May 20, 2024 · 12 min read

The Role of Board Member Positions in Shaping Effective Corporate Governance

Shaimaa Badawi

Effective governance hinges on the capabilities and dynamics of its board members. Understanding the various board member positions, their responsibilities, and the value of diversity within the boardroom is crucial for any organization aiming for success. This article delves into the key aspects of board member positions, offering insights into how these roles contribute to robust corporate governance and strategic decision-making.

What is a board of directors?

A board of directors is a group of elected individuals responsible for the strategic management and oversight of a company or organization. This body, which includes the CEO and sometimes external experts, sets high-level policies and guides the company's direction. Public companies are required by law to have a board, and stock exchanges like the NYSE and Nasdaq mandate that these boards consist mostly of independent directors. Private firms and non-profits often establish boards for the strategic benefits they provide.

Board members are elected by shareholders or stakeholders and bring their expertise and independent judgment to the board. They support senior management with advice and mentorship, participate in meetings and committees, and help shape the company's future. Some board members serve voluntarily, while others are compensated for their contributions.

What are positions on a board called?

A board of directors typically includes several key positions, each with specific roles and responsibilities essential for the organization's governance and strategic direction. Common positions on a board include:

- Chair of the Board: The highest-ranking member, responsible for leading the board, organizing meetings, appointing committees, and working with the CEO to shape the organization's culture and strategy.

- Vice-Chair: Supports the chair, assumes responsibilities in their absence, assists in setting meeting agendas, conducting board assessments, and resolving conflicts.

- Company Secretary: Manages administrative tasks, legal compliance, and communication. Records meeting minutes, ensures legal conformity, notifies members of meetings, and maintains records.

- Treasurer: Oversees the organization's financial health, manages budgets, audits, investments, and high-level financial policies.

- Executive Director: Actively involved in daily operations, representing the organization’s interests, and guiding its management.

- Non-Executive Director: Independent advisor providing objective advice and representing stakeholders' interests not involved in daily operations.

- Managing Director: Oversees specific business functions, guiding and monitoring areas like marketing or operations.

- Shadow Director: Exerts control over the organization without being officially listed as a director.

- Celebrity Director: Adds credibility and public image to the board, influencing public perception.

- Emeritus Board Members: Former board members who provide mentorship and guidance to the current board.

- Other common positions: Include roles like CFO (Chief Financial Officer), COO (Chief Operating Officer), and various committee heads who handle specific areas of focus within the organization.

What are the roles and responsibilities of the board?

The board of directors holds key responsibilities to ensure the strategic direction, effective management, and legal compliance of a company. Their primary roles include the following:

1. Protecting stakeholder interests: The board ensures that the company's actions safeguard investor and shareholder assets by determining policies for dividends and other financial decisions.

2. Conducting and attending meetings: The board oversees the annual shareholders' meeting to announce revenues, elect new members, and outline the company's future plans. Regular board meetings are crucial for discussing strategic plans, financial matters, and project approvals. Consistent attendance is essential for maintaining governance and making timely decisions. Secretaries play a vital role in scheduling these meetings and preparing the agendas.

3. Establishing vision and goals: The board sets the company's mission and strategic objectives, ensuring alignment with organizational plans.

4. Recruiting and overseeing executives: The board is responsible for hiring, evaluating, and, if necessary, terminating top executives, including the CEO. They ensure these executives act in the best interests of the company and its stakeholders, setting performance standards, providing necessary resources, and preparing for board elections to maintain a strong leadership team.

5. Making strategic decisions: The board is responsible for critical decisions such as mergers, acquisitions, and significant product launches.

6. Managing finances: They oversee high-level financial matters, including executive compensation and approving the annual budget. A compensation committee is often formed to evaluate and determine appropriate compensation levels for executives and employees.

7. Crisis management: In times of crisis, the board acts as a shield, guiding the company's response and mitigating risks.

8. Monitoring and control: They ensure proper auditing processes are in place and that the company’s assets and investments are protected. This includes a fiduciary duty to safeguard the organization’s assets and ensure legal and regulatory compliance.

9. Developing governance policies: The board establishes policies for governance, defining how they interact with the CEO and other executives, ensuring a clear framework for decision-making and oversight.

9. Fiduciary and legal compliance: Board members must exercise a duty of care by acting in the best interests of the organization, adhering to the bylaws, articles of incorporation, and relevant regulations. Failure to meet these obligations can result in legal repercussions.

10. Strategic planning: The board develops both short-term and long-term strategies. Short-term planning focuses on immediate progress and improvements, while long-term planning aims at achieving significant objectives like enhancing brand awareness.

11. Assessing board performance: Regular evaluations of the board's performance help identify strengths and areas for improvement. This can be done through surveys or third-party assessments, ensuring the board remains effective and accountable.

How are board members selected or appointed?

Selecting new board members is a crucial process that varies between for-profit and non-profit organizations, though both aim to ensure the board has the necessary expertise and perspective to guide the company.

- For-profit organizations: Typically, for-profit boards use a Nominating and Governance Committee (NGC), which consists of current board members and sometimes representatives chosen by major shareholders. This committee identifies and shortlists qualified candidates. Shareholders then vote to appoint the final candidates.

- Non-profit organizations: Non-profits often adopt a more inclusive approach. Any interested individuals can submit their names for consideration. These names are compiled into a slate, which is then voted on by the entire membership.

Board election process

1. Define guidelines and by-laws: Establish rules for conducting the election.

2. Form nominating committee: This committee should be appointed at least six months before the election.

3. Solicit nominations: The committee gathers nominations from members or section chairs.

4. Review board composition: Determine the number of open positions.

5. Propose candidates: Announce the slate of candidates at least four weeks before the election.

6. Voting: Members receive candidate information and voting instructions, then submit their votes.

7. Announce results: Election results are announced, and guidelines may be amended if necessary.

Voting methods

1. Preferential voting: Voters rank candidates in order of preference. The candidate with the majority of first-preference votes wins. If no majority is reached, the candidate with the fewest votes is eliminated, and their votes are redistributed based on the next preferences until a winner emerges.

2. Cumulative voting: Voters have a certain number of votes equal to the number of vacancies and can allocate multiple votes to a single candidate or distribute them among several candidates.

What is the typical term for a board member?

A term refers to the duration of service for a board member, usually specified in the organization’s bylaws. Board terms typically range from two to six years, with an average of about three years. This duration strikes a balance, as shorter terms might not allow enough time for significant contributions, while longer terms may deter potential candidates.

Non-profit organizations

Non-profit organizations often implement two consecutive three-year terms. This structure allows for both continuity and fresh perspectives, as board members can serve for up to six years consecutively.

For-profit corporate boards

For-profit corporate boards may have term limits ranging from 10 to 15 years. Longer terms in these settings help maintain stability and continuity in corporate governance.

Staggered terms

Both non-profit and for-profit organizations often use staggered terms to prevent too many board members from leaving at once. This approach ensures that new board members can be mentored by those with more experience, maintaining institutional knowledge and continuity.

Renewable terms and early departures

Board terms are usually renewable, but most organizations have limits on consecutive terms to encourage rotation and diversity. Board members who have completed their terms can either renew for another term or step down gracefully. If a board member needs to leave before their term ends, the bylaws typically provide a process for a smooth transition and replacement.

What qualifications are required for board member positions?

Board members need a blend of formal education, industry experience, and specific skills to effectively fulfill their roles. Here are the key qualifications and experiences typically required:

Corporate governance training

Board members often undergo training in corporate governance, which provides them with the knowledge needed to oversee and guide an organization effectively. This training helps them understand their legal and fiduciary responsibilities and equips them to make informed decisions.

Industry-specific experience

Experience within the industry the organization operates in is crucial. Board members should have a deep understanding of the sector’s challenges, opportunities, and dynamics. This expertise enables them to contribute valuable insights and strategies tailored to the organization's needs.

Environmental, Social, and Governance (ESG) education

With ESG considerations becoming increasingly important, board members should be educated in these areas. Understanding ESG principles helps board members align corporate strategies with sustainable practices, meeting the growing expectations of investors, consumers, and regulators.

Cybersecurity knowledge

As cyber threats become more prevalent, board members must be knowledgeable about cybersecurity. They should understand the risks and be involved in developing strategies to protect the organization from cyber attacks, ensuring that adequate measures are in place to safeguard data and operations.

Financial expertise

Board members need a solid grasp of financial principles, including the ability to interpret financial statements and understand budgeting, forecasting, and financial planning. This knowledge is essential for overseeing the organization's financial health and making informed economic decisions.

Human resources experience

Experience in HR is valuable as board members often guide the organization in retaining top talent and fostering a positive workplace culture. They also play a role in establishing policies that support these goals.

Strategic decision-making skills

The ability to make strategic decisions is critical for board members. They must consider the broader impact of their decisions on stakeholders and the organization's long-term success. This requires a strategic mindset and the ability to analyze complex situations.

Analytical skills

Strong analytical skills enable board members to assess data, understand the implications of various actions, and develop solutions to complex problems. These skills are crucial for identifying opportunities and risks and for making evidence-based decisions.

Adaptability

Board members must be adaptable to respond to changes within the industry, the organization, and the broader economic environment. This includes being open to new ideas and capable of leading change initiatives when necessary.

Networking skills

Effective networking is important for board members to bring in new resources, knowledge, and partnerships. Strong networks can enhance the organization's reputation and provide access to valuable external insights and opportunities.

Tailored skills

Depending on the organization and its specific needs, certain tailored skills may be required. These could be related to current economic conditions, specific business challenges, or industry-specific requirements. Conducting thorough research and engaging with current board members can help identify these tailored skills.

Why is board diversity important?

1. Enhanced decision-making

Board diversity brings together individuals with varied backgrounds, experiences, and perspectives. This variety fuels innovation and creativity, leading to more robust and well-informed decision-making. Diverse boards can consider a broader range of viewpoints, which helps in making decisions that are more comprehensive and well-rounded.

2. Better understanding of markets and stakeholders

Having board members from different races, ages, and cultural backgrounds provides a deeper understanding of diverse markets, customers, and stakeholders. This inclusivity ensures that the board can relate to and address the needs and expectations of a broader audience, ultimately enhancing customer insight and satisfaction.

3. Improved corporate governance

Diverse boards are less likely to fall into "groupthink," where similar backgrounds and experiences lead to consensual decisions that avoid conflict. Instead, diversity encourages healthy debate and challenges, fostering more objective and holistic governance.

4. Increased innovation

Studies have shown a strong correlation between board diversity and improved financial performance and value creation. Diverse perspectives lead to innovative solutions and creative problem-solving, which can drive growth and competitive advantage.

5. Enhanced corporate reputation

A diverse board can positively influence the company's reputation. It demonstrates a commitment to inclusivity and equal opportunity, which can enhance investor relations and attract top talent. Additionally, it aligns with societal values of fairness and representation.

6. Legal and investor pressure

There is increasing pressure from investors and, in some cases, legal requirements to include more women and minorities on boards. This push reflects the growing recognition that diversity contributes to better board performance and long-term success.

7. Fostering inclusion

Diversity must be coupled with inclusion to maximize its benefits. An inclusive boardroom environment ensures that diverse members feel valued and respected, encouraging active participation and equitable decision-making. This inclusivity leads to more effective governance and better outcomes for the organization.

8. Overcoming challenges

While embracing diversity can present challenges such as resistance and unconscious biases, these can be addressed through proactive strategies like targeted recruitment and board education on the value of diversity. Overcoming these obstacles builds stronger and more inclusive boards.

Elevate your board's performance with adam.ai

Effective communication and coordination are paramount for successful governance. Board members need a streamlined, secure, and efficient solution to navigate their complex responsibilities. This is where adam.ai, the board meeting management platform, becomes invaluable. Designed with the unique needs of board members in mind, adam.ai enhances communication, decision-making, and overall board effectiveness.

Here's what you can do with adam.ai:

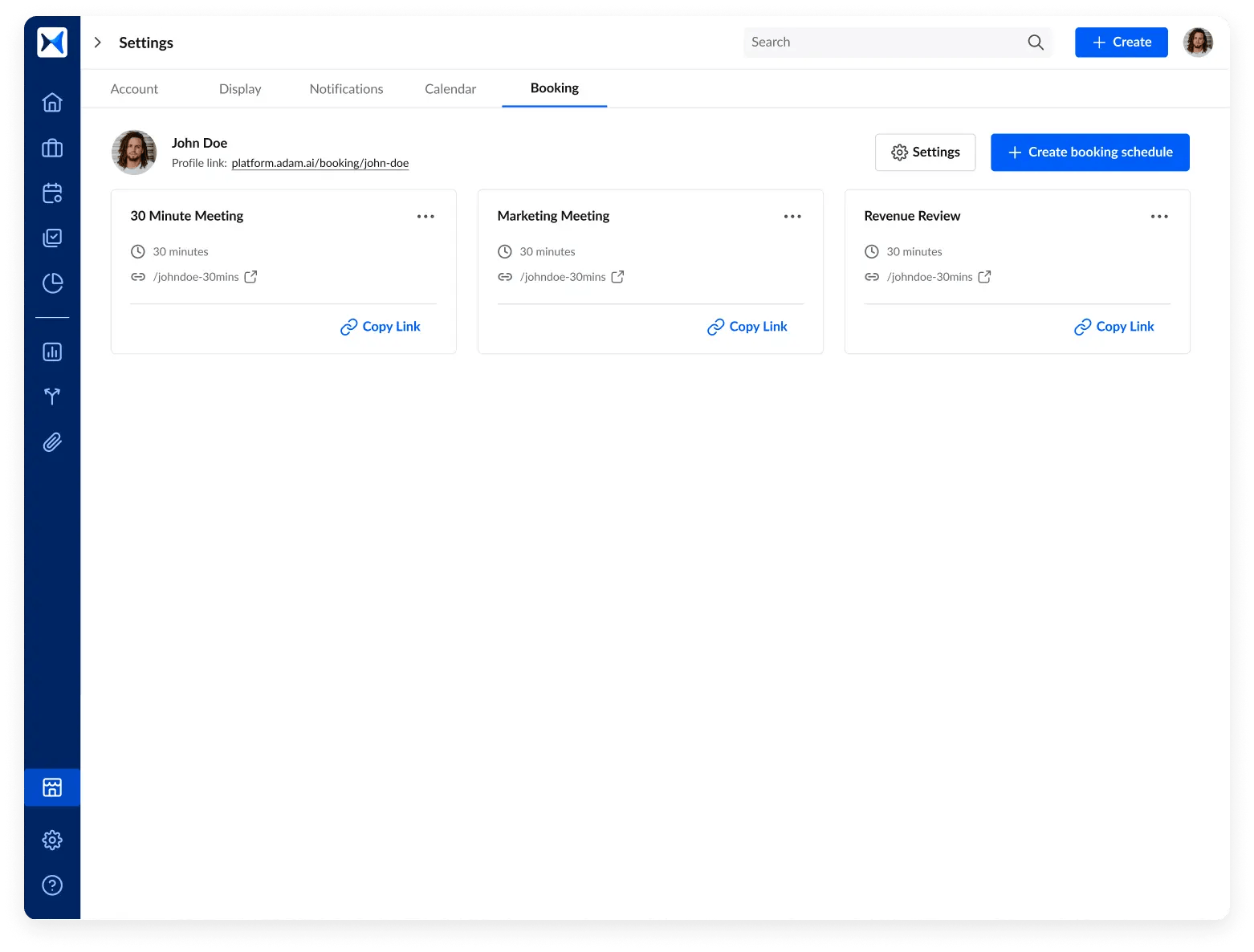

- Unlimited booking pages: Easily organize meetings between board members, committees, and stakeholders. Simplify the scheduling process to ensure timely and regular board interactions.

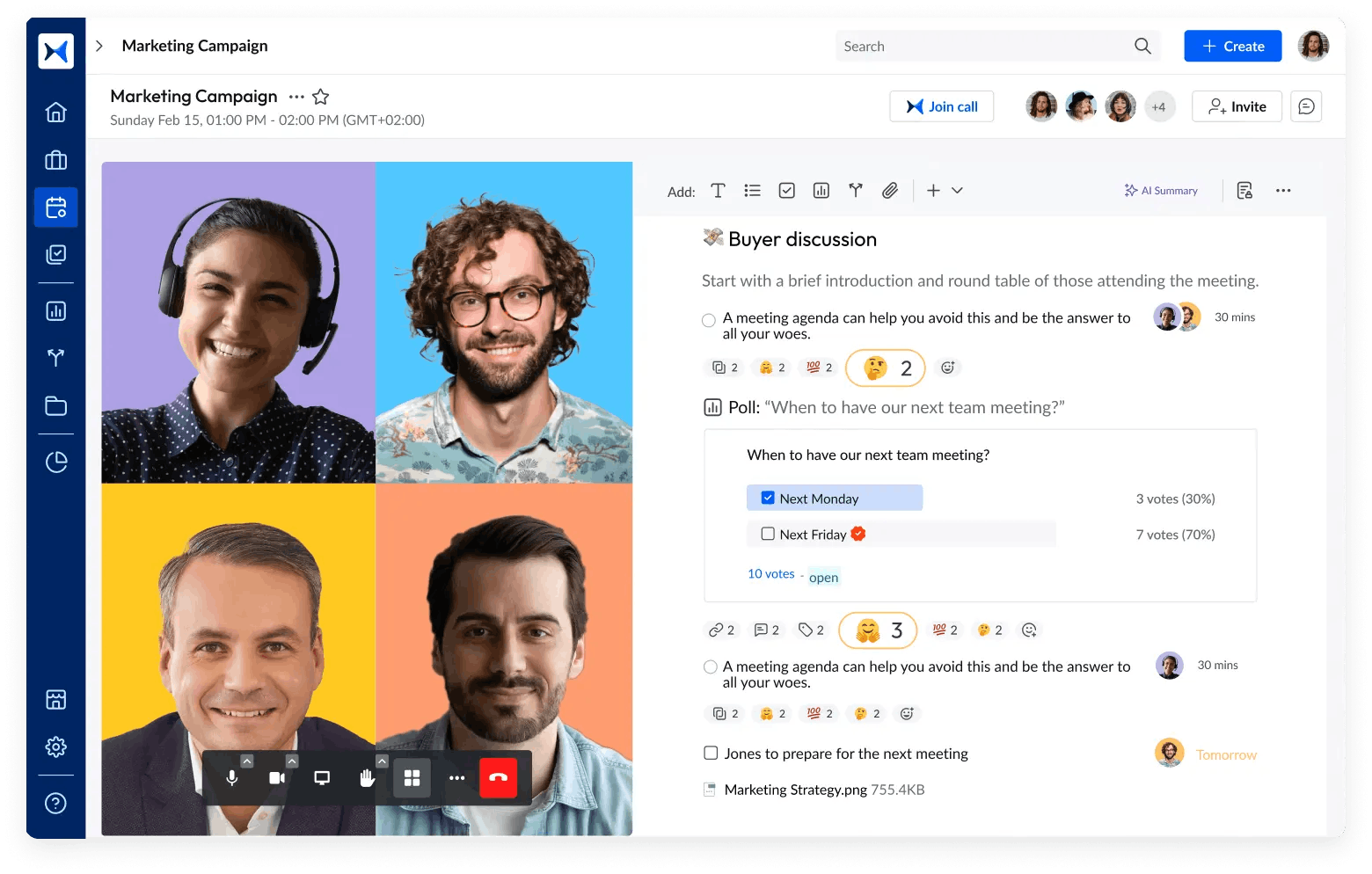

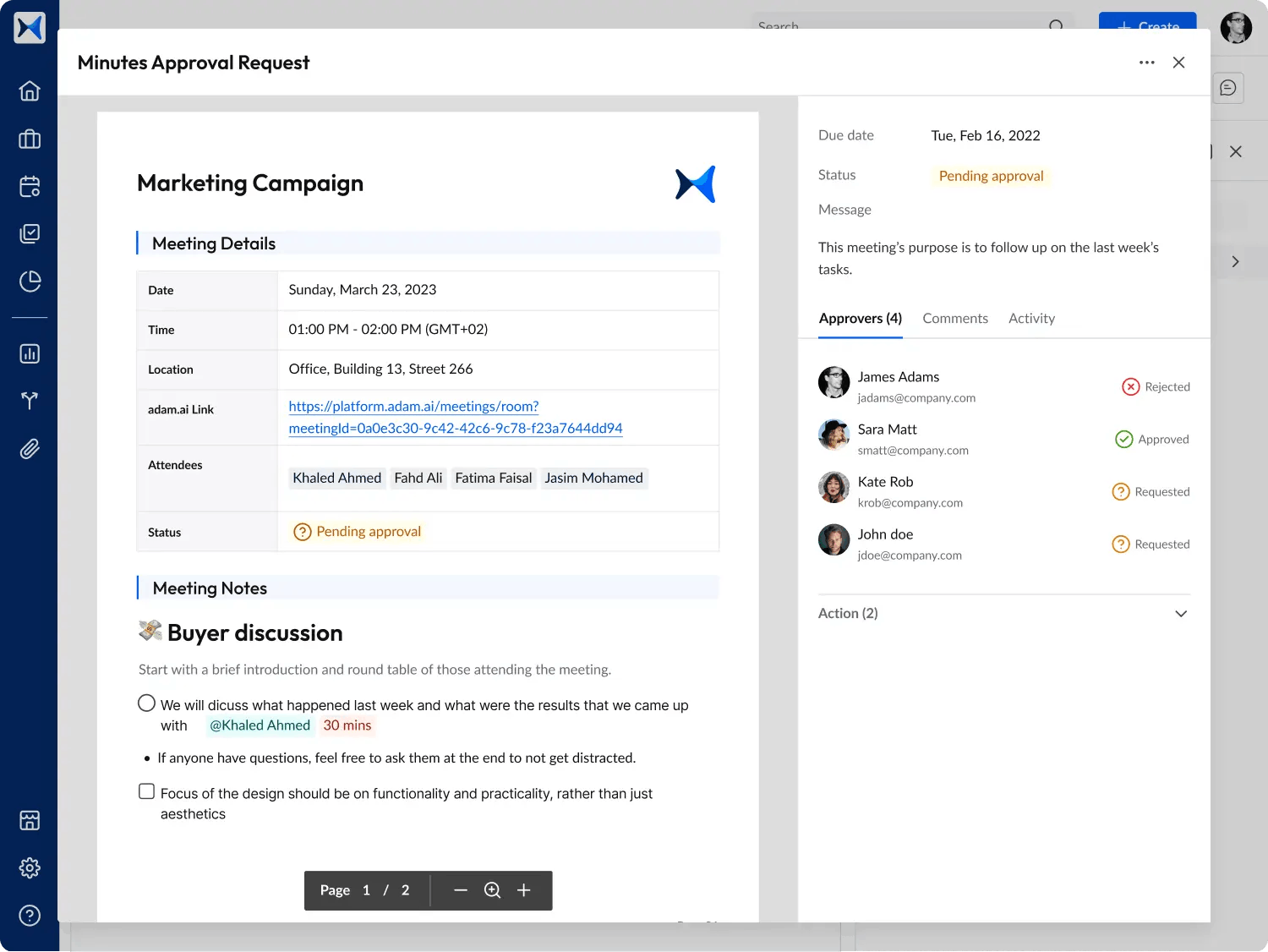

- Smart note-taking system: Record agenda items, actions, decisions, and notes with a user-friendly interface. This system, integrated with built-in video conferencing, allows board members to discuss and make decisions seamlessly, without delays.

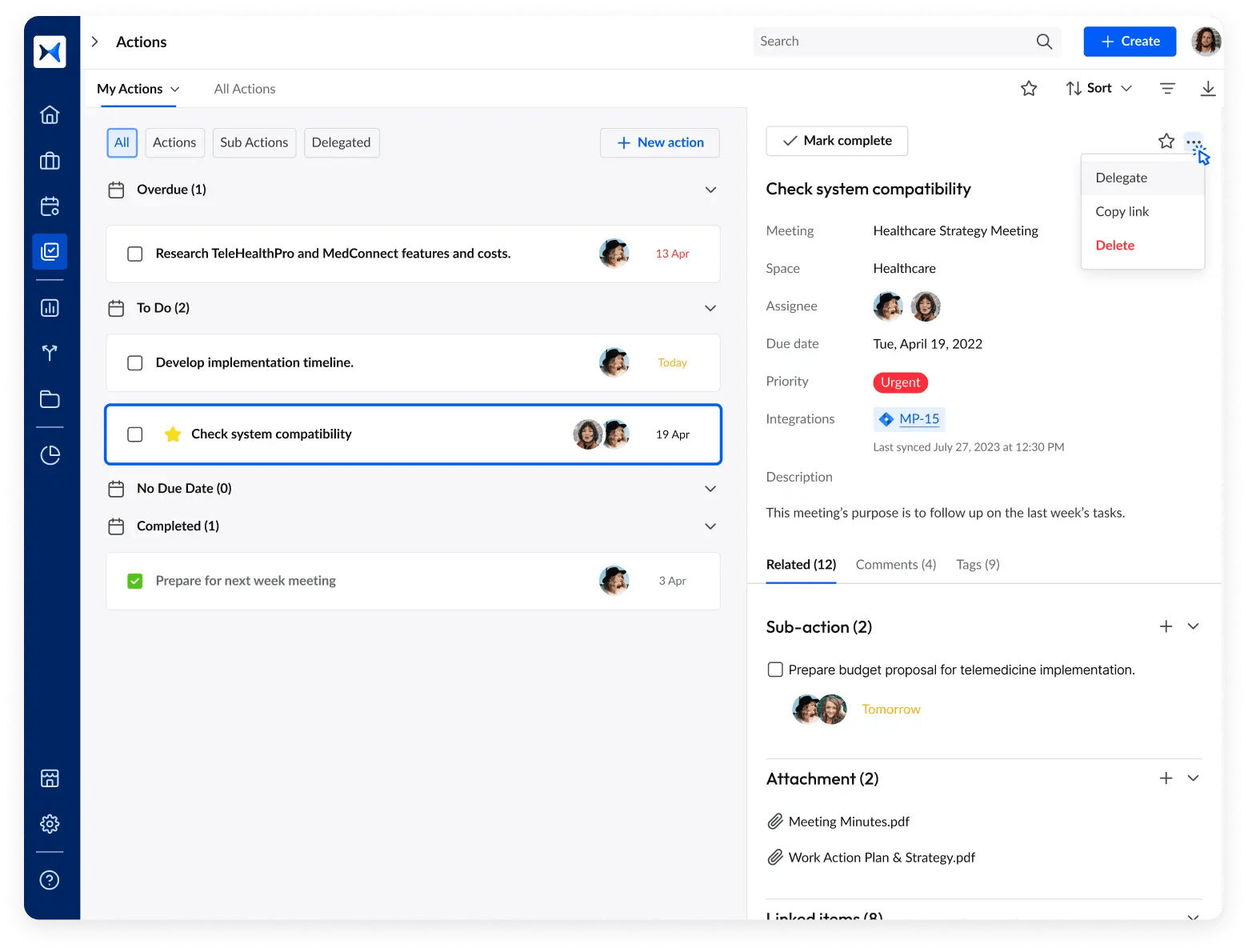

- Action and decision tracking: Follow up on actions and decisions made during board meetings to ensure follow-through. This feature helps board members stay updated on progress and outcomes, enhancing accountability.

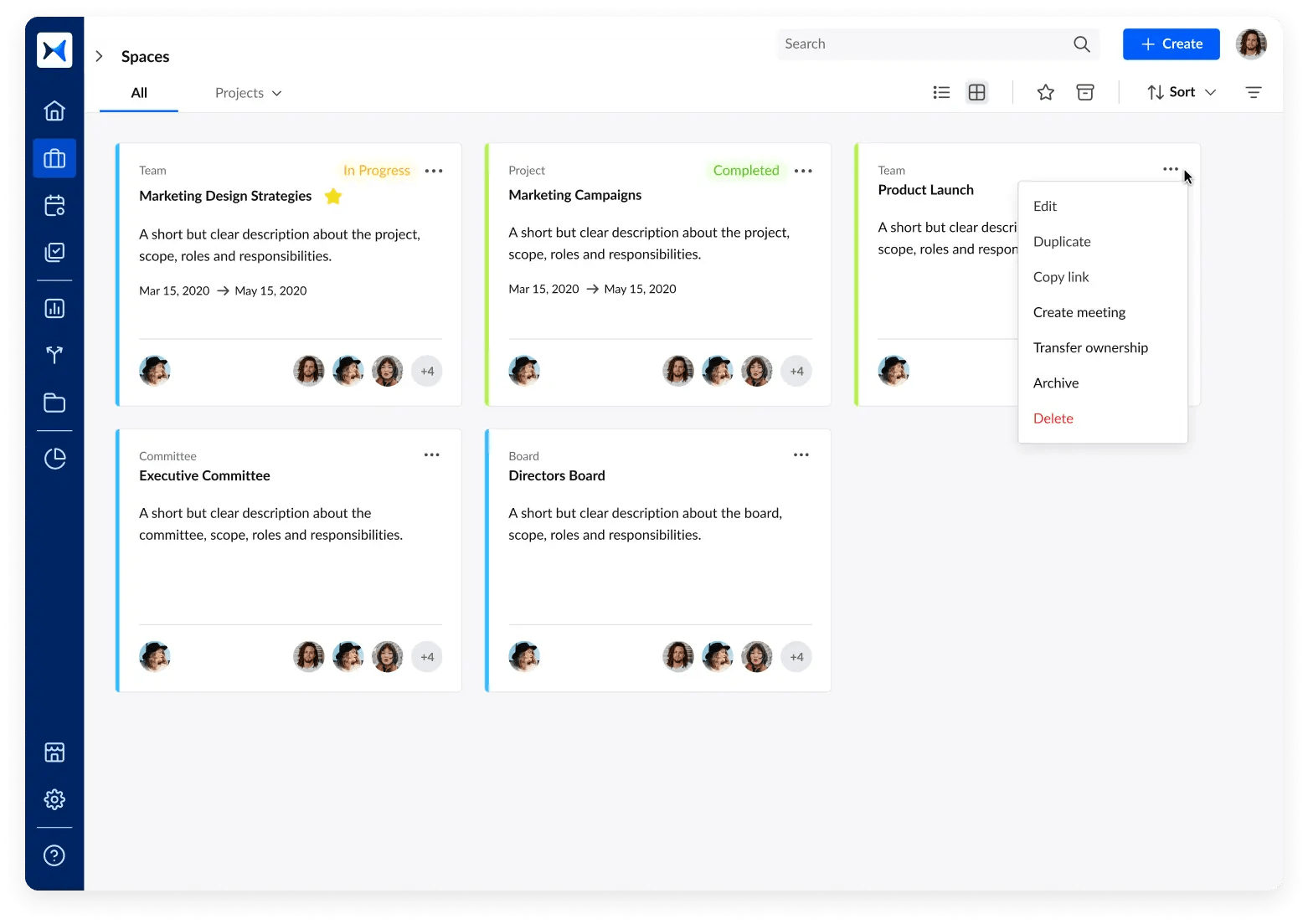

- Categorize meetings into spaces: Organize meetings into specific spaces for various boards, committees, teams, and projects. This categorization helps maintain clear records and focus on specific areas of governance.

- Generate and share meeting minutes: Automatically generate and share meeting minutes to ensure transparency and maintain a comprehensive record for future reference.

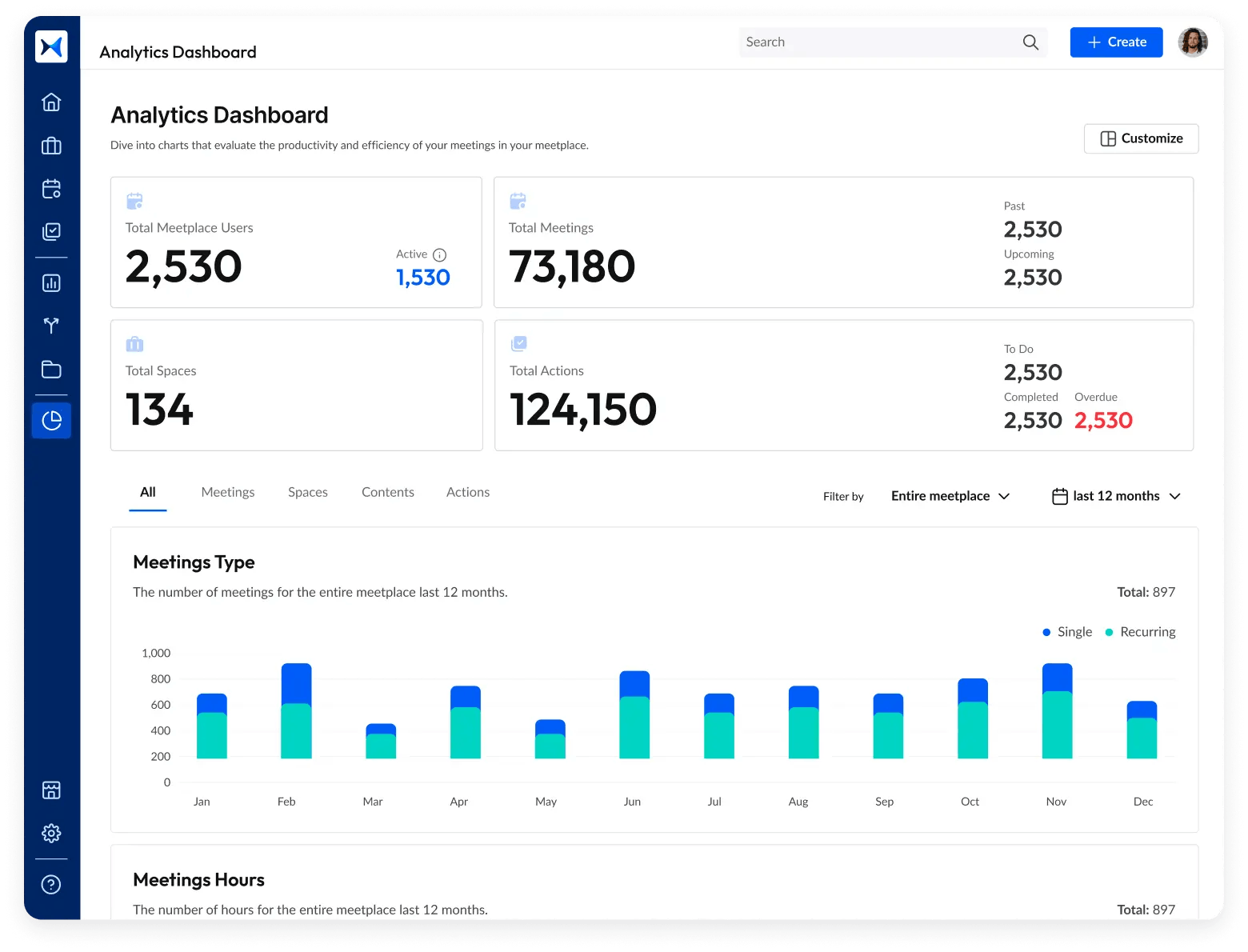

- Analytics dashboard: Assess participation rates, decision outcomes, and the progress of action items. This feature facilitates smooth and effective meetings, helping board members stay informed and proactive.

Transform how you conduct critical meetings—From meticulous preparation to effective execution and insightful follow-up, adam.ai integrates comprehensive analytics, full customization, and intuitive interfaces with powerful meeting management tools.

Easy onboarding. Enterprise-grade security. 24/7 dedicated support.

The bottom line

The success of any organization is significantly influenced by its board member positions. A well-structured board with diverse and skilled members ensures effective governance, strategic direction, and innovative problem-solving. Modern tools and technology are essential for board members to manage their responsibilities efficiently and effectively.

And while there may be multiple meeting management solutions available, here is why adam.ai is the board management software platform you can trust:

- adam.ai is one of Atlassian Ventures' portfolio companies.

- In the meeting management software category on G2, adam.ai has been ranked a leader and a high performer for successive quarters in the past years.

- adam.ai has been included in the Forrester Report in the AI-enabled meeting technology landscape.

- adam.ai is trusted and used by powerful teams and organizations worldwide for all types of critical meetings, like board, committee, project management, and business development meetings.

- And most importantly, adam.ai integrates with your existing workflow, is SOC2 compliant, provides dedicated support and success, and has a free trial option.

Subscribe to adam.ai blog

Stay ahead with the latest insights—get our newest blog posts, tips, and updates sent straight to your inbox.