting management tools to facilitate the process of conducting proxy votes and discussions.

And while there may be multiple solutions available, here is why adam.ai is the meeting management software platform you can trust:

- adam.ai is one of Atlassian Ventures' portfolio companies.

- In the meeting management software category on G2, adam.ai has been ranked a leader and a high performer for successive quarters in the past years.

- adam.ai has been included in the Forrester Report in the AI-enabled meeting technology landscape.

- adam.ai is trusted and used by powerful teams and organizations worldwide for all types of critical meetings, like board, committee, project management, and business development meetings.

- And most importantly, adam.ai integrates with your existing workflow, is SOC2 compliant, provides dedicated support and success, and has a free trial option.

Subscribe to adam.ai blog

Stay ahead with the latest insights—get our newest blog posts, tips, and updates sent straight to your inbox.