May 15, 2024 · 12 min read

Financial Reporting for Boards: Key Practices for Compliance and Governance

Shaimaa Badawi

In the complex landscape of corporate governance, the role of the board in financial reporting cannot be overstated. Effective financial oversight is a cornerstone of robust board governance, ensuring that an organization not only complies with legal standards but also thrives through strategic decision-making. This article explores the critical functions of the board in financial reporting, the essential reports for board review, and best practices to streamline these processes and enhance efficiency and transparency.

What financial reports are needed for a board meeting?

When preparing for board meetings, it is critical to present comprehensive financial reports that enable board members to assess the organization's health and make informed strategic decisions. Here are the most critical financial reports that should be shared with the board.

1. Performance overview

This report provides a snapshot of the organization's key performance indicators (KPIs), including new bookings, revenue run rates, burn rate, and cash runway. It may also highlight progress on significant initiatives such as product launches or executive hires. This overview sets the stage for detailed discussions by offering a concise summary of how the company is performing against its strategic goals.

2. Income statement (Statement of Activities)

Known as the profit and loss statement in the for-profit sector, this document details the company’s revenues, expenses, and net income over a specific period. It is essential for showing how the organization has performed financially, highlighting trends in revenue generation and expense management. For nonprofits, this is often referred to as the Statement of Activities, summarizing revenues, expenses, gains, and losses, and showing the net change in assets.

3. Balance sheet (Statement of Financial Position)

This statement provides a snapshot of the company’s assets, liabilities, and shareholders' equity at a specific point in time. It is crucial for assessing the organization's financial stability, liquidity, and capital structure. In the nonprofit sector, it is known as the Statement of Financial Position.

4. Cash flow statement

This report is vital for understanding the movements in cash related to operating, investing, and financing activities. It’s particularly important for startups and nonprofits where cash flow is a significant indicator of sustainability and operational health.

5. Budget vs. actual report

This financial report compares the planned budget against actual performance, highlighting variances that may need corrective action. It helps the board understand where the organization stands in terms of meeting its financial objectives.

6. Additional reports

- Annual audit: It reviews the organization’s compliance with accounting standards and identifies areas for financial improvement.

- Cash flow projections: They assess future liquidity needs and help in planning for financial sustainability.

- IRS 990 information return: For nonprofits, ensuring compliance with tax regulations is crucial, and this report is reviewed annually.

What’s the role of the board in financial governance?

The board of directors bears the ultimate responsibility for financial oversight to ensure the organization's funds are managed effectively and used in alignment with its mission and goals.

1. Financial oversight and governance

The board of directors is tasked with the ultimate responsibility for the financial oversight of an organization. This includes regular reviews of financial reports to ensure that funds are being managed effectively and in alignment with the organization’s mission and strategic goals. Effective governance involves the ability to oversee financial processes and to maintain transparency and accountability in financial matters.

2. Legal responsibilities and compliance

Board members are legally responsible for understanding and adhering to the organization’s constitutional documents and the legal landscape that affects it, including tax, contract, and labor laws. This legal comprehension is crucial for making decisions that are in legal alignment with the organization's objectives and for avoiding potential liabilities.

3. Managing personal liability

The structure of the organization significantly influences the personal liability of board members. For instance, board members of incorporated entities typically have limited personal liability, which protects their personal assets unless there is proof of dishonest or imprudent actions. In contrast, members of an unincorporated group might be personally liable for the organization’s obligations. The board must act honestly, prudently, and solely in the interests of the organization, without personal gain, to maintain this shield of limited liability.

4. Strategic financial planning

Beyond the annual budget, the board should engage in developing a long-term financial plan that anticipates future income and expenditures over several years. This strategic planning helps the board navigate through varying economic conditions and ensure sustainable growth and stability.

5. Monitoring financial health through indicators

Boards use financial performance indicators or ratios to monitor the organization's financial health effectively. These indicators help in recognizing trends and significant changes in the organization’s financial condition. By understanding and reacting to these metrics, the board can proactively manage financial risks and adjust strategies as necessary to maintain financial stability.

What’s the purpose of financial reporting to the board?

Different types of financial reporting serve distinct purposes:

1. Compliance and information: This includes ensuring that resources are used efficiently and align with operational controls. It typically involves reviewing income statements against budgets, balance sheets, and auditing outcomes.

2. Evaluation: It aims to assess the effectiveness of activities and resource utilization. This involves analyzing financial data alongside programmatic benchmarks to gauge progress towards organizational goals.

3. Planning: It focuses on projecting future needs and preparing for potential changes. Reports for planning include trend analyses and financial forecasts that inform strategic decisions.

4. Action: It addresses immediate needs or corrections based on previous plans. This reporting type requires detailed comparisons of budgeted plans versus actual results and exploring multiple scenarios to guide decision-making.

How to ensure accurate and reliable financial statements

The board's ability to analyze and interpret financial data directly impacts its governance and decision-making processes. As an Executive Director, you need to ensure that financial statements are accurate, timely, relevant, and customized to the organization's unique needs.

Verify the accuracy of all financial statements

This involves meticulous checks, such as confirming that balance sheets are properly balanced and cash balances match those reported in bank accounts.

Timely delivery of financial information is crucial

Advance preparation is key, which means ensuring that accountants or financial officers provide all necessary financial documents well before board meetings. This allows adequate time for review and facilitates detailed discussions during the meetings.

Financial information must be relevant

Comparative analysis with previous years or periods is vital. It helps in understanding trends and assessing performance against historical data, providing a context that enriches current financial assessments.

Customize financial reports

Tailored reports ensure clarity and facilitate easier analysis by the board, making the financial discussion more productive and focused on strategic outcomes.

Best practices for presenting financial information

1. Simplify financial information

Understanding that board members often come from diverse backgrounds with varying degrees of familiarity with financial jargon, it's crucial to simplify accounting terms and practices. Clear explanations and the avoidance of overly technical language can make financial reports more accessible and understandable.

2. Establish strong financial policies and budgeting processes

Effective board financial reporting is underpinned by robust financial management policies and a well-structured budgeting process. These policies should clearly define the roles and responsibilities of the treasurer, executive director, and other key figures within the organization, ensuring that everyone understands their part in financial oversight.

3. Present regular and clear financial reports

Boards require regular updates to maintain oversight and drive strategic decisions. Essential reports should include the balance sheet, income statement, and cash flow statement. Presenting these reports in an intuitive format, possibly supplemented by visual aids like graphs and dashboards, can help board members digest and act on the information more effectively.

4. Proactively address financial red flags

Identifying and addressing financial anomalies or issues early is key to maintaining the financial health of the organization. Regularly scheduled discussions dedicated to potential red flags can help mitigate risks before they evolve into more significant problems.

5. Engage with visual and narrative reporting techniques

Dense financial tables can be off-putting or difficult to understand. Employing engaging reporting techniques, such as visual summaries and dashboards, makes the data more appealing and easier to grasp. Additionally, framing these reports within the narrative of the organization’s objectives and challenges can help contextualize the financial data, making it more meaningful and actionable.

6. Tailor communications to your audience

Detailed financial data and analyses should be directed towards treasurers and finance committees who require in-depth understanding, while executive summaries should distill the essence of the reports for the broader board. This targeted approach ensures that all board members receive the information in a form that is most useful to them.

7. Facilitate effective discussions

To foster productive discussions, prepare for potential questions and topics that board members are likely to raise. Providing pre-meeting briefings can also help align board members' understanding and expectations, reducing surprises and enabling more strategic discussions during board meetings.

8. Utilize modern financial tools

Leverage modern tools and software to present financial information. These technologies can simplify the presentation of complex data and improve clarity, making it easier for board members to grasp key financial insights and trends.

How to plan and schedule board meetings for financial reporting

Advance planning

To respect the busy schedules of board members and demonstrate your organizational skills, it's advisable to schedule board meetings well in advance. For startups, while it might not be feasible to plan a year ahead like larger companies, setting regular meetings and providing a few weeks' notice for any ad-hoc discussions can make a substantial difference.

Timely distribution of materials

Ensure that all materials for the meeting are sent to board members at least one week in advance. This preparation allows them ample time to review the data, ensuring they can engage productively during the meeting.

Consistency and clarity

Maintain consistency in the metrics reported at each meeting and present them in a format that is easy to digest. Clear and strong materials not only show that you understand your financials but also that you are adept at making informed decisions based on these figures.

Inclusion of Key Performance Indicators (KPIs)

Besides basic financial data like revenue and profits, include KPIs that provide deeper insights into the business's health, such as cash burn rate and customer acquisition metrics.

Detailed discussions

Prepare to discuss the nuances behind the numbers. An investor update should accompany your materials, offering explanations for why certain numbers or KPIs might differ from expectations and outlining the steps you're taking to address any issues.

Preparation for inquiries

Anticipate the questions and concerns board members might raise. Detailed preparations to address these points can help avoid surprises and demonstrate your command of the business situation.

Feedback and collaboration

Encourage feedback on your strategies and remain open to suggestions from board members who bring diverse experiences and perspectives. Their insights can be invaluable in steering the company toward success.

What’s the role of CFO in enhancing board meeting outcomes?

Strategic preparation and presentation

Preparing for a board meeting involves more than compiling data—it’s about ensuring that this data is accurate, timely, and presented in a way that aligns with the company's strategic goals:

- Pre-meeting alignment: Before the board convenes, the CFO should collaborate with the CEO and management team to align on key financial metrics and company objectives, ensuring consistency in the data presented.

- Interdepartmental coordination: Effective financial reporting requires cooperation with various departments like General Counsel and Human Resources to ensure all legal and regulatory compliances are met and accurately reflected.

- Engagement with the audit committee: Early discussions with the audit committee chair are essential to address specific interests and prepare for any focused inquiries, smoothing the way for a streamlined meeting process.

Enhancing board communication

The CFO’s role extends beyond the numbers; it's about shaping the narrative and context in which these numbers are discussed:

- Clear and insightful reporting: The CFO must present financial data in a digestible format, using visual aids and summaries to highlight key trends and metrics, making complex financial terms accessible.

- Risk management and forecasting: Part of the CFO’s responsibility is to anticipate potential risks and perform stress tests on financial models. This proactive analysis helps mitigate the "fear of the unknown," providing the board with a comprehensive view of potential financial scenarios.

- Building relationships: Trust and transparency are critical. The CFO should strive to be seen not just as a reporter of figures but as a strategic advisor who offers honest insights and assessments. Open communication and readiness to address tough questions are crucial in fostering a productive dialogue with the board.

Continuous improvement and feedback

Post-meeting, the CFO must follow up on any outstanding requests and address additional concerns that may have arisen, demonstrating a commitment to ongoing improvement and responsiveness. This approach not only reinforces the reliability of the financial reporting but also strengthens the trust and working relationship with the board.

Streamline financial reporting with adam.ai

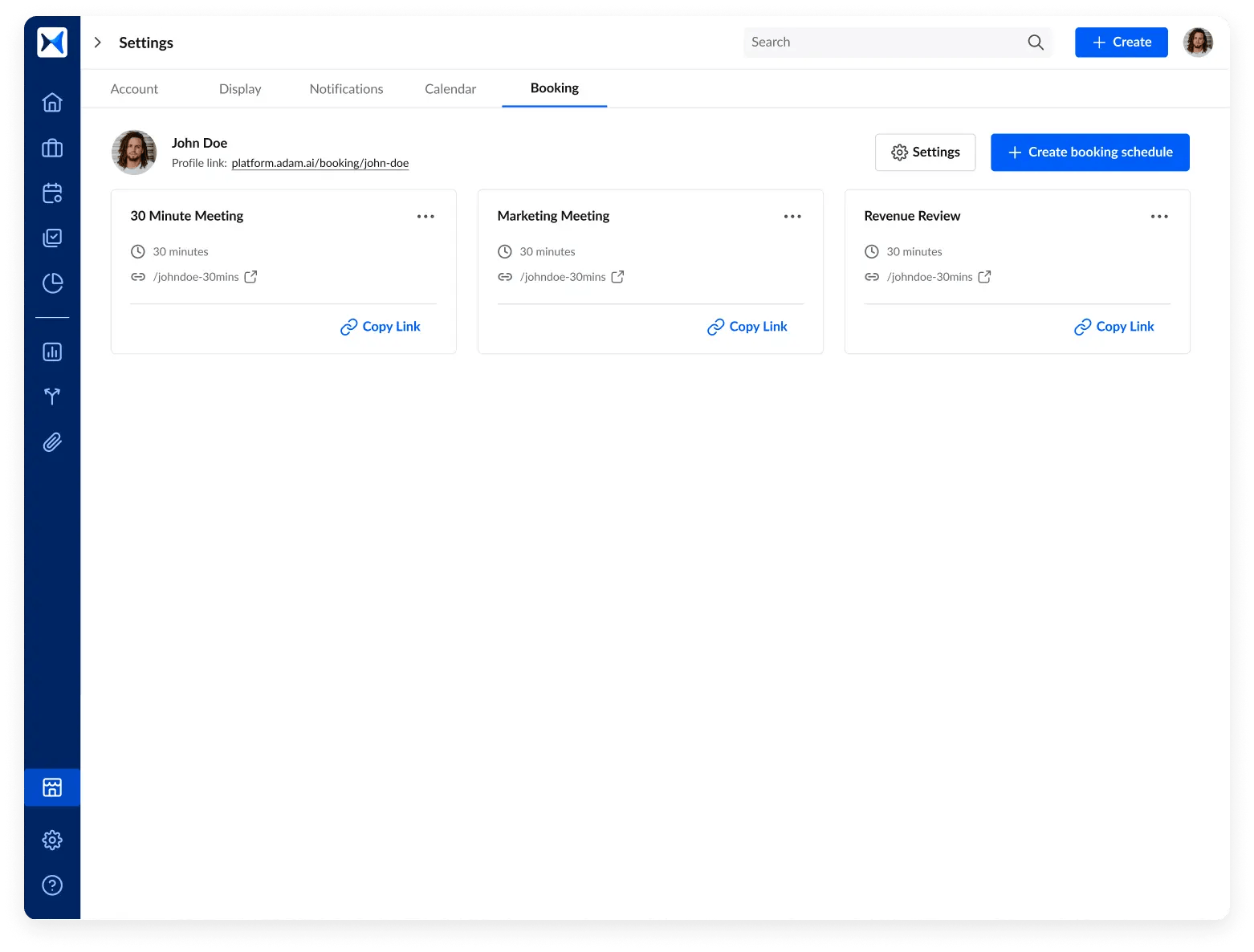

1. Organize efficient stakeholder meetings: Create unlimited booking pages to streamline the process of scheduling meetings among various stakeholders, including executives, shareholders, and department heads, ensuring efficient communication and decision-making.

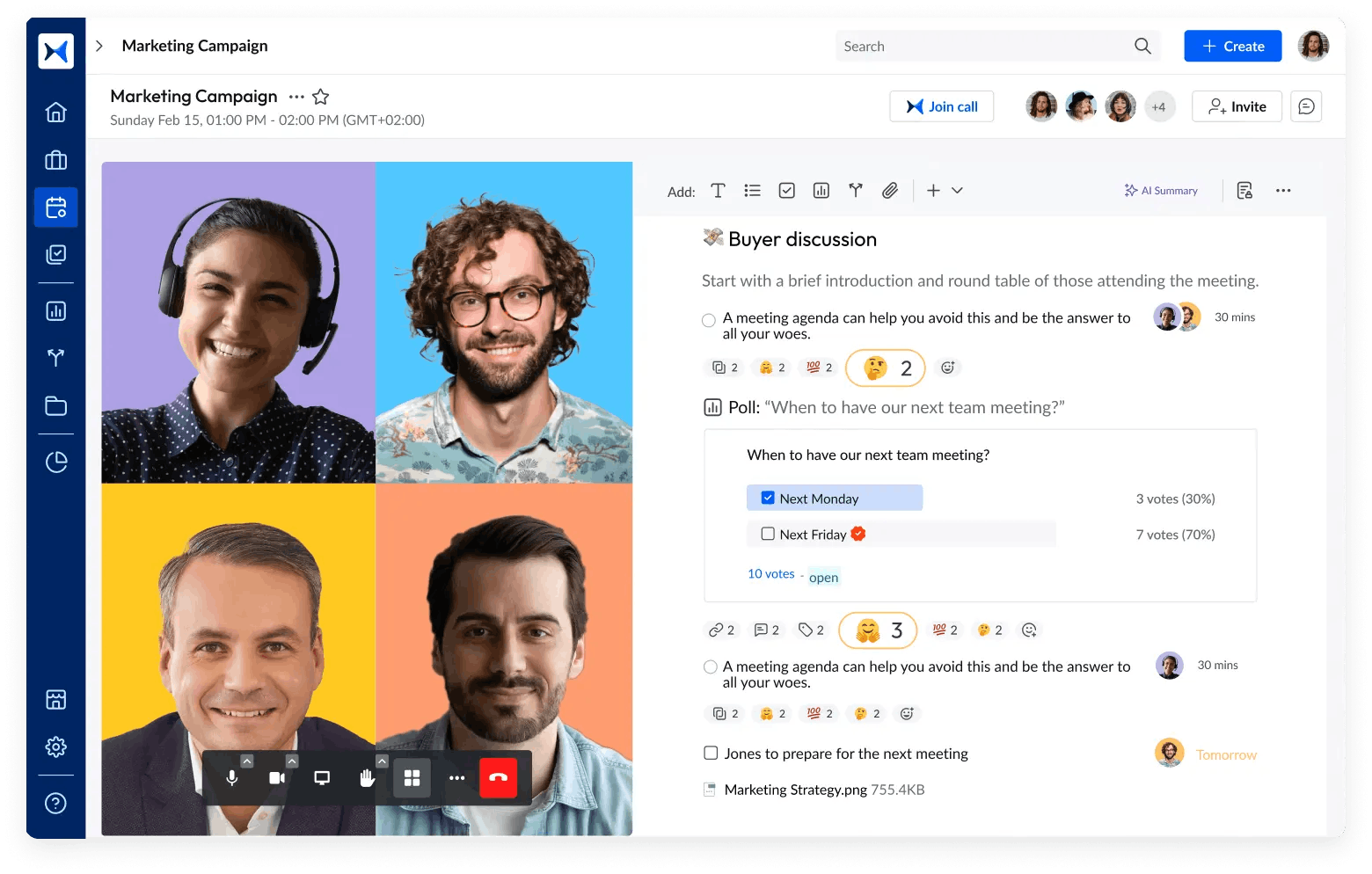

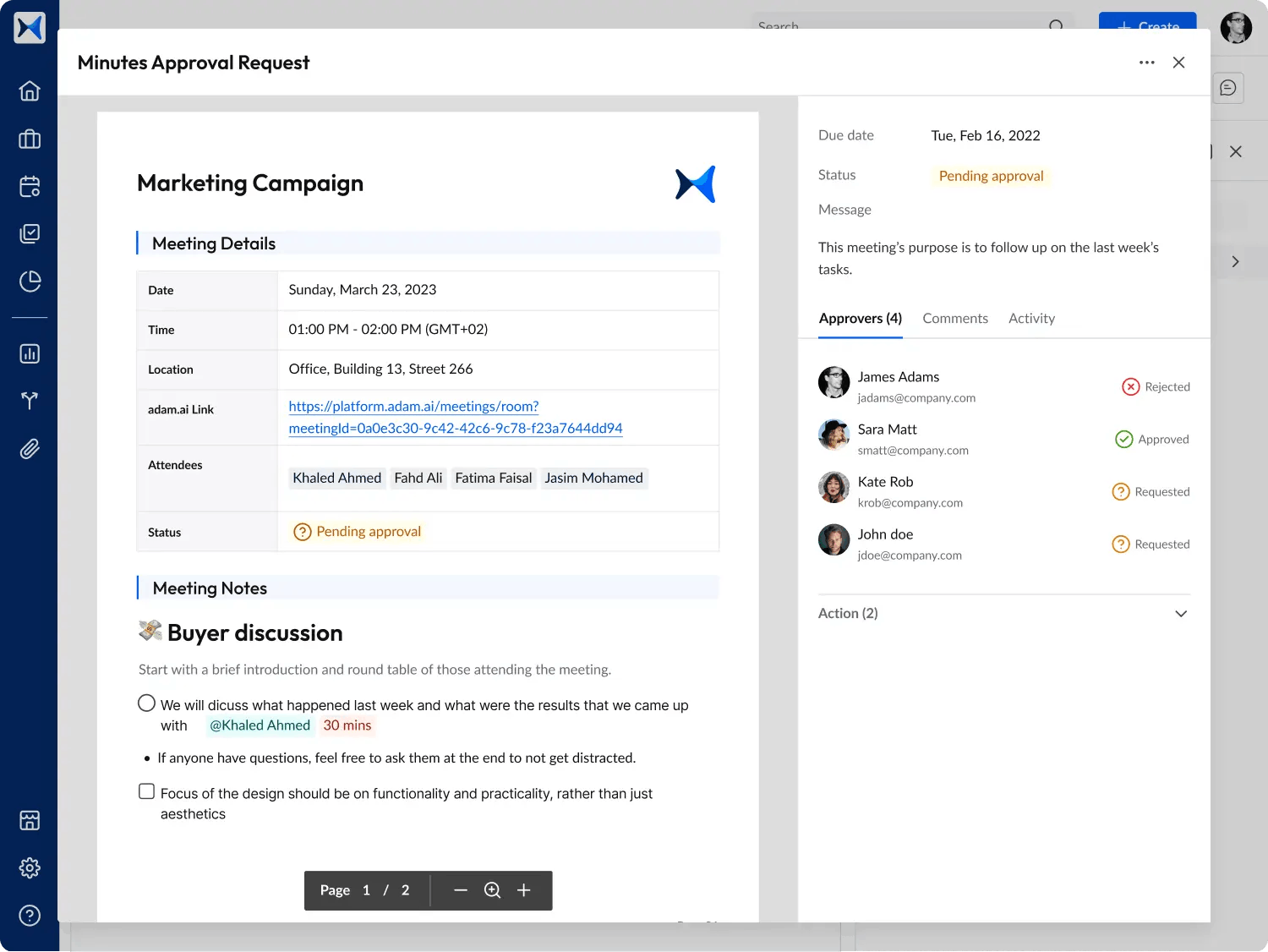

2. Integrated meeting management: Leverage a smart note-taking system that records agenda items, actions, polls, decisions, and notes, all displayed alongside a built-in video-conferencing feature. This system facilitates detailed discussions on financial strategies, regulatory compliance, and operational decisions without the delays of in-person meetings.

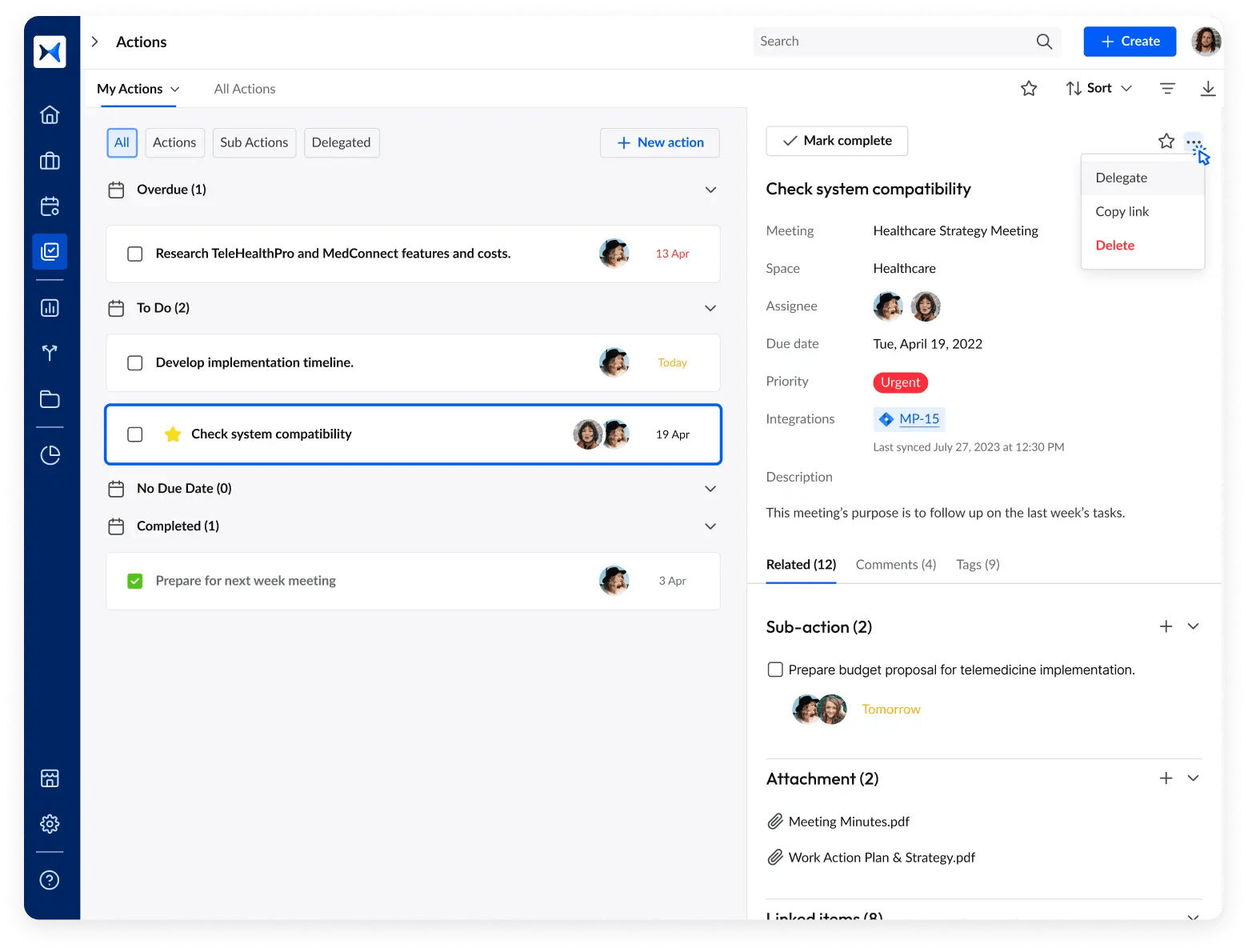

3. Action and decision tracking: Maintain meticulous records of decisions and action items from financial reviews and strategy sessions to ensure no detail is overlooked. This feature is crucial for tracking the implementation of financial plans and operational changes.

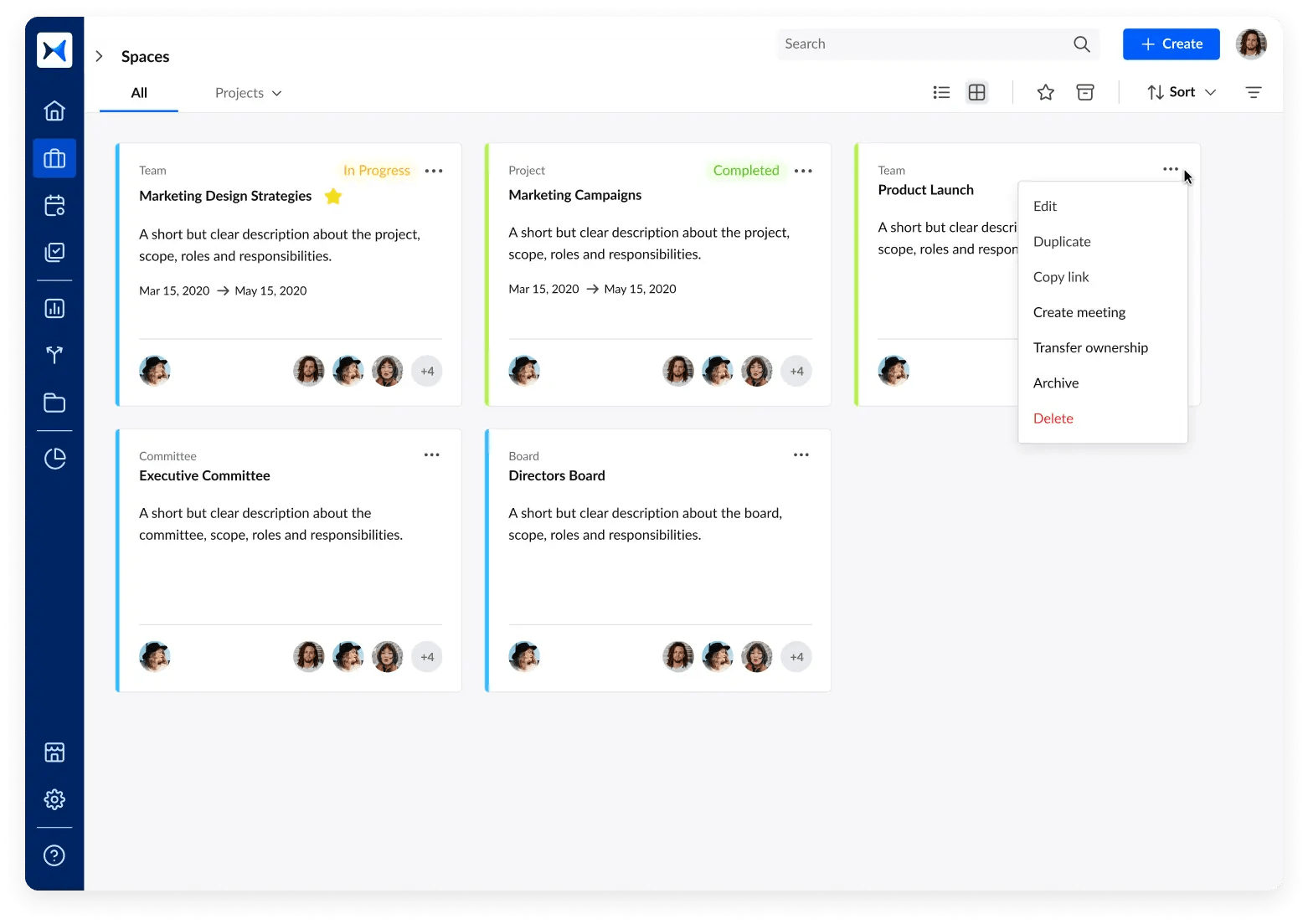

4. Categorize meetings for better organization: Organize meetings into specific spaces, such as board, committee, project, and teams, to streamline access to documents and discussions related to particular financial functions or strategic projects.

5. Generate and share meeting minutes: Automatically generate and distribute meeting minutes to ensure all stakeholders are aligned on decisions made and actions agreed upon, providing a reliable record for audit trails and regulatory compliance.

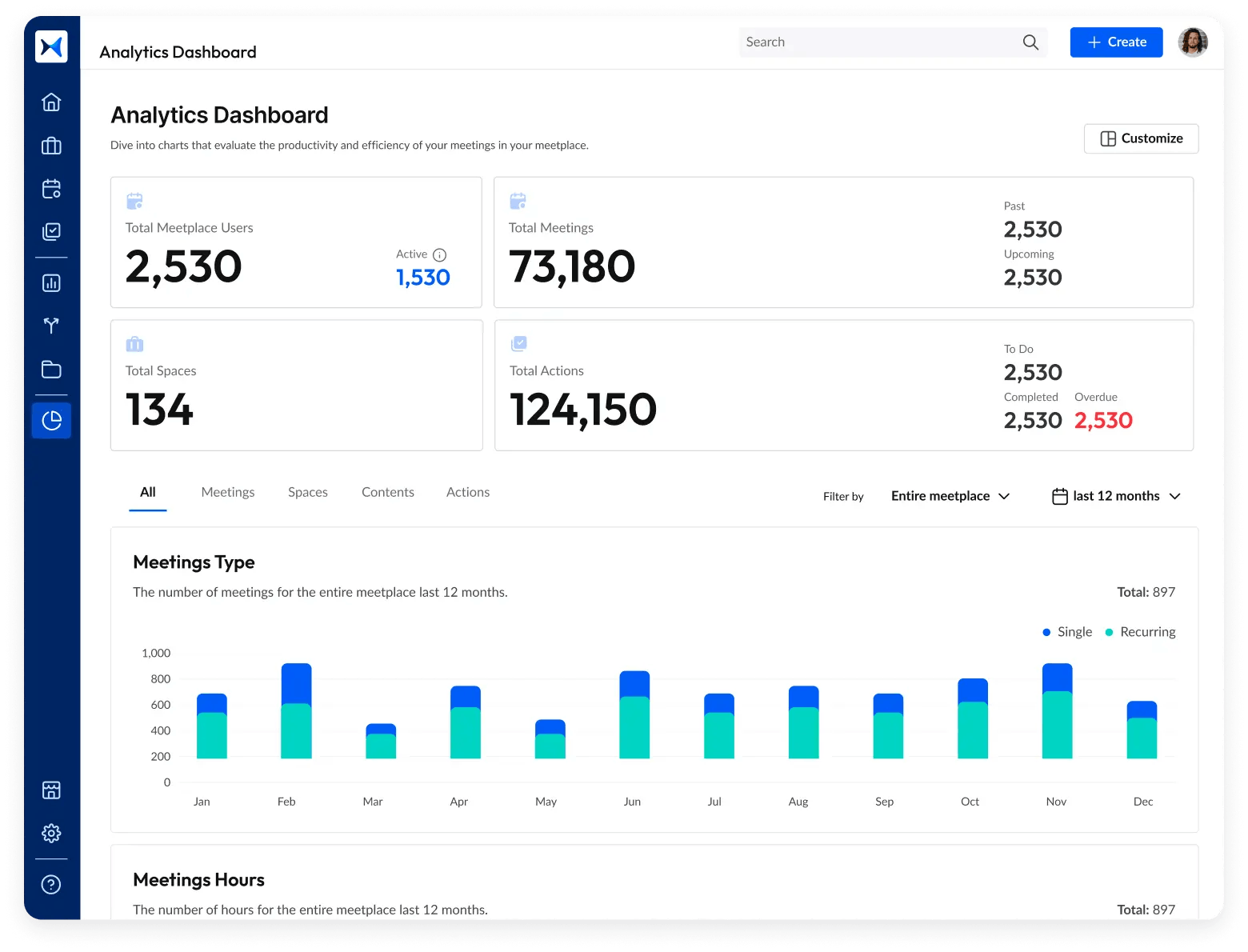

6. Analytics dashboard: Utilize an analytics dashboard to assess participation rates, outcomes of decisions, and progress of action items. This tool helps in optimizing meeting efficiency and ensures that financial strategies are progressing as planned.

All data, including actions, decisions, agenda items, and uploaded files, are securely managed on a platform that meets the high standards of confidentiality and security required by financial institutions. This ensures that sensitive financial information is handled with the utmost integrity and compliance.

Transform how you conduct critical meetings—From meticulous preparation to effective execution and insightful follow-up, adam.ai integrates comprehensive analytics, full customization, and intuitive interfaces with powerful meeting management tools.

Easy onboarding. Enterprise-grade security. 24/7 dedicated support.

The bottom line

Effective financial reporting is integral to the health of any organization, providing the necessary insights for informed decision-making and strategic planning. Boards play a pivotal role in overseeing these processes, ensuring accountability, and maintaining organizational integrity. By leveraging advanced tools like adam.ai, boards can enhance their financial oversight capabilities, streamline reporting processes, and focus more on strategic growth and governance excellence.

And while there may be multiple meeting management solutions available, here is why adam.ai is the board management software platform you can trust:

- adam.ai is one of Atlassian Ventures' portfolio companies.

- In the meeting management software category on G2, adam.ai has been ranked a leader and a high performer for successive quarters in the past years.

- adam.ai has been included in the Forrester Report in the AI-enabled meeting technology landscape.

- adam.ai is trusted and used by powerful teams and organizations worldwide for all types of critical meetings, like board, committee, project management, and business development meetings.

- And most importantly, adam.ai integrates with your existing workflow, is SOC2 compliant, provides dedicated support and success, and has a free trial option.

Subscribe to adam.ai blog

Stay ahead with the latest insights—get our newest blog posts, tips, and updates sent straight to your inbox.